This week we present two strategies: Buy CAD/CHF, 2Y/10Y UST flattener

CAD/CHF – Trend higher set to continue

Strategy Summary – Buy at market (.8558) for an objective of .8855. Place stop at .8395.

Since posting a low of .7810 on 19 March this year, the market has rebounded strongly. Recent attempts to sell off have attracted fresh buying interest over the .9400 handle and the 100-Day MA has now turned higher, indicating a shift in wider trend momentum. Further gains are anticipated as bulls look to recover ground lost during the August 2012- March 2014 down move.

Clearance of the current yearly high at .8590 and the 38.2% retracement of the .9905- .7810 fall at .8610 (Not shown) will open .8690 (3 October 2013 low) next. Through here we will target the 7 November 2013 high at .8855, which also coincides with the 50% retracement level (where we will look to take profits).

Attempts to sell off are expected to hold over the recent .8405 reaction low (15 September). Below will delay the advance but bears need to breach trend-line support (drawn from the 19 March/8 August lows) at .8365 and the 100-Day MA (currently at .8320) to cause greater concern.

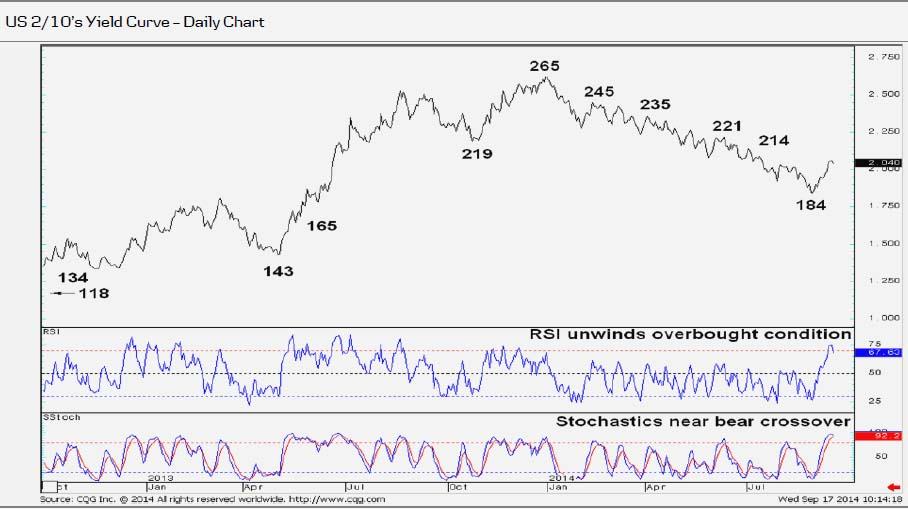

2/10’s UST Yield Curve – Lower peak potentially developing

Strategy Summary – Look to buy at 214bp ahead of flattening to retest 184bp with scope for a break towards 143bp. Place stops over 221bp.

US 2/10’s recovered sharply off 184bp (28 August trough), reversing a steady 9-month flattening campaign. That said, the unwinding of RSI from overbought territory, coupled with a possible bear cross on the daily stochastic chart, suggests that the recent recovery may be losing momentum. Also, since the current steepener has retraced only a small portion of the 265/184bp decline, it is still considered as a corrective up-move. A stochastic bear cross would allow 2/10’s to flatten back towards 184bp. Below this would highlight another lower peak within the medium-term down-trend. This would open minor support at 165bp (16 May 2013) ahead of a re-test of the 143/134bp region (1 May 2013 trough)/(November/December 2012 troughs). Sustained weakness at that point would expose the key trough located at 118bp (24 July 2012).

A clean break above the 214bp area (2 July peak), however, would signal an extended recovery phase with scope for 221bp (11 June, near 219 – 23 October 2013 trough) ahead of resistance in the 235/245bp region (2 April/12 February peaks). Above the latter would then shift focus to the key peak at 265bp (31 December 2013).

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.