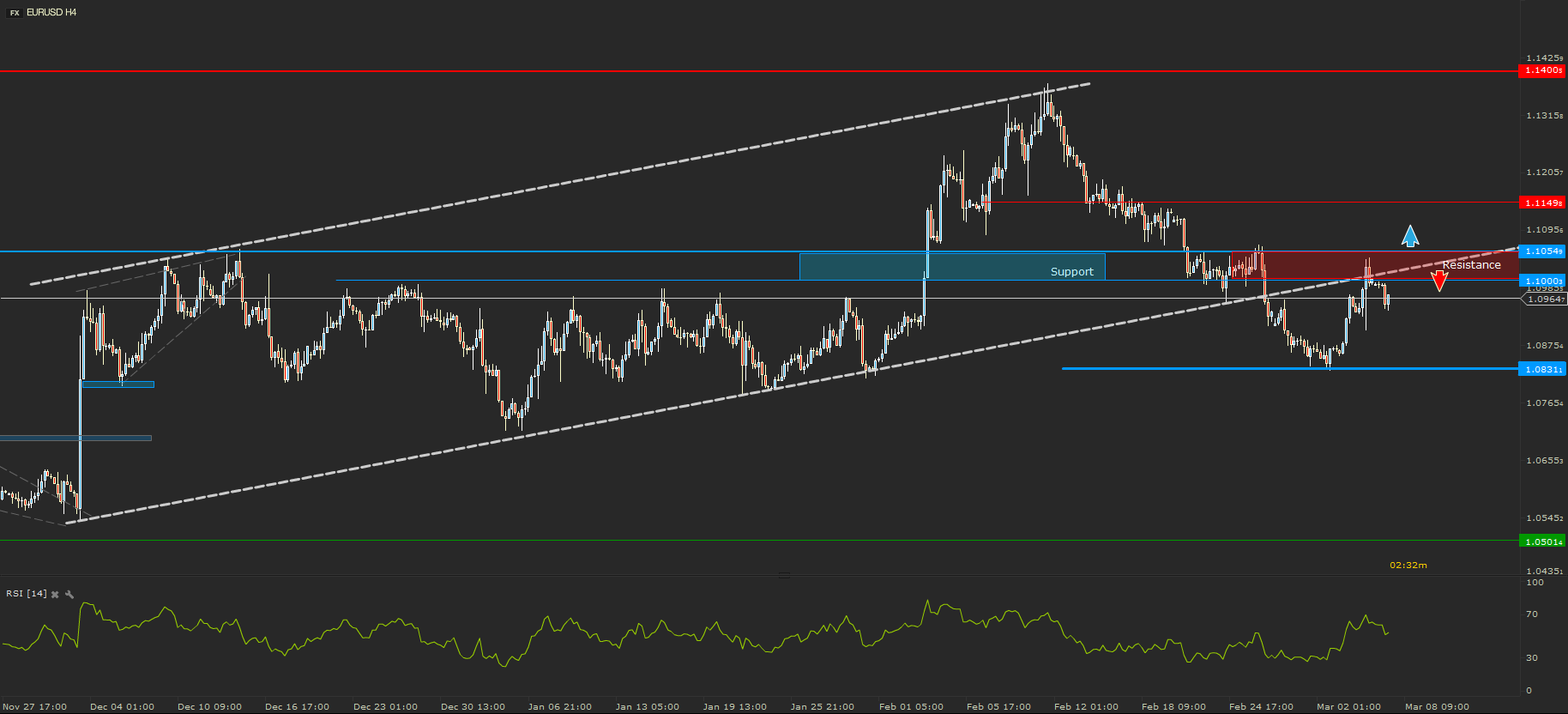

EURUSD – Trying to comeback

The EURUSD managed to break the support area from 1.1000 and dropped below the main trend line of the uptrend. The fall has stopped at 1.0830, where it found a local support. The bounce brought the price back above 1.1000, but it was not enough to continue the rally. Currently bulls are trying to push against the resistance area.

A break above 1.1055 would be a strong buying signal because this would signal a comeback of the price in the main uptrend channel. A fail to break above the latest high and 1.1055, could signal another drop back to the previous lows from 1.0830.

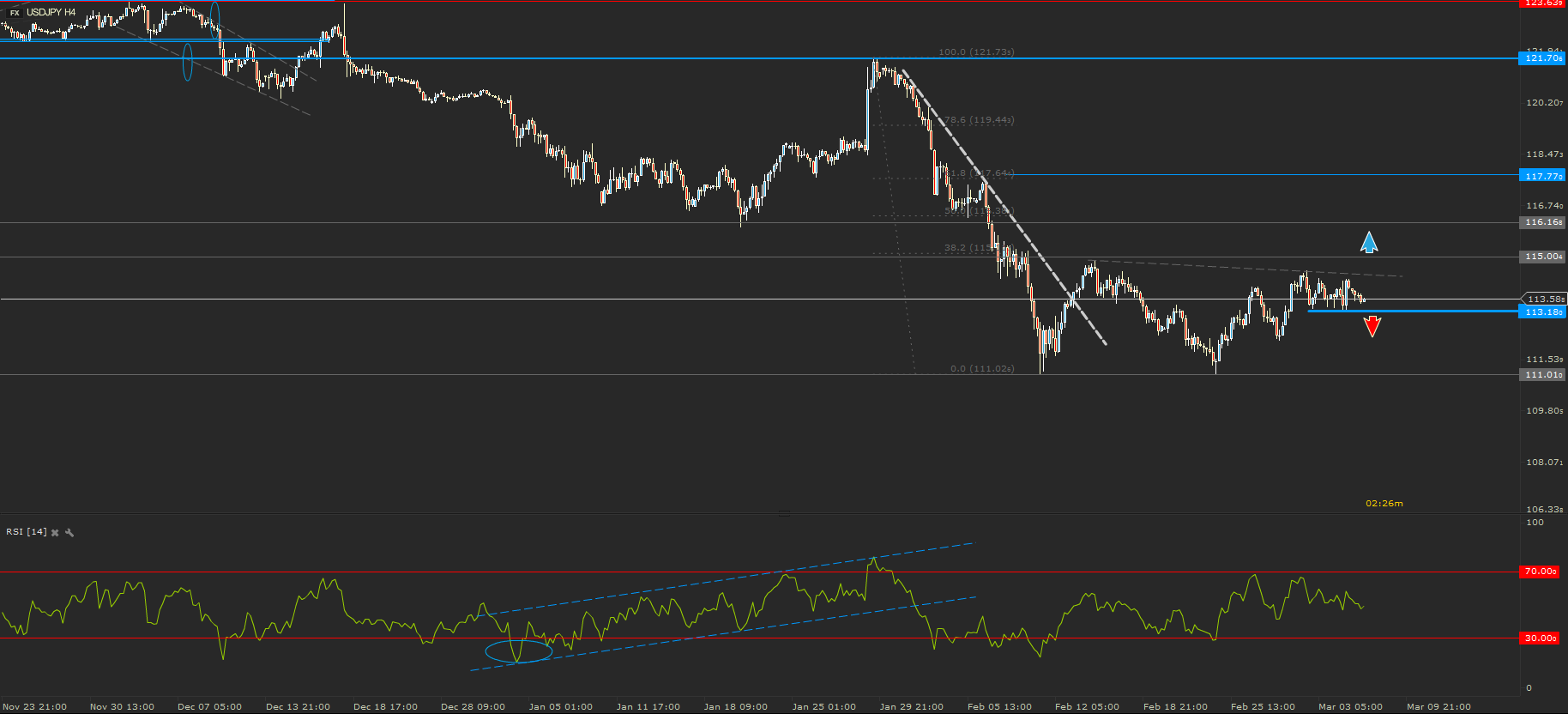

USDJPY – In a sideways move

Two weeks ago I was expecting the price of USDJPY to move sideways without proper fundamental incentives. Which actually happened. After another bounce from 111.00, the price moved towards 115.00 which did not reach until today.

A break below the local support from 113.18 would signal a drop back towards the main support from 111.00. On the other hand, a break above 115.00 resistance, would signal a possible rally towards 116.00, or even higher towards 117.00.

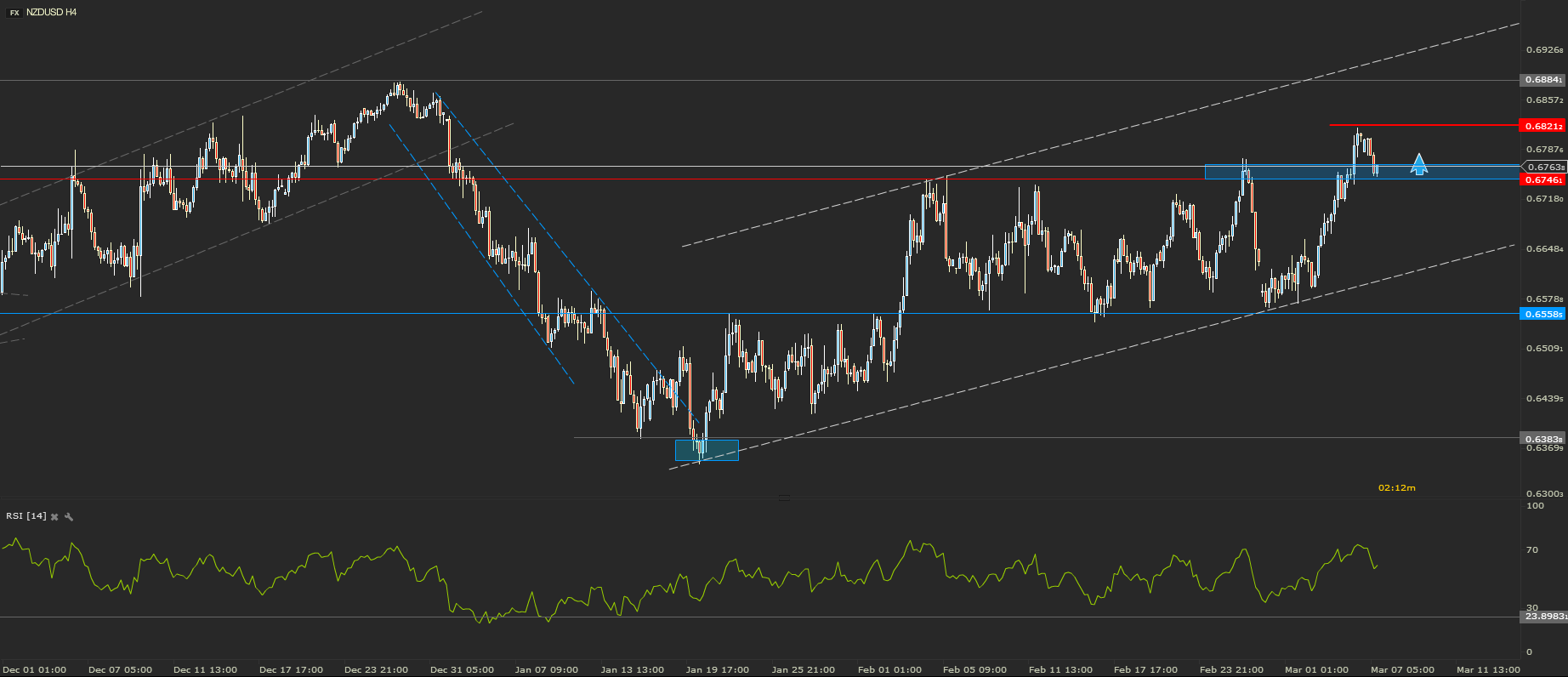

NZDUSD – On its way to 0.6900.

The price of kiwi dollar has broken twice the resistance from 0.6746. First time was a false break, which was followed by a plunge back to the key level support from 0.6558, while the second one was a strong break which triggered a rally stopped only at 0.6820.

Currently the price retested 0.6746 as support. I am expected a bounce to start and trigger another rally which, this time, would get the price above 0.6850, targeting 0.6900. A strong break below 0.6700 would infirm my current theory.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.