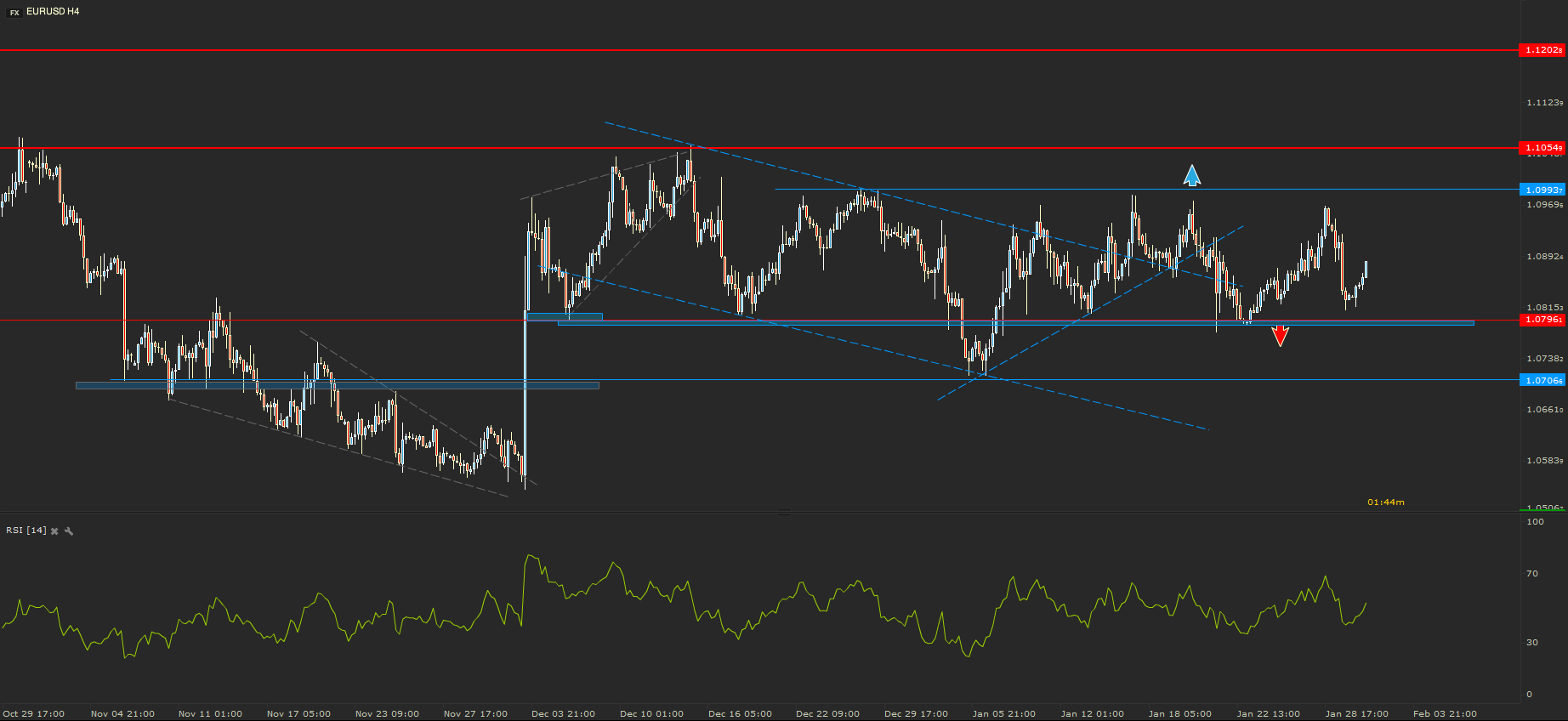

EURUSD - Continuing the sideways

From the beginning of this year the price of EURUSD has been trading between two strong boundaries. The resistance is found at 1.0993, while the support is found at 1.0796. Nothing up until today manage to get the price out of this range.

Giving the current price action, a strong signal for future movement I would consider to be a break out of this sideways move. A break below the support would signal a drop back towards 1.0700, while a break above 1.0993 could signal a rally to wards 1.1055.

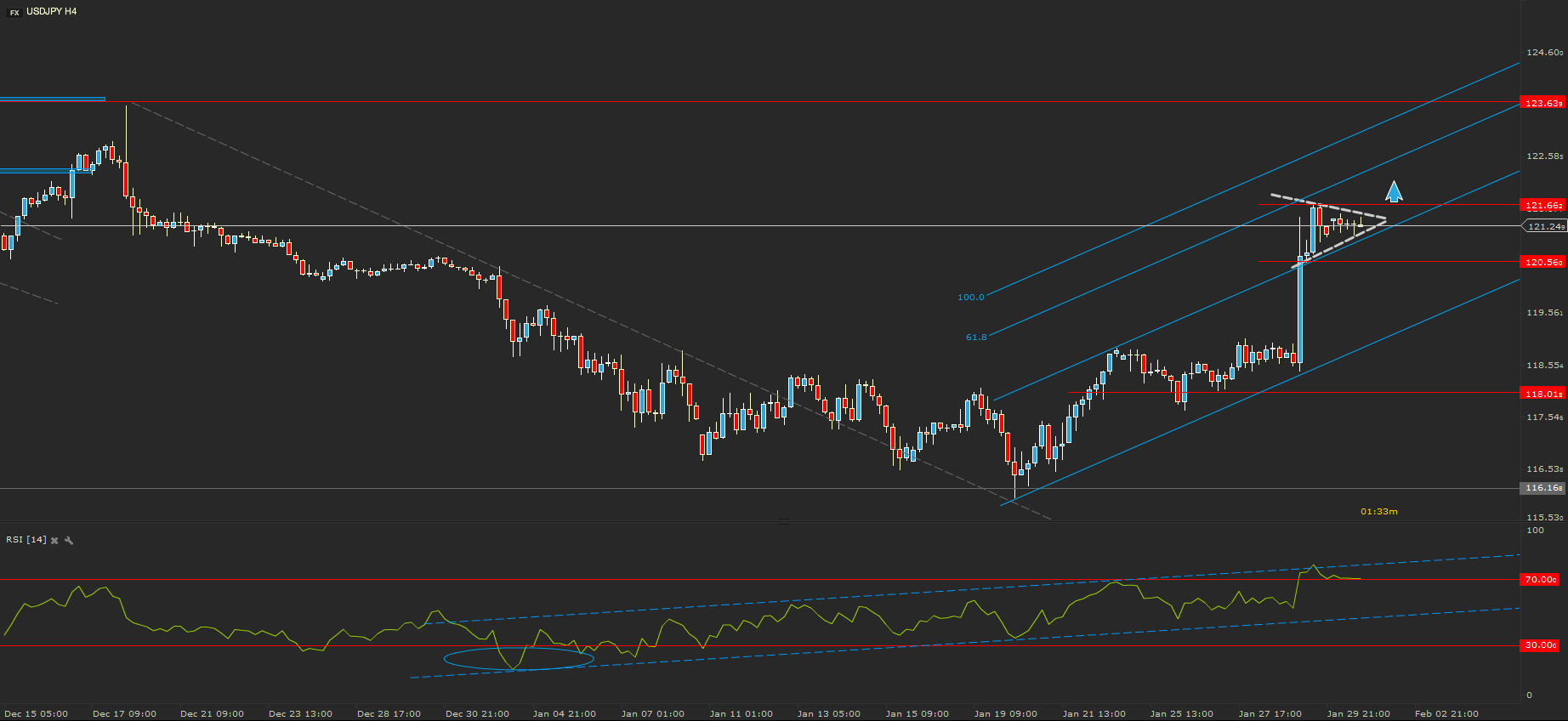

USDJPY - Pennant

Bouncing off the key support level was signaled by the positive divergence drawn on the 14 periods RSI. The price of USDJPY continues to rally based on the fundamentals. The up move stopped at 121.66 for the moment and the corrective moment seems to be a Pennant.

The Pennant is a continuation price pattern. Usually these kind of patterns, signals the continuation of the previous move. In this case a break above 121.66 would be considered a strong positive signal. While a drop below 120.56 would signal a drop back towards 119.50.

NZDUSD - Playing Boring

The price of NZDUSD has broken the inferior line of the Rising Wedge. But the drop did not even manage to hit the support from 0.6383. The price action of this pair has drawn a range between the mentioned support and the resistance from 0.6545.

In the current conditions, a break below the local support from 0.6424 would signal a drop back towards 0.6383, while a break above the resistance would signal a rally towards the key resistance level of 0.6600

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.