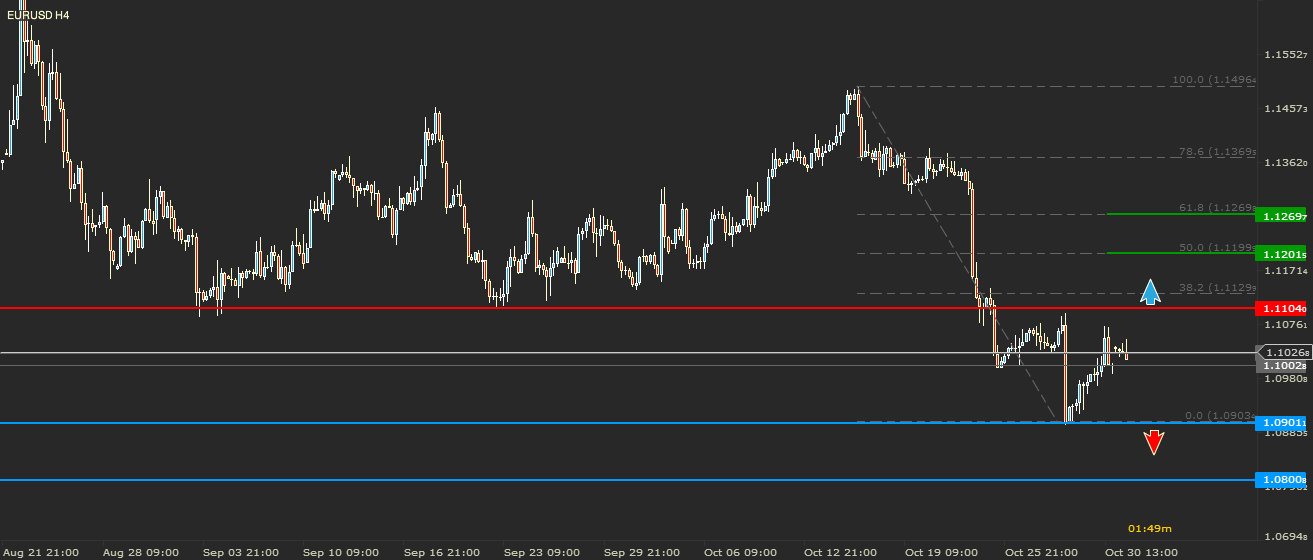

EURUSD - Played by the rules

Last week EURUSD played by the price action and technical analysis rules. Its price bounced from 1.1000 and retested at 1.1100. After FOMC announced a high probability for the interest rate to hike in December, the US dollar has gained across the board. EURUSD plunged 200 pips and tested the next round number support from 1.0900. Currently the price of this currency pair is trading above 1.1000 again.

The waters seem to have calmed and the market is free to move higher during the week, at least up until Friday when a new NFP is scheduled to be released. I expect the price to break above 1.1100 and head toward a 50% retrace (1.1200) out of the entire drop. A break above this level could trigger a continuation of the rally towards the 61.8 Fibonacci retrace. An alternative scenario would be for the price to continue moving sideways in between the upper limit from 1.1100 and the lower limit 1.0900. Breaking below the current support could bring in more bears, which would push the price towards the next round level (1.0800).

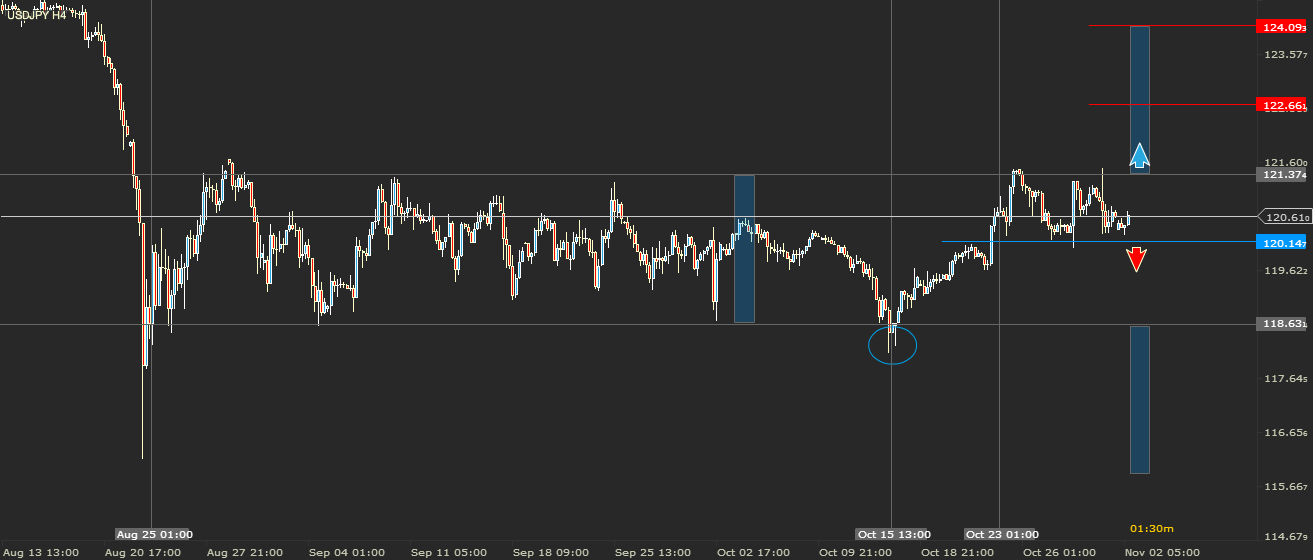

USDJPY - Nothing spectacular, yet!

The USDJPY began trading in a 300 pips range on 25th of August. Although it had a couple of opportunities to break out of this sideways move, the price was dragged back inside really fast. The range has an upper limit of 121.37 and lower limit of 118.63. After the last false breakout the from 15th of October to the downside, the price began to move up again. Bulls tried their luck to break the upper limit with no success.

The price is now trading below 121.37. During the past week it drew a new and smaller sideways move. The local support is set at 120.14 while the resistance is the same as the bigger range. A break below the current support would signal a drop back to 118.63. A break above 121.37 could result in another false break. Traders should consider this if they intend to trade the breakout. Buying or selling the pullback might be a better strategy when it comes to this currency pair.

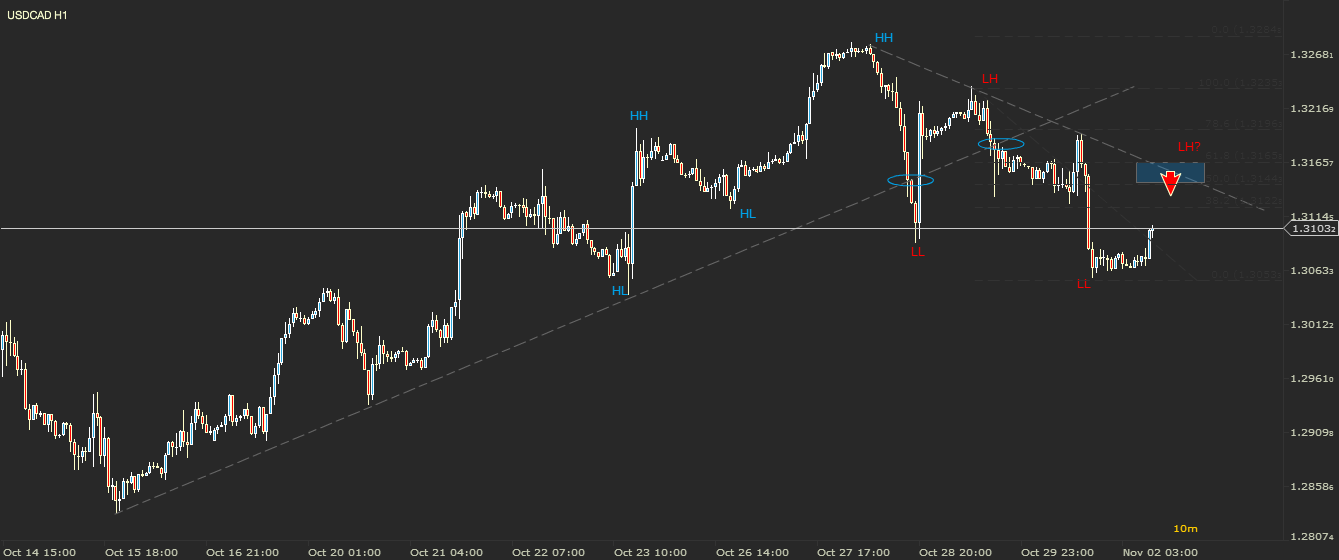

USDCAD - Is this a the beginning of a downtrend?

In the last weeks overview, I anticipated the USDCAD to move higher and retest 1.3320. It moved higher but did not reach that far. The price dropped and plunged below 1.3100. On the 28th of October, the price break below the uptrend line, which can be seen on the 60 minute chart, but ended up being just a false break. This was the first bearish signal, followed by a Lower High and a Lower Low.

The current price action is not yet totally bearish. This move down, although larger than the rest, might end up being an ABC corrective movement. To say that a new downtrend is in place, another Lower High will be needed and a Lower Low. A good resistance area is found between 1.3144 and 1.3165 (the range between the 50% and 61.8 Fibonacci retrace of the latest down move). A break above this area would lower the probability for the price to continue moving down.

AUDUSD - In a down trend

The Rising Wedge about which I was talking last week has been invalidated by the fall of the price. An alternative scenario was triggered by the drop below 0.7200. The price fell to 0.7065. From here it bounced back and rallied towards 0.7150. A strong resistance is found at 0.7200. However, the bulls might not have enough power to push the price all the way there.

The latest up move looks like a Rising Wedge. If the price breaks and closes on a 60 minute chart below the trend line and also below the local support from 0.7120, I anticipate a drop towards the latest low from 0.7067. This bearish scenario can be invalidated only by a bounce from the local support and a rally above the current highs, the up move targeting this time 0.7200.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.