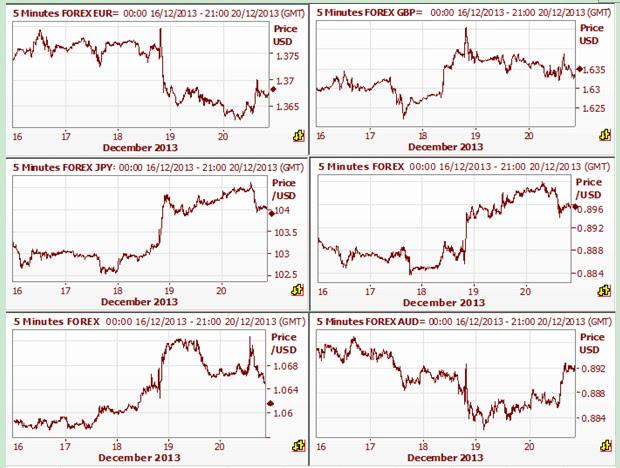

FOREX

Forex – The dollar fell from five-year highs against the yen on Friday as investors consolidated gains this week and pared positions back ahead of the holidays, but the strong trend for the U.S. currency remained intact going into next year. The yen's losses against the dollar were compounded by a decision by the Bank of Japan (BoJ) to maintain its pledge of increasing base money in the financial system.The greenback also climbed to two-week peaks against both the euro and the Swiss franc. Data showed the U.S. economy grew at its fastest pace in almost two years in the third quarter while business spending was stronger than previously estimated. The GDP report was consistent with an improving U.S. economy, validating the Fed's decision this week to taper stimulus by $10 billion. The greenback earlier gained against the euro, which was held back by S&P's decision to cut the European Union's supranational long-term rating to AA-plus from AAA, citing rising tensions on budget negotiations. The euro, which has surprised many analysts and hedge fund managers by moving higher against the dollar since the summer, its lowest since Dec. 5. On the week, the euro was down 0.6 percent, its weakest weekly performance in seven weeks. The common currency has been boosted in recent weeks by tightening monetary conditions in the euro zone as banks repay cheap borrowing to the European Central Bank. Next week banks will return 20.7 billion euros, the ECB said on Friday, which is above expectations and which will offer further support to the currency. The dollar rose to a two-week high of Swiss franc.

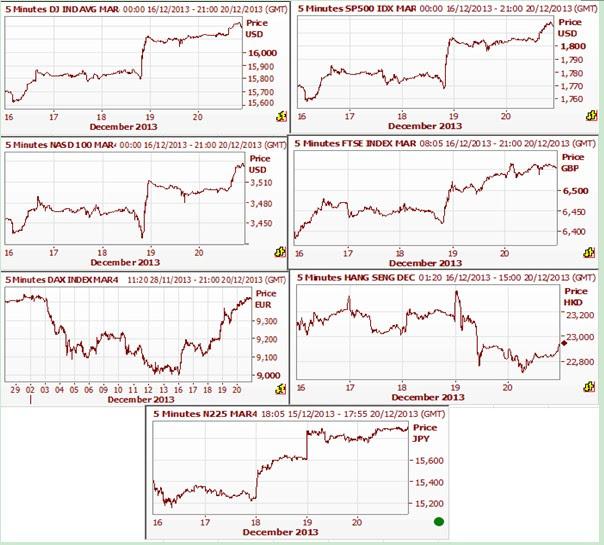

INDICES

Indices – U.S. government bonds sold off sharply on Thursday, one day after the Federal Reserve started winding down its crisis-era stimulus, while major U.S. equity averages slipped from record levels reached in Wednesday's post-Fed rally. The bond market was a bit more worried on Thursday. Most issues were lower, with the 10-year benchmark Treasury note yield rising to 2.93 percent, but the most significant selling was in the five- to seven-year maturities on concerns about the Fed's eventual plans to raise interest rates. The Dow Jones industrial average .DJI fell 0.15 percent, the S&P 500 lost 0.34 percent and the Nasdaq Composite .IXIC dropped 0.36 percent. U.S. stocks jumped on Friday after the U.S. government said the economy grew at its briskest pace in nearly two years, while the euro held steady, paring earlier losses after Standard & Poor's stripped the European Union of its triple-A credit rating. The S&P 500 index and the Dow Jones Industrial average posted record highs, while the Nasdaq composite advanced to its highest since 2000. The FTSEurofirst 300 .FTEU3 index of top European shares booked its biggest rise in eight months.

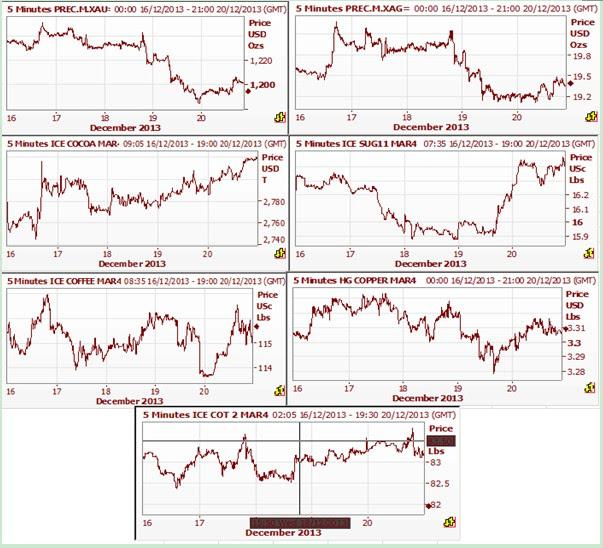

COMMODITIES

Commodities – Gold rebounded from an early dip to a six-month low on short covering on Friday, but is still on track for its largest annual loss in 32 years, as the Federal Reserve's plan to scale back its monetary stimulus and expectations of narrower U.S. government deficits have weighed on bullion. The metal, a traditional inflation hedge and safe haven, also came under heavy selling pressure after the U.S. Congress reached a two-year budget deal earlier in the week, which is set to ease automatic spending cuts and reduce the risk of a government shutdown. With its copper stocks shrinking, the impact of any future squeeze could be more severe than what happened this week, said analysts, who noted a 19-month high in the key price spread between copper for immediate delivery and that for future delivery. Among those potentially hardest hit by a spike in prices are the numerous speculators who have taken short positions on the LME - selling copper for future delivery in the hope of buying it more cheaply later, before the contracts fall due. They were betting that the copper market would move into surplus as new mines churn out more supply. But backlogs in processing the ore have limited the amount of refined metal being produced and prices have failed to fall significantly.

ENERGY

Crude Oil – U.S. crude oil prices rose and gasoline futures hit a three-month high on Friday, fueled by spread trading and supply concerns. Speculators added bullish bets to their U.S. crude futures and options positions in the week to Dec. 17, the U.S. Commodity Futures Trading Commission said on Friday. Brent prices were also underpinned by continuing disruption in Libya, where crude exports have dropped to 110,000 barrels per day (bpd) from more than 1 million bpd in July.

Brent futures slipped towards $109 a barrel on Thursday after shrugging off in the previous session the U.S. Federal Reserve's move to taper its monetary stimulus. Brent crude oil futures on Wednesday shrugged off the U.S. Federal Reserve's decision to begin tapering its stimulus program, maintaining gains that widened its premium to U.S. crude. Both Brent and U.S. crude oil pared gains immediately after the 2 p.m. then bounced back several minutes later. But it fell by nearly $1 on Tuesday, pressured by the spectre of the U.S. Federal Reserve tapering its monetary stimulus program. U.S. oil also ended lower, but not by as much, tightening the spread between the two benchmarks. Gains in international benchmark Brent crude outpaced those in U.S. oil futures. Market players said the narrowing in Brent's premium to U.S. crude to $10 a barrel earlier this week had been overdone. The crack, or difference, between Brent crude oil futures and gasoline, widened to a more than three-month high of $5.70 per barrel. U.S. oil CLc1 settled up 28 cents at $99.32 a barrel.

Natural Gas – U.S. natural gas futures climbed more than 2 percent early Thursday on forecasts for increased heating demand next week and expectations of data showing a near-record inventory withdrawal later in the day. Front-month January futures on the New York Mercantile Exchange NGc1 were up 8.5 cents to $4.336 per million British thermal units. Money managers, including hedge funds and commodity trading advisers, added bullish bets in natural gas futures, options and swaps in the week to Dec. 17, for the fourth week in a row, data from the U.S. CFTC showed on Friday. U.S. natural gas futures, lightly pressured by profit taking ahead of a mild weekend, settled slightly lower on Friday, but colder weather forecasts for later next week that should stir more heating demand helped limit the downside. The front-month contract, which shot up 5 percent Thursday after U.S. Energy Information Administration data showed natural gas stocks fell last week by a record amount, finished the week up 1.5 percent, its seventh straight weekly gain. Next week's report is likely to show another above-average drawdown, with early estimates ranging from 135 bcf to 177 bcf, versus a 74 bcf drop during the same week a year ago and a 125 bcf five-year average decline for the week. If drawdowns for the rest of the heating season match the five-year average, storage would end winter below 1.5 tcf, the lowest since 2008.

Traders noted the premium of the March 2014 gas futures over the April contract this week shot up more than 50 percent, its widest in eight months. Gains in winter months have outpaced spring contracts as the cold start to winter lowered analyst expectations for end-winter inventories.

The information set forth herein was obtained from sources which we believe to be reliable, but its accuracy cannot be guaranteed. It is not intended to be an offer, or the solicitation of any offer, to buy or sell the products or instruments referred herein. Any person placing reliance on this commentary to undertake trading does so entirely at their own risk.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.