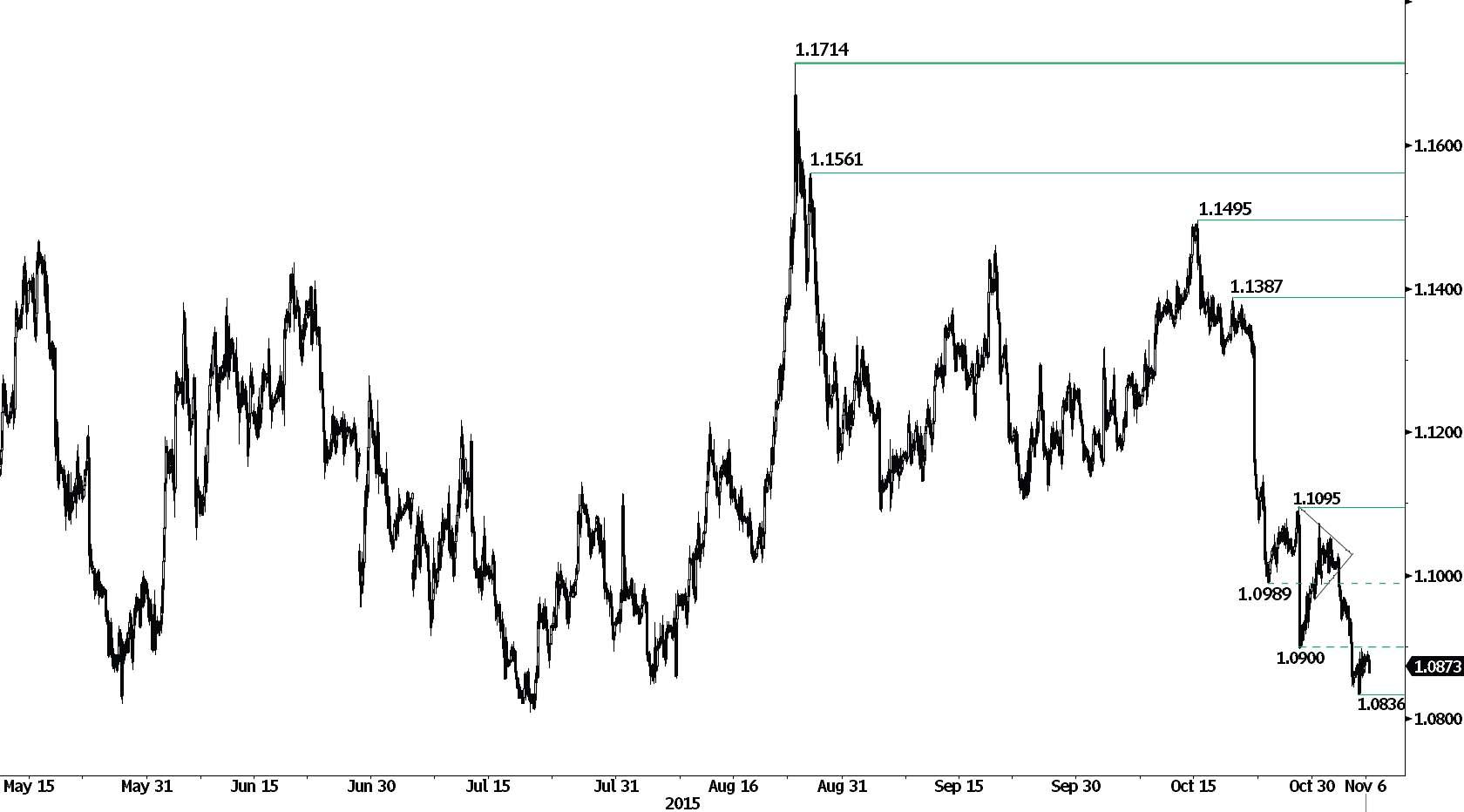

EUR/USD

Weak bounce.

EUR/USD has bounced close to the support implied by the recent low (around 1.0836). Hourly supports can now be found at 1.0836 then 1.0812 (21/07/2015). Hourly resistances stand at 1.0888 (intraday high) and 1.0968 (04/11/2015).

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

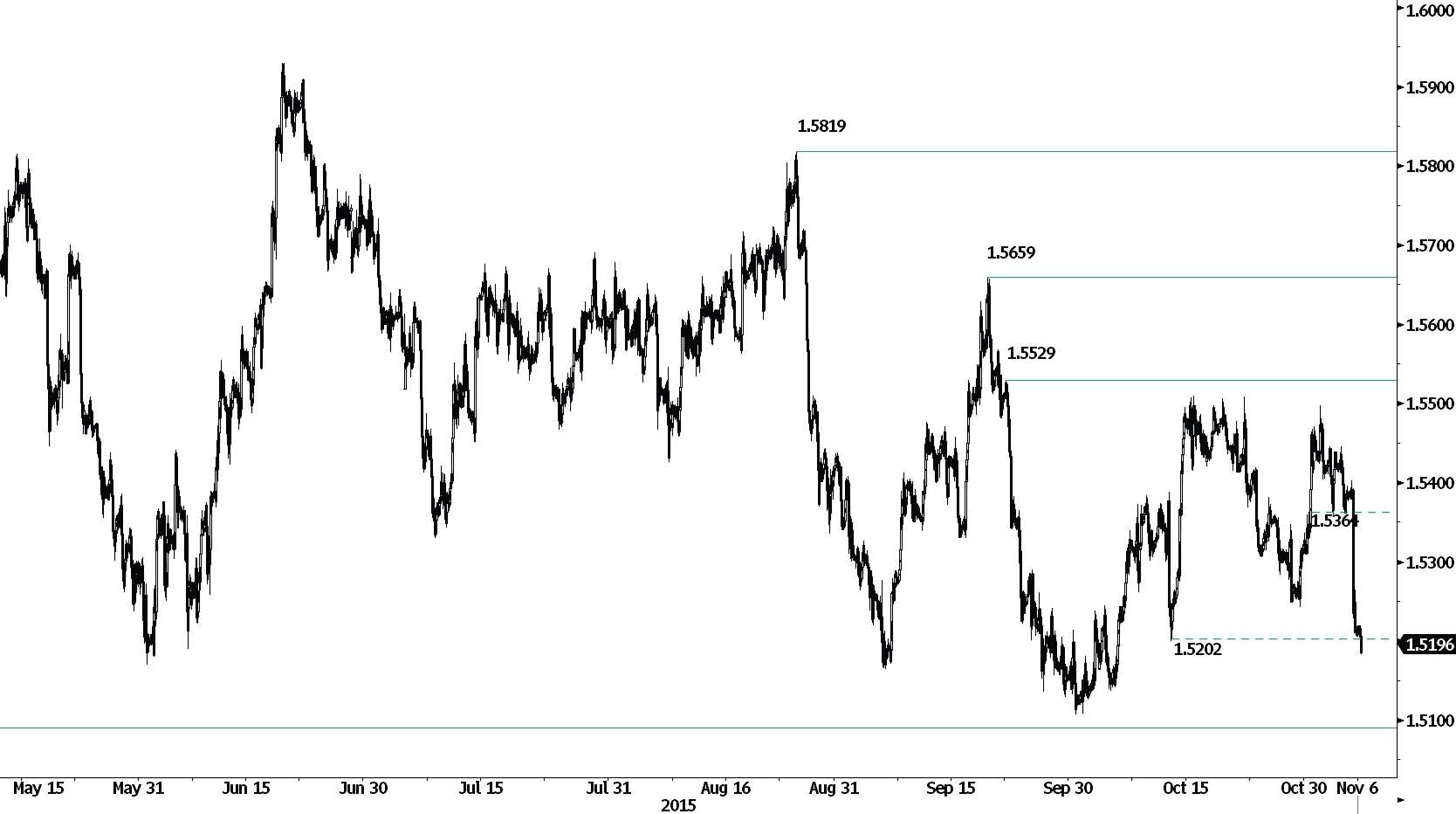

GBP/USD

Sharp decline thru key support.

GBP/USD has broken the support at 0.9007, invalidating the recent short-term uptrend and suggesting a deeper corrective phase. Next supports can now be found at 1.5140 (06/10/2015 low) and 1.5110 (30/09/2015 low). Hourly resistances stand at 1.5219 (intraday high).

The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Pushing higher.

USD/JPY continues to improve. Hourly resistances now stand at 121.98 (intraday high) The short-term technical structure favours a further rise as long as the hourly support at 121.65/70 region holds. Another support lies at 121.40 (05/11/2015low).

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Bullish breakout at 0.9957.

USD/CHF has broken the resistance at 0.9957 (28/10/2015 range high and long term decliing trendline), confirming an increasing buying interest. As long as the support at 0.9808 (27/10/2015 low) holds, the technical structure looks to further bullish momentum. Additional hourly support is given at 0.9476 (15/10/2015 low). Resistance is located at 1.000 key psychological level.

In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.

USD/CAD

Moving sideways.

USD/CAD recovery bounce has thus far failed to break the resistance at 1.3195 (304/11/2015), suggesting persistent selling pressures. Resistances can be found at 1.3280 (28/10/2015 high). Significant supports stand at 1.2949 (Fibo 38% retracement level).

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Sideways pause.

AUD/USD bullish momentum has improved but prices have thus far failed to decisively break their declining trendline at 0.7220. An hourly support can be found at 0.7120 (03/11/2015 low). As the pair has broken hourly support at 0.7165 (08/10/2015 low) underlying downside trend is dominate.

In the long-term, there is no sign to suggest the end of the current downtrend. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

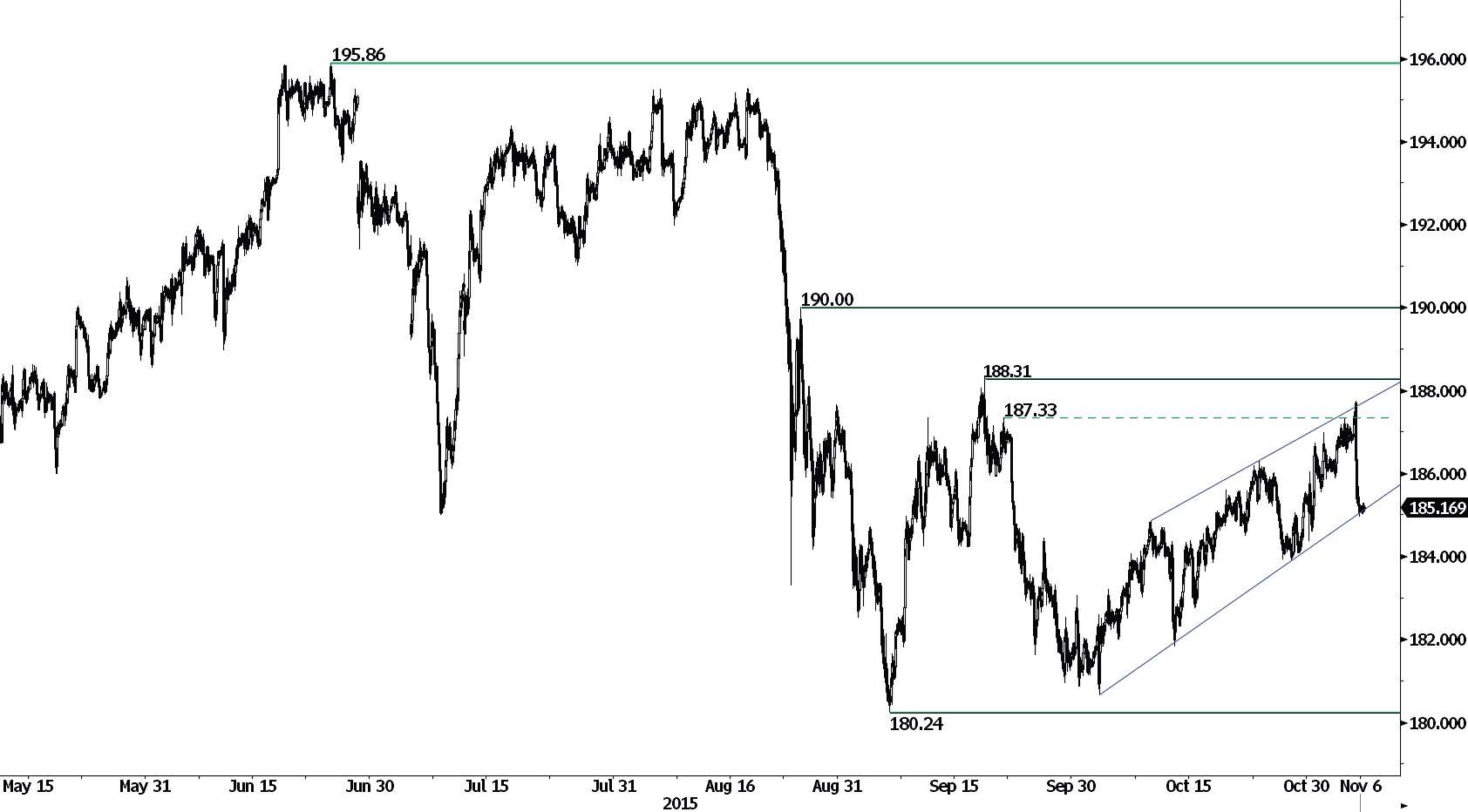

GBP/JPY

Collapse.

GBP/JPY has corrected sharply lower, running into rising trendline at 185.10. Break of key support would suggest a deeper corrective phase. Support stands at 183.90 (28/10/2015 low. An initial resistance can now be found at 185.27 (intraday high).

In the long-term, the lack of any medium-term bearish reversal pattern favours a bullish bias. The successful test of the strong support at 175.51 (03/02/2015 low) signals persistent buying interest. Key resistances stand at 197.45 (26/09/2008 high). A major support area can be found between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low).

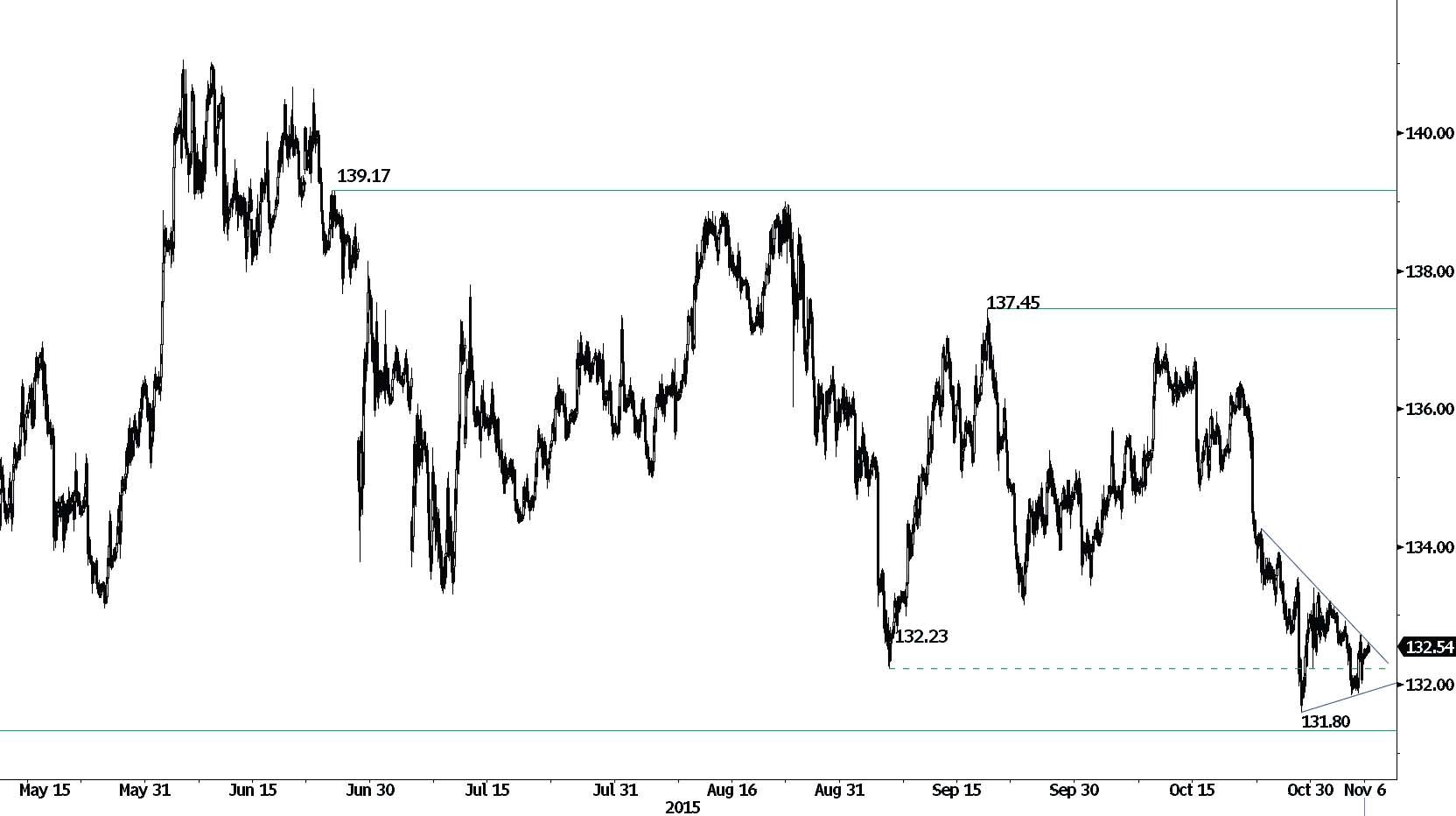

EUR/JPY

Grinding higher under declining trendline.

EUR/JPY is moving sideways under declining trendline. Hourly resistance is located at 132.65 (declining trendline) and hourly support lies at 132.24 (09/04/2015 low).

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

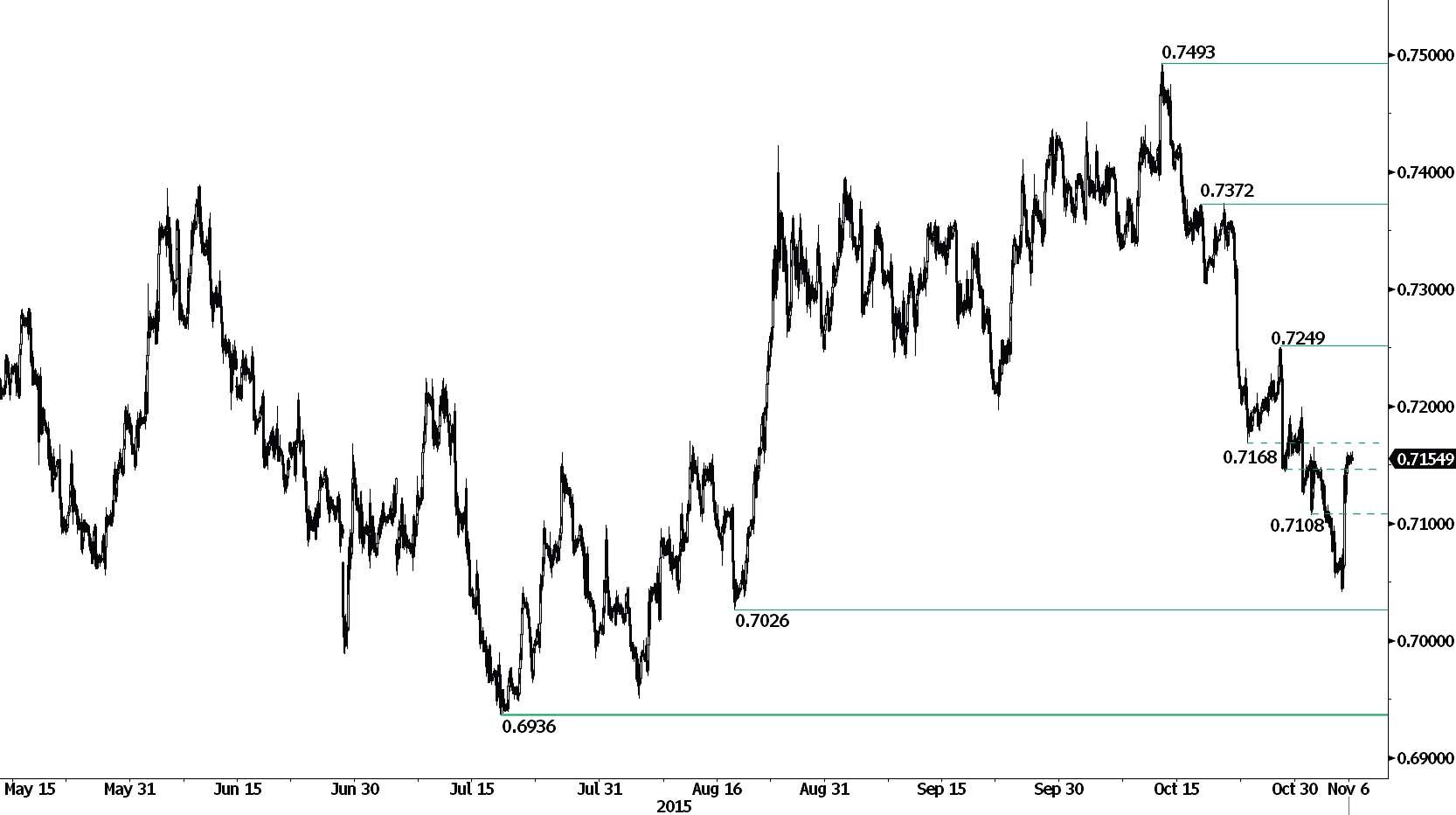

EUR/GBP

Reversal?

EUR/GBP has broken the resistance at 0.7168 (23/10/2015 low), opening the way for further strength. However, short-term succession of lower lows indicates the technical structure is negative. Monitor the support at 0.7108 (02/11/2015 low). Resistance can be found at 0.7195 (30/10/2015 high). Structural pattern indicates continued weakness.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

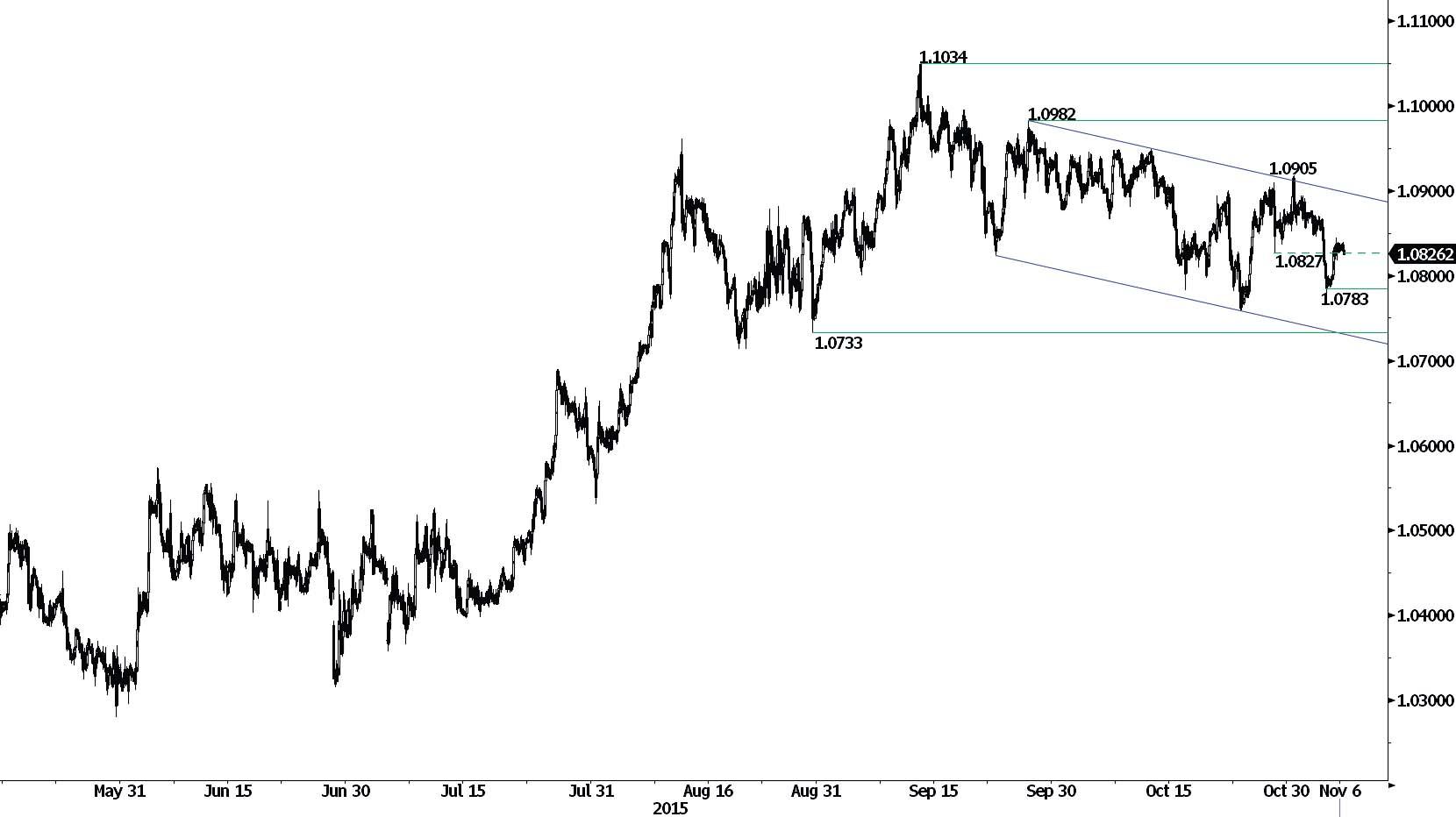

EUR/CHF

Minor bullish bounce.

EUR/CHF is moving sideways off support, though a bearish bias is favoured given the recent lower highs. Hourly support lies at 1.0827 (intrday low) and 1.0733 (16/10/2015 low). Resistance can be found at 1.0908 (declining channel resistance). Expected to fall below 1.0800.

In the longer term, the technical structure remains negative as long as prices remain below the resistance at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

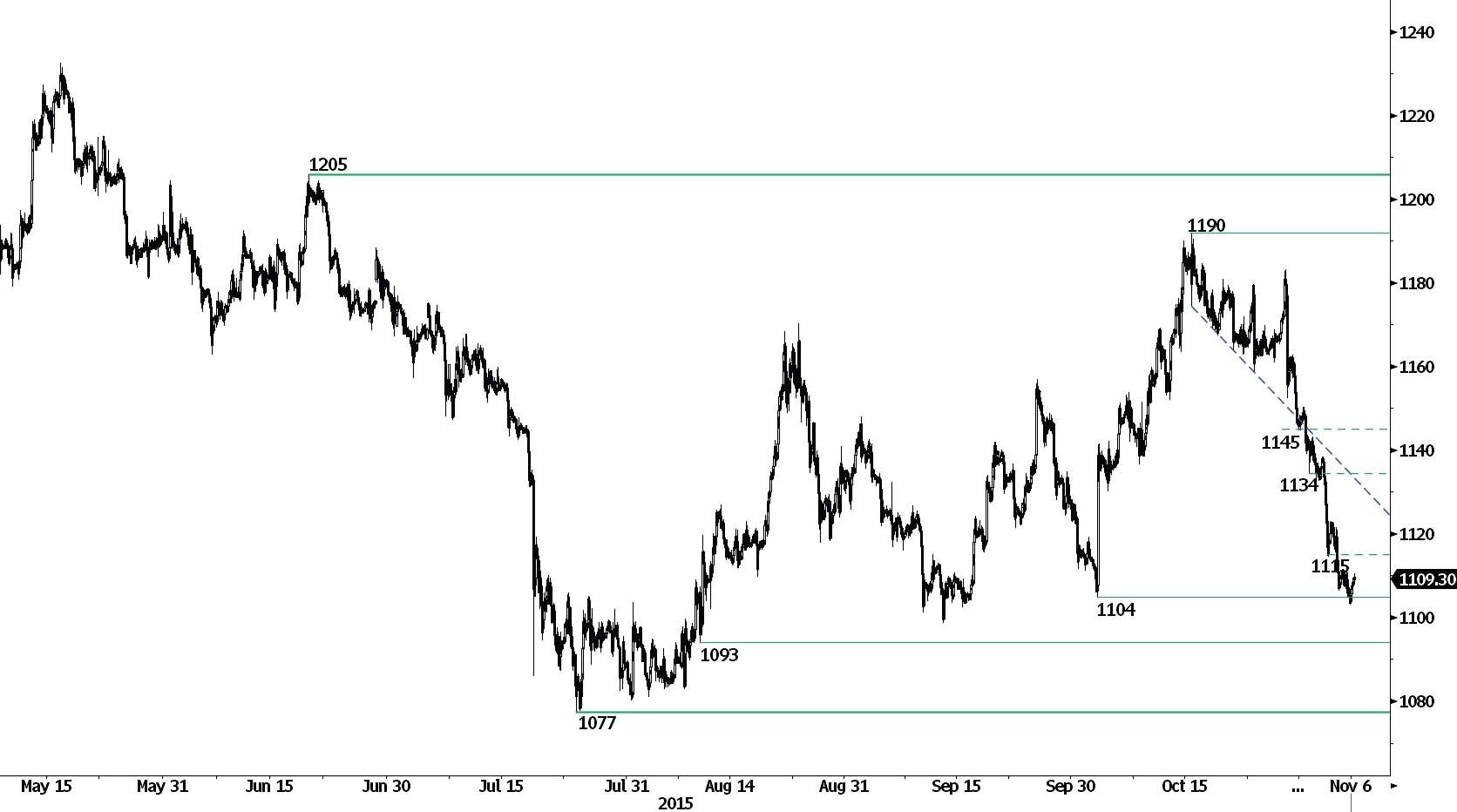

GOLD

Weak bounce.

Gold has broken the key support at 1115 (03/11/2015low). and the short-term technical structure is negative. Short-term supports region can be found at 1104. Another support can be located at and 1093 (12/08/2015 low). Hourly resistance is given at 1115 (old resistance). Expected to show continued weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. Although the key support at 1132 (07/11/2014 low) has been broken, a break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Weak bounce.

Silver has remained weak after its failure to make a daily close below the support at 14.94. The potential medium-term base formation and the short-term challenge to range support favours a bearish bias. Another support is given at a distant 14.79 (uptrend channel). The resistance at 15.45 (declining channel) has thus far held.

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. The strong support at 14.66 (05/02/2010 low) has been broken and prices have then consolidated. A key resistance stands at 18.89 (16/09/2014 high).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.