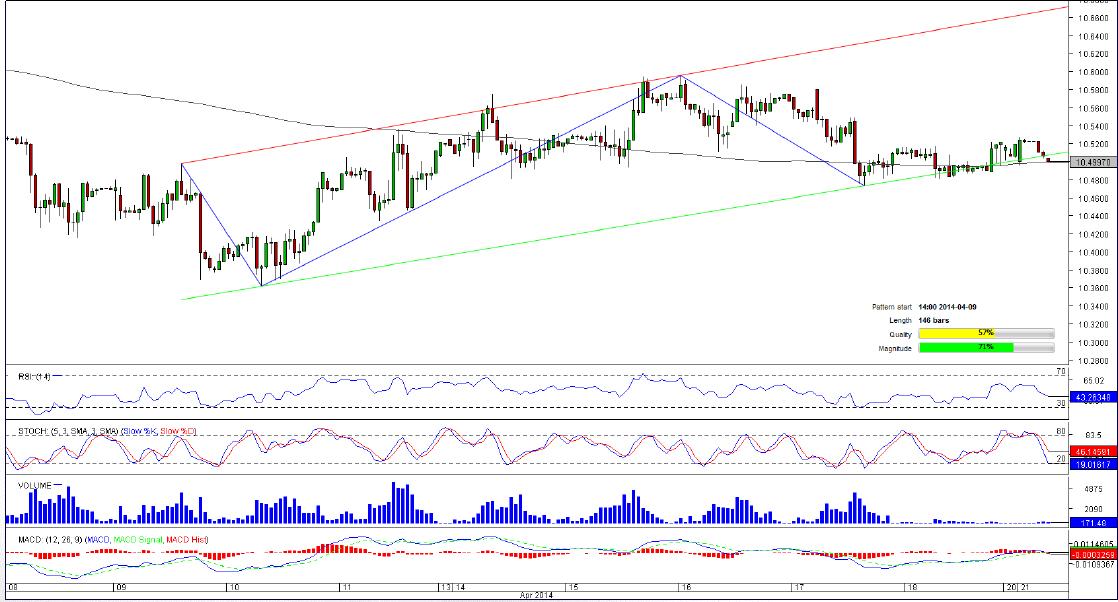

USD/ZAR 1H Chart: Channel Up

Comment: After a prolonged two-month decline the U.S. Dollar commenced a recovery on Apr 10 that still persists. Because of this USD/ZAR was able to form a bullish channel with the resistance at 10.6516 and the support at 10.4952. Right now the currency pair is testing the lower boundary of the pattern at the latter level, therefore the near-term bias towards the price is bullish.

However, if, contrary to this scenario, the selling pressures gains the upper hand, we will be looking at the nearby weekly pivot points as the most likely targets. Meanwhile, the sentiment among the SWFX market participants is moderately bearish—60% of open positions are short.

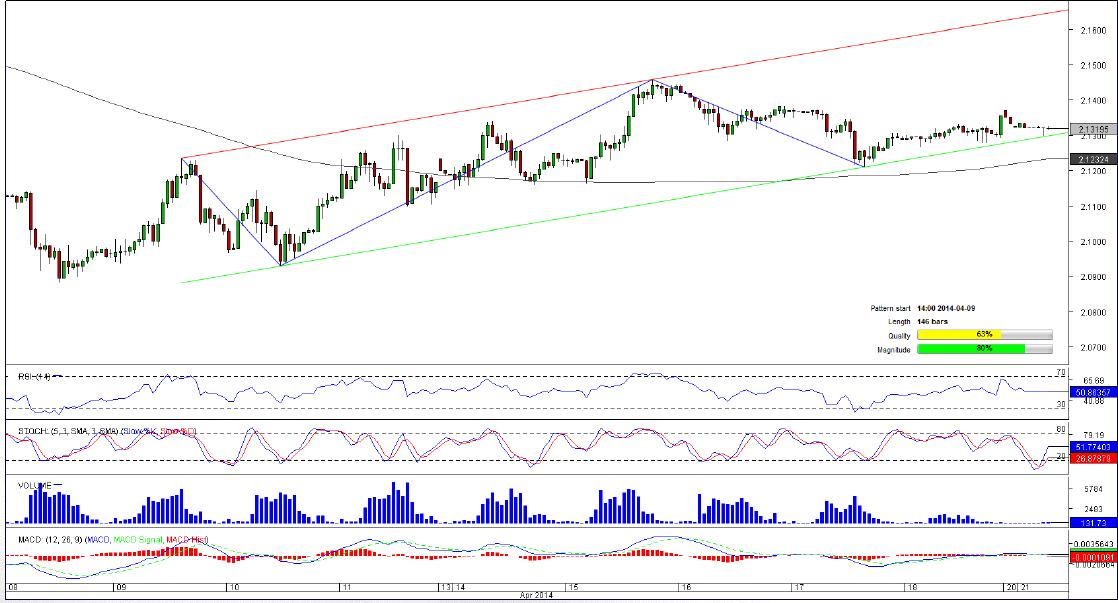

USD/TRY 1H Chart: Channel Up

Comment: The present situation in USD/TRY is reminiscent of the one currently being observed in USD/ZAR, where the currency pair is also forming an upward-sloping channel starting from Apr 10.

Considering that USD/TRY is currently trading near the lower rising trend-line, the U.S. Dollar is expected to appreciate versus the Turkish Lira in the short run. However, the technical indicators at the moment are mixed and do not support such a course of events. At the same time, the distribution between the bulls and bears is in favour of the latter (58%), meaning a significant part of the SWFX traders believe the greenback is going to cede ground.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.