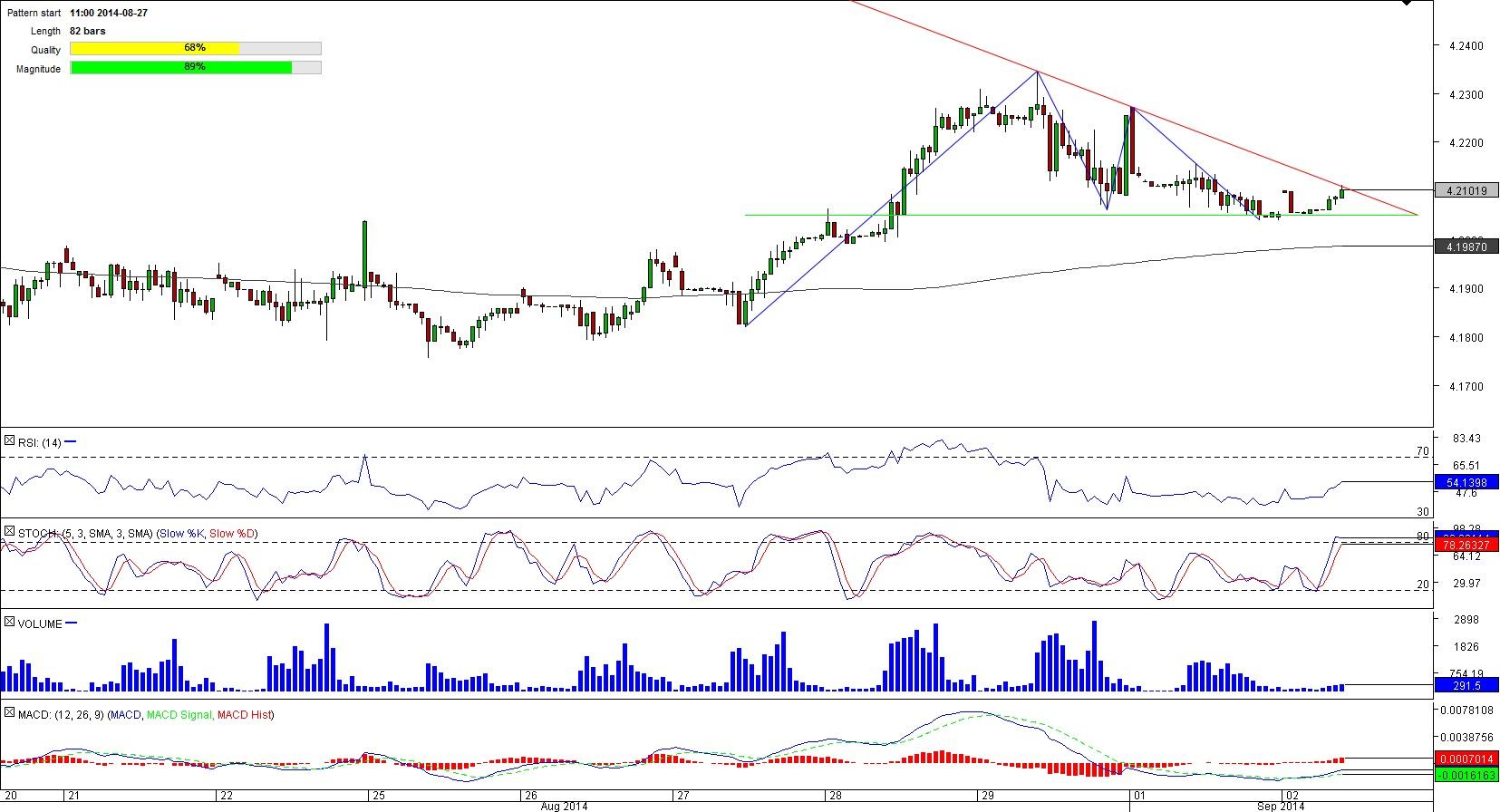

EUR/PLN 1H Chart: Descending Triangle

Comment: The pair failed to reach the 4.24 level at the end of August, as it entered consolidation phase , being supported around the 4.2050 mark. Even though the pair is trading near the triangle’s apex the technical indicators are not giving clear signals, as they are neutral. Although, an overwhelming majority (70.75%) of the traders expect the pair to decline. At the same time there are substantial resistance levels (weekly and monthly PPs) near the pattern’s support around 4.2050. Thus, if the pair manages to slide below the previously mentioned cluster of resistances then there are no major obstacles in front to reach the 4.1900 level.GBP/USD 4H Chart: Channel Down

Comment: GBP/USD remains bearish since the second week of July and is likely to stay that way for foreseeable future, given that it is trading between two parallel downward-sloping lines. At the moment, the currency pair is hovering above the major level at 1.6500, which has not been breached since March 2014. That, of course, makes this level significant. And if the pair’s bears fail to drag the Pound below this level then a rebound towards 1.66 might be expected. Moreover, since the bulls are in majority (56.02%) this scenario is rather likely. However, if the pair slides below the 1.65 level then the bearish channel is likely to stay in effect.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.