The mounting anxieties over Iran’s looming sanction relief which may open doors to more oil exports has threatened WTI oil and led to the commodity sinking to fresh 12 year lows at $29.40 on Friday. Oil experienced a very turbulent start to 2016 and remains victim to a ceaseless theme of an aggressive oversupply in the markets, while rising concerns around slowing global growth have renewed fears that demand may be waning. A strengthening US dollar has added to oil’s woes, while investor attraction periodically diminishes as escalating tensions between Saudi Arabia and Iran thwart any remaining hopes of a production cut. This commodity is extremely bearish and with no signs of an emergency OPEC meeting forthcoming weighing heavily on sentiment, sellers may be encouraged to send prices towards $29 and possible lower.

From a technical perspective WTI Oil is heavily bearish with prices crashing to fresh 12 year lows in Friday’s trading session. Previous psychological support at $30 may become a dynamic resistance which should invite an opportunity for bearish investors to send prices to $29. A solid daily close below $30 may suggest a further decline towards the lows of April 2003 at $25.

Today the focus will be turned toward the US sales report, in which investors will be perusing the health of the US economy and to assess whetherUS consumers have begun to spend following the significant savings on gas and a sturdy labour market. If the sales report is firm and exceeds expectations, then the bullish sentiment towards the Dollar may receive an uplift as consumer spending accounts for two-thirds of the US economy. A positive sales report that shows a healthy US economy may also offer the Fed another compelling reason to raise US interest rates once more before the end of this quarter.

Gold balances above $1075

Gold bulls have been struggling slightly in Friday’s trading session with prices currently meandering above the sticky $1080.0 level as of writing. Despite the risk averse trading environment, this precious metal remains bearish and Thursday’s hawkish comments from the president of the US Federal Reserve suggesting the potential of further US rate hikes in the future should heavily cap how high prices can rise. A strong Dollar may be the trigger for Gold to decline further and if retail sales exceed expectations today then bearish investors may be offered an opportunity to send prices towards the $1060 support.

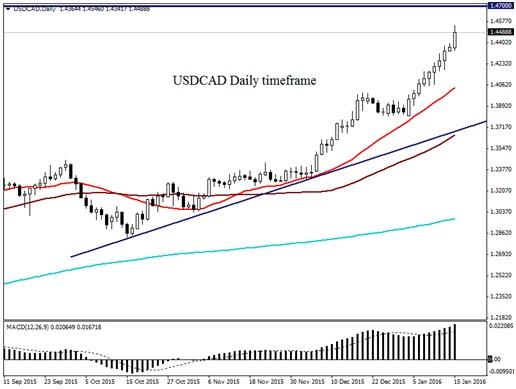

USDCAD

The USDCAD is heavily bullish on the daily timeframe as there have been consistently higher highs and higher lows. Prices are trading above the 20,50 and 200 SMA while the MACD also points deep into the upside. The current momentum may take prices to the next relevant resistance based at 1.4700.

CADCHF

This pair remains technically bearish on the daily timeframe as long as prices can keep below the 0.7050 resistance. Prices are currently below the daily 20 SMA and the MACD has also crossed to the downside. Seller may be encouraged to send the CADCHF towards 0.6850.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.