Global Markets

The Sterling spiked to downside across the global currency markets as a result of UK GDP printing below expectations at 0.5%. This currency has suffered for an extended period of time as a result of a riskoff environment mixed with escalating fears of a slowdown in economic momentum in the UK economy. It seems that BoE Mark Carney’s statement suggesting the possibility, rather than the certainty of a UK rate hike has pushed back expectations deep into 2016. Economic data in October from the UK has lost its robust touch and with this GDP figure failing to meet expectations today, the Sterling has been left vulnerable. The GBPUSD which had four consecutive days of decline last week remains under pressure, a breakdown below the 1.5300 support on this pair may open a path to the next relevant support at 1.5200.

The Dollar Index encountered an aggressive appreciation last week as a result of the ECB hinting of further QE in the future. Despite the index surging to 10week highs, Dollar vulnerability still remains the main theme in the global currency markets. This upside momentum within the USD may be shortlived as with only a slim chance that the US rates will be hiked in the FOMC statement this week, this single currency will be left vulnerable which should result in the bears taking control once again. Sentiment remains bearish for the Dollar and the creeping fears of a potential slowdown in economic momentum in the States combined with the mounting concerns that the GDP growth in the US for Q3 has shrunk, add to the already diminishing expectations of a US rate hike in 2015.

Even though Gold has experienced a technical decline which started from the second week of October, it still remains fundamentally bullish. Whilst the sharp appreciation of the USD played a part in capping any upwards momentum in this precious metal, the renewed fears about the decelerating growth in China should provide a foundation for the Gold bulls to take center stage once more. The FOMC statement this week, which most are expecting to conclude with no action being taken by the Fed to hike US rates, may inspire upwards momentum within this yellow metal, resulting in prices trading back above the 1170.00 resistance.

EURCHF

The EURCHF is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. As long as the 1.0900 resistance holds, there may be a decline to the next relevant support at 1.0700.

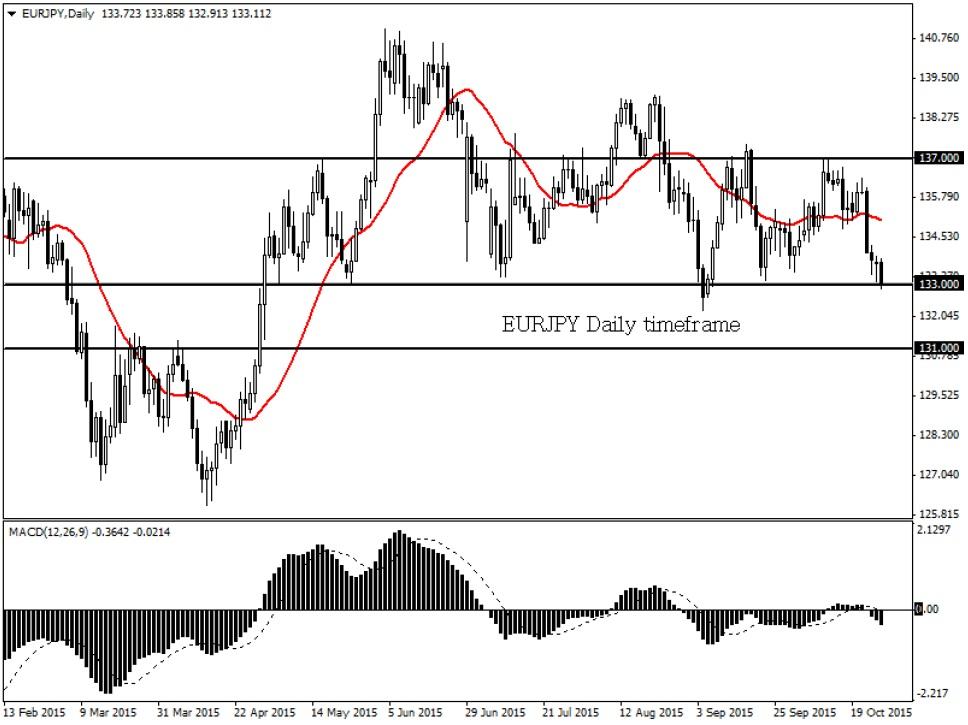

EURJPY

The EURJPY is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below the 133.00 support may open a path to the next relevant support at 131.00.

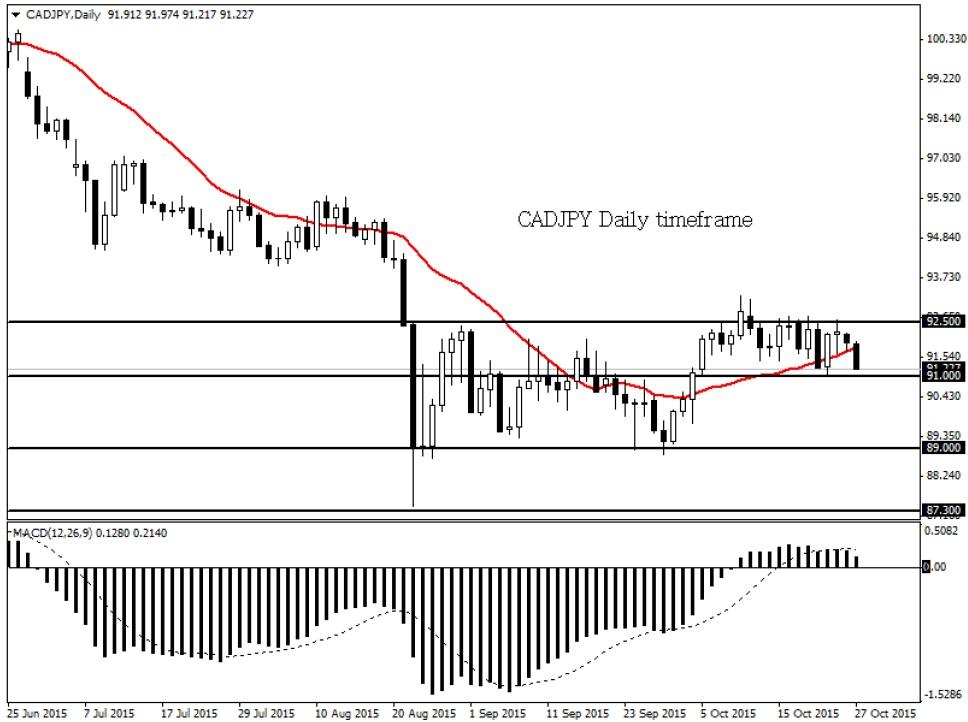

CADJPY

The CADJPY becomes technically bearish once a breach below the 91.00 support is achieved. Prices are currently trading below the daily 20 SMA and the MACD is in the process of crossing to the downside. The next relevant support is based at 89.00.

AUDCAD

The AUDCAD is technically bullish on the daily timeframe. A break above the 0.9580 resistance may open a path to the next relevant resistance based at 0.9650. Technical indicators such as the 20 SMA and MACD point to the upside.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.