Is the Spoo aboutto repeat September trick?

I don't think much needs tobe said with this chart. it is just an observation for now but Friday left anincredibly bearish candle after running up over the previous few weeks. This,coupled with the failure to get above the 61.8% of the years down move make mevery cautious going into this week. Today's close is likely to be important andbeing month end it could be fun and games all round. Watch this space.

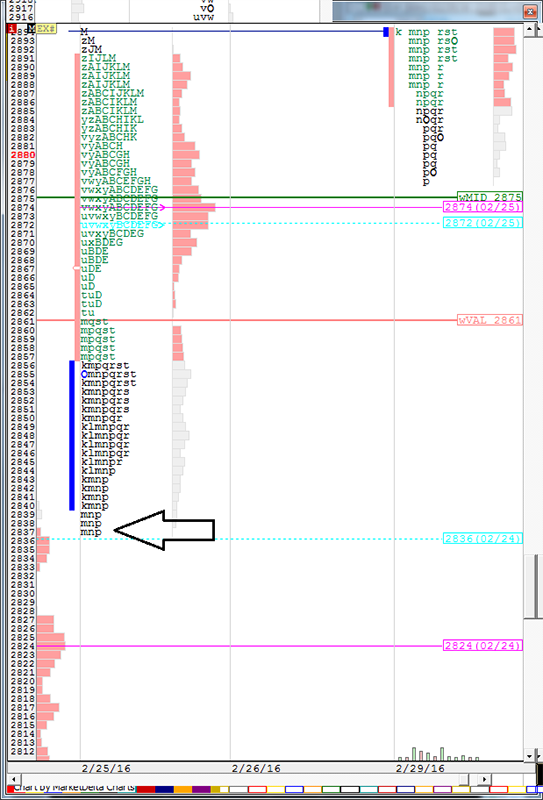

Stoxx poor lowunlikely to be left behind

Thursday saw the Eurostoxxleave an incredibly poor low before ramping. These lows are very rarely leftbehind and I expect this area to be revisted this week at some point. Whilethis doesn't give a trade opportunity right away, it is something to be awareof if you are long now. Any break of Friday's lows and I would expect this areato be the next target.

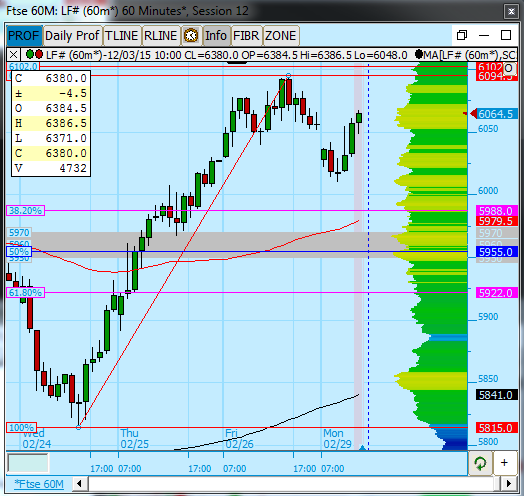

Watch for FTSEmonth end flows

FTSE is generally theequity market which has the most flow during the month end moves (typically inthe final 10 minutes of the cash hours and then the following five minutes ofsettlement). It has been outperforming in this recent leg higher so it could bethat we see a squeeze higher into the close I would argue that for this weeklongs are preferred until we break and hold below the 38.2% of the most recentmove. Targets above are at 6102, 6138 and the big one at 6182. That beingsaid, dont go into the final minutes blindly long. You'll see plenty of flow onther DOM (depth of market, or ladder) and this should give clues for fast moneymoves..

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.