Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Retains a firm tone above the 1.1400 level though the upside kept in check at the 1.1454 high so far. Break here is needed to expose the Oct high at 1.1495 to retest. Beyond this will return focus to the 1.1714, Aug high. Only below the 1.1327 support will fade upside pressure and swing focus lower. [PL]

EUR/CHF

Higher in consolidation from the 1.0843 low of last week but risk is seen for break to see further decline to retest the 1.0821/10 lows. Resistance is at 1.0900/13 area and lift over this needed to clear the way for stronger recovery to 1.0933 and 1.0954 high. [PL]

USD/CHF

Still weak and further slippage see the .9494/76 lows now within reach. However, divergence on daily and intraday tools caution bounce with the .9600/26 area to watch as lift over this needed to clear the way for stronger recovery to the .9651/61, recent lows. Below .9476 will see further decline to the .9400 level. [PL]

GBP/USD

Nothing much to add to this morning's view with the swing from last week's low of 1.4006 still in play and break of 1.4287 high set prior session will trigger extension to 1.4322 then daily resistance line behind at 1.4405. [W.T]

USD/JPY

Probes below the 108.00 level see the downside checked at 107.67/63 so far. Consolidation here tracing out a potential bear flag and see risk for break to trigger further decline to the 106.55, 38.2% retracement level. Resistance is at 108.44 and 109.10. [PL]

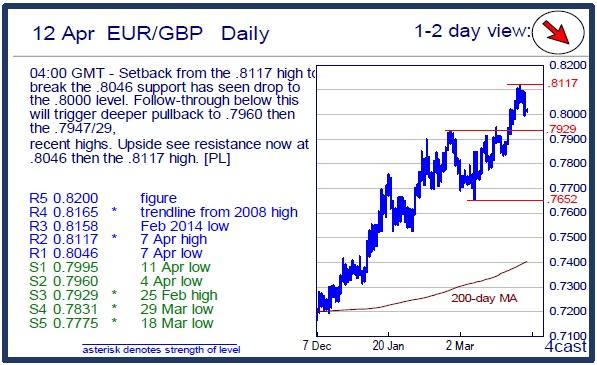

EUR/GBP

Setback from the .8117 high to break the .8046 support has seen drop to the .8000 level. Follow-through below this will trigger deeper pullback to .7960 then the .7947/29, recent highs. Upside see resistance now at .8046 then the .8117 high. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.