EUR/USD Daily

Limited to 1.1320 high so far though the upside stays in focus and see scope to retest the 1.1338 high. Break here will see scope to target the 1.1400 level. Beyond this will shift focus to the 1.1460 and 1.1495, Sep/Oct highs. Support starts at 1.1246 then the 1.1161 low, seen protecting the downside. [PL]

USD/CHF Daily

Rejection from the .9820 high yesterday see pressure returning to the downside and the .9695 low at risk. Follow-through below this will see further decline to .9612 and .9578 support. Resistance now at the .9786, Dec low, and .9820 and lift over these needed to ease downside pressure. [PL]

USD/JPY Daily

Bears showing no signs slowing and break of the 113.00 level see further decline to 112.45 next then the 112.00 level. Below the latter will shift focus to the 110.00 level though stretched intraday and daily tools caution corrective bounce. Resistance now at 114.21 and 115.54. [PL]

EUR/CHF Daily

Steadying at the 1.0952 low to consolidate the sharp drop from 1.1200 high of last week. However, the upside seen limited with resistance now at 1.1019/34 area. Would take lift over this to see room for stronger recovery to the 1.1100 level. Break of the 1.0940 support will see deeper pullback to the 1.0900 level and 1.0870 support. [PL]

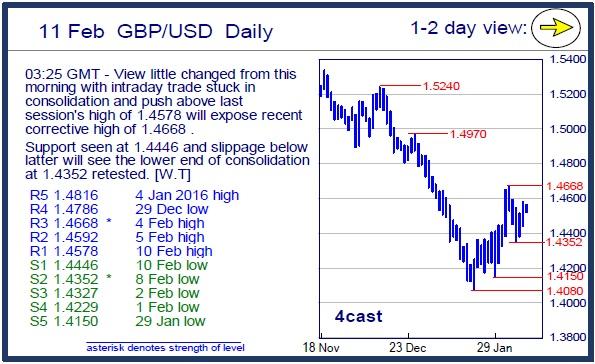

GBP/USD Daily

View little changed from this morning with intraday trade stuck in consolidation and push above last session's high of 1.4578 will expose recent corrective high of 1.4668 . Support seen at 1.4446 and slippage below latter will see the lower end of consolidation at 1.4352 retested. [W.T]

EUR/GBP Daily

Lower to unwind the strong rally from the .7526 low of last week. Setback from the .7851 high to break the .7756/31 support see room for stronger pullback to the .7666/61 area. Higher low sought for renewed strength later, above the .7851 high will see resumption of the strong up-leg from the Nov low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.