EURUSD

The Euro is regaining traction and rallies above 1.14 barrier, after yesterday’s brief probe above and subsequent consolidation. Bullishly aligned technicals support fresh extension higher and test of 1.1458, 17 Sep peak and 1.1473, Fibonacci 61.8% of 1.1712/1.1086, break of which to trigger further acceleration higher.

Session low at 1.1372, offers initial support, with extended dips to be contained at 1.1340 zone, broken bull-channel resistance / higher low of 13 Oct.

Res: 1.1458; 1.1473; 1.1500; 1.1564

Sup: 1.1400; 1.1372; 1.1340; 1.1317

GBPUSD

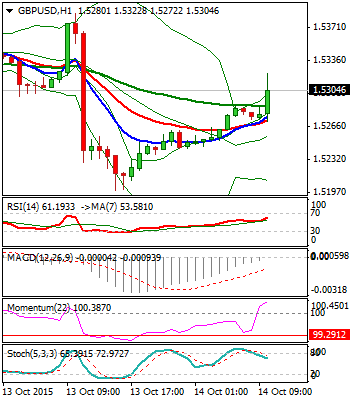

Cable recovers yesterday’s losses, when the pair fell sharply after repeated rejection at strong 1.5380 barrier. Strong fall found support at 1.52 zone, with subsequent bounce, probing again above 200SMA at 1.5319. Failure to sustain break above 200SMA, which is seen as key barrier, keeps the downside at risk.

Daily technicals are mixed, with bearish setup of MA’s and slow Stochastic reversing from overbought territory, giving negative signals. Some support is for now given by bullishly aligned momentum.

Near-term studies entered neutrality zone and will be looking for signal, to establish fresh direction.

Lower platform at 1.5380, also 50% of 1.5656/1.5105 downleg, marks the upper breakpoint, while yesterday’s low at 1.52 is seen as a trigger for fresh weakness towards 1.5105 base.

Res: 1.5342; 1.5386; 1.5420; 1.5446

Sup: 1.5275; 1.5243; 1.5200; 1.5135

USDJPY

The pair remains under pressure in the near-term and probes again below triangle support, currently at 119.81. Repeated daily close in red, after multiple failure to break above 120.40/70, daily Ichimoku cloud, keep the downside under pressure. Daily studies maintain bearish tone and favor further downside. Final break below 119 support zone, low of short-term congestion and loss of 118.67, 02 Oct spike low, is required to confirm bearish resumption. Descending daily 20SMA, caps at 120.03, ahead of triangle resistance at 120.15, which mark the upper breakpoints.

Res: 120.03; 120.15; 120.55; 120.87

Sup: 119.47; 119.23; 119.05; 118.67

AUDUSD

Extended near-term correction off fresh high at 0.7380, briefly probed below 0.72 handle, near Fibonacci 38.2% of 0.6935/0.7380 upleg. Dips were contained by rising daily 10SMA /Tenkan-sen line, keeping daily bulls unharmed for now. The move is seen as correction of nine-day rally, with current low, seen as ideal reversal point, with extension above daily cloud top at 0.7321, needed to confirm. However, further easing cannot be ruled out, as daily slow Stochastic reversed from overbought territory and shows more room towards the downside. Rising daily 20SMA at 0.7128, reinforced by daily Ichimoku cloud base, few ticks lower, should contain extended dips. Otherwise, break here would signal an end of recovery phase.

Res: 0.7288; 0.7310; 0.7321; 0.7362

Sup: 0.7196; 0.7157; 0.7128; 0.7105

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.