Briefly: In our opinion, speculative short positions are favored (with stop‐loss at 2,140 and profit target at 1,990, S&P 500 index)

Our intraday outlook is bearish, and our short‐term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short‐term outlook (next 1‐2 weeks): bearish

Medium‐term outlook (next 1‐3 months): bearish

Long‐term outlook (next year): bullish

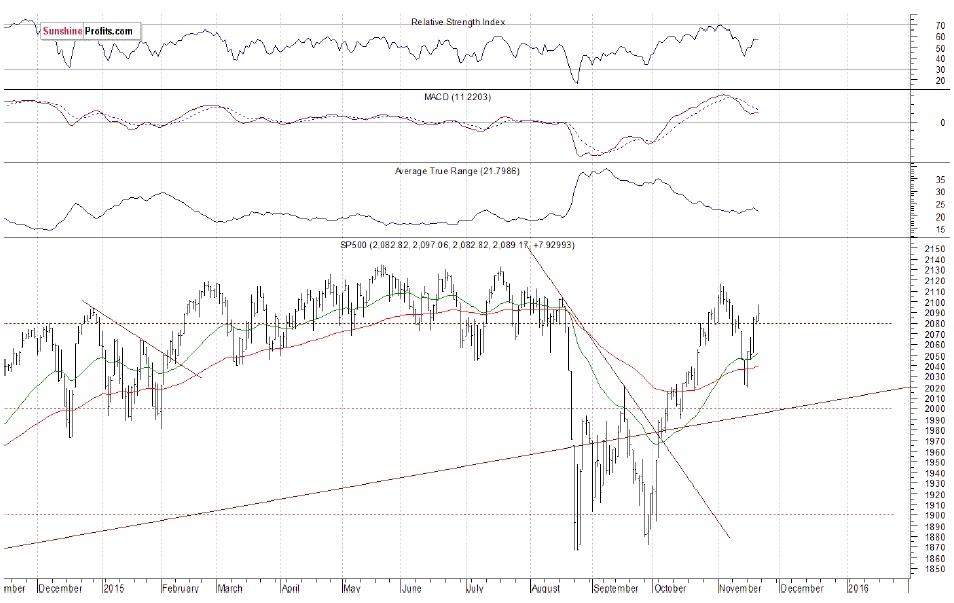

The U.S. stock market indexes gained 0.4‐0.7% on Friday, extending their recent move up, as investors reacted to economic data releases. The S&P 500 index continues to trade below resistance level of 2,100. The next important level of resistance is at around 2,130, marked by May all‐time high. On the other hand, level of support remains at 2,020‐2,050. For now, it looks like a consolidation following October rally:

Expectations before the opening of today's trading session are negative, with index futures currently down 0.2‐0.3%. The main European stock market indexes have lost 0.4‐0.9% so far. Investors will now wait for the Existing Home Sales number release at 10:00 a.m. The S&P 500 futures contract (CFD) trades within an intraday downtrend, as it retraces Friday's advance. The nearest important level of resistance is at 2,090‐2,100. On the other hand, support level is at 2,070‐2,080, as the 15‐minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it retraces its Friday's advance. The nearest important level of resistance is at 4,700, and support level is at 4,650, among others, as we can see on the 15‐minute chart:

Concluding, the broad stock market extended its short‐term move up on Friday, as it got closer to its early November local high. However, it bounced off resistance level of 2,100. Despite recent rally, there have been no confirmed positive signals so far. Therefore, we continue to maintain our speculative short position (2,088.35, S&P 500 index). Stop‐loss is at 2,140 and potential profit target is at 1,990 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract ‐ SP, E‐mini S&P 500 futures contract ‐ ES) or an ETF like the SPDR S&P 500 ETF ‐ SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.