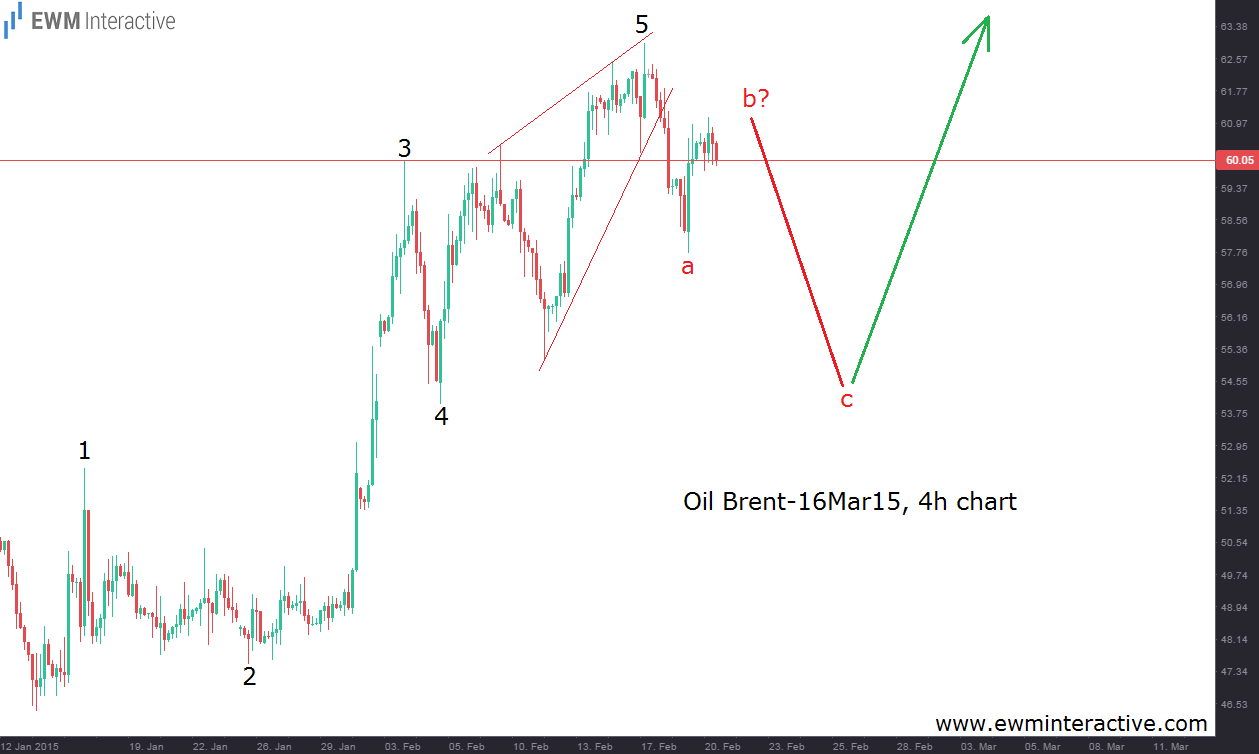

Almost two months ago, on February 21st, we said that brent oil is likely to get more expensive, but needs a downside correction first. We thought so, because there was a nicely-looking five-wave impulse to the upside on the 4-hour chart. The Elliott Wave Principle postulates, that there should be a three-wave retracement after every impulse. That is only the reason why our forecast looked like this:

As visible, we assumed brent was in wave B of an A-B-C zig-zag correction. So, wave C to the south was needed before the bulls could return. As the next chart demonstrates, the price of brent oil developed as a textbook example of the basic 5-3 wave cycle.

Wave C led prices as low as $52.50, which is precisely where the 61.8% Fibonacci level lies. Then the bulls came back and took the wheel. Yesterday, brent oil almost reached the $65 mark, thus making a new top, above the one left by wave 5 at $63. In terms of the Wave Principle, this is the minimum requirement for a successful forecast. However, if we stick to the big picture outlook, we will see there is room for much higher levels.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.