Polish Zloty (EUR/PLN) – rates cut to historical lows

The first week of March was supposed to be very volatile. Not only Mario Draghi revealed more details about the ECB’s QE program (which will begin on Monday, March 9th), and a strong NFP report gave a boost to the USD. What could be the effect of more Euros circulating in the Eurozone? More investments in emerging markets is a possibility, which in turn can strengthen currencies like the PLN, HUF or RON. To be honest, a strong Zloty is the last thing the Polish economy needs. Exports will drop and with the current deflation it can give a dangerous mixture. This past week major markets experienced larger movements but emerging market currencies remained rather stable. The main event of the week on the Polish market was the MPC’s decision to cut interest rates by 50bp (finally!) to its lowest level in history at 1.5%. This move actually surprised analysts as most of them were expecting a rather mediocre cut of 25bp. Well, the MPC “shocked” the world but to be honest, it should have done it some time ago. Marek Belka, MPC’s Governor, stated that this cut ends the cycle and that we should not expect any more cuts coming up. I believe this will be the case unless the economy really struggles and lower rates will be needed. So far, deflation has been (and still is) the main problem. Other macro indicators show the Polish economy is in decent shape. The most recent (for February) Manufacturing PMI increased to 55.10 points while other indicators remain stable. The question is if consumption will pick up causing inflation to increase. The effects of lower interest rates will be seen in a couple of months. How do we currently stand with inflation we will learn next week when the CPI report for February will be published. Despite the interest rate cut, the Polish Zloty fought back and appreciated. Just after the decision, the EUR/PLN climbed to 4.18 but it retreated pretty quickly and broke the 4.15 support. What certainly helped the PLN were the increasing yields on Treasuries and foreign capital flying in.Looking at the daily chart we see the EUR/PLN broke the 4.15 support and continued its descent in a strong fashion after the NFP report. Currently, it is being traded around 4.12 and if this level is broken, the market will target the 4.09 support. A rebound could take the market back to 4.15. Reaching 4.09 next week is the more probable scenario but I do not see the EUR/PLN heading towards 4.00. Sure, the economy is showing strength but the uncertainty around inflation (or the lack of it) and how this will affect the GDP makes me believe the EUR/PLN will remain above the this crucial level in the upcoming weeks. _20150306155416.png)

Pic.1 EUR/PLN D1 source: xStation

Hungarian Forint (EUR/HUF) – Week for rollercoaster fans

Monday began with strong Forint negative moves. The Hungarian currency depreciated almost 1.5% against the euro. The possibility for an interest rate hike by National Bank of Hungary and profit taking stopped the Forint bulls at the beginning of the week. From Wednesday though, an acceptable ADP Non-Farm Employment Change report changed the sentiment and thanks to the weak Euro the Forint regained some ground. As for the macroeconomic side, Hungary shows convincing exports and GDP performance figures. Both exports and imports volumes grew by 11% (yearly basis) in external trade. The trade surplus was 345 million EUR in December, which was 120 million EUR more than in the same month of 2013. Credit rating agencies started to perceive Hungary in a different light in 2014 than before. The NBH Governor, György Matolcsy, said in January that it is a realistic expectation that Hungary’s credit rating will be upgraded this year due to the country’s solid economic fundamentals. Moody's is reviewing Hungary’s credit rating on Friday and it is hard to say how the credit agency will decide. It can still have a big impact on the Forint market.Taking a look at the weekly chart it is clear that the EUR/HUF slid back below the 100 EMA, which is still an important resistance for Forint buyers. If the EUR/HUF remains under that level, the 300 zone will be available next week. We also see that more carry traders took advantage of the pull back and opened sell transactions above the 305-306 zone. Next week we are expecting the detailed NBH's Meeting Minutes, which could bring more light to the monetary policy view in the near future.

_20150306155441.png)

Pic.2 EUR/HUF W1 source: Metatrader

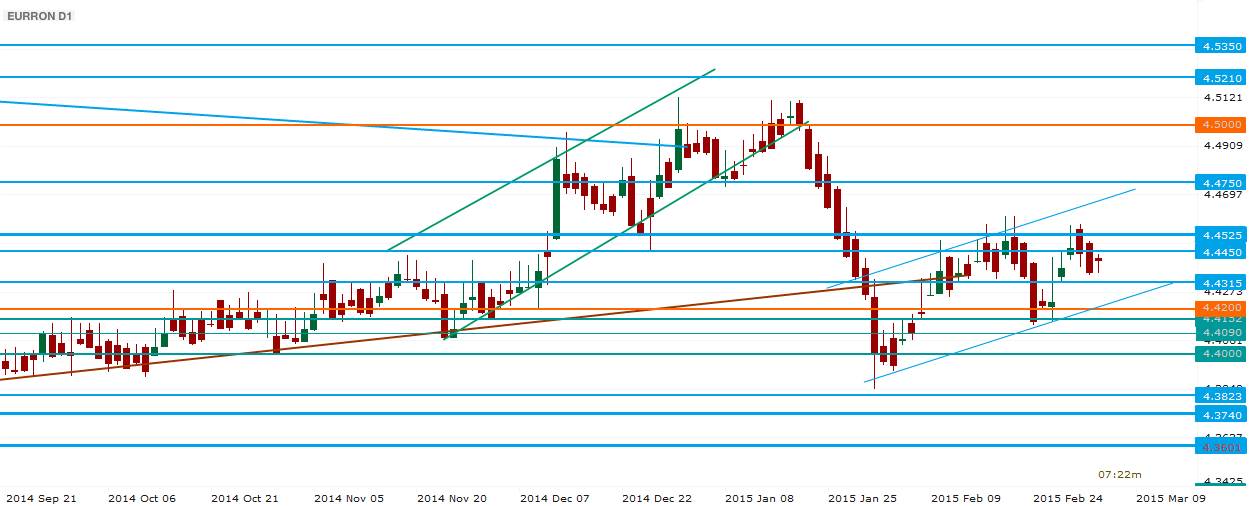

Romanian Leu (EUR/RON) – Looking forward to European QE

The EUR/RON moved higher, and only found a new balance around 4.44, as it digested the fiscal relaxation plans – with the concern that the government may be overestimating the positive effect on income of better lower taxes – and the coming QE in the largest commercial partner – the Eurozone. Local macro data is on the bright side, GDP grew by 2.9% last year, and there may be room for a similar performance this year, despite the agriculture likely putting a break, very differently from last year. Retail and even wages move forward, yet the PPI suggested a deepening of deflation risks, and more energetic response from the National Bank. We view the risks are broadly balanced for EURRON, with a large help from Mario at the helm of ECB, but watchful traders would observe the record highs in USDRON and decide that probability still goes for the USD in the aftermath of payroll data.Technical analysis image becomes more lateral, over the short term, but redefines an uptrend channel from a broader view. The support stands at 4.4315 and 4.4200, with very good chances of touching the first one. We view the market as most likely crawling higher, with resistance to watch at 4.4525 and 4.4750, as soon as the current price-discovery Brownian move matures.

Pic.3 EUR/RON H1 source: xStation

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.