The GBP/USD pair jumped to 1.43 levels in the European session and extended gains further to a high of 1.4445 in the US session on the back of a broad based USD weakness triggered by a weak US PMI manufacturing and personal spending data. The major takeaways from the US data released yesterday are – the savings rate in December rose to highest since Dec 2012 (as income rose, but spending dropped) and ISM manufacturing employment index dropped to 45.9 in Jan from 48.0 in Dec.

Eyes UK construction PMI

Cable’s corrective rally from the multi-year low of 1.4079 could receive another shot in the arm today if the construction PMI for January prints more than the estimated drop to 57.6 from 57.8. This is the least important PMI when compared to the other two – manufacturing and services. Nevertheless, a better-than-expected construction PMI would be welcome development. Again, the single most important component of the construction PMI (apart from the headline) is the employment sub-index. A rise in construction sector employment would be good news but may receive little immediate attention from the markets. Later in the day, Fed’s George’s comments would be watched out for any hints regarding the next rate hike.

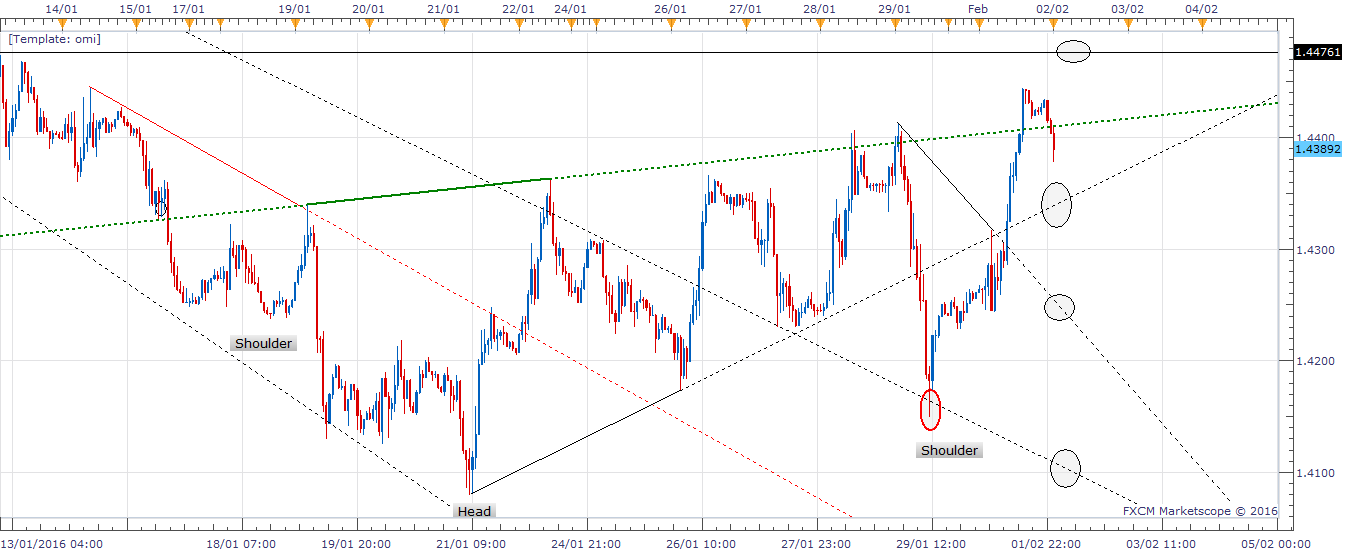

Technicals – Next stop at 1.4476 after bullish daily close

Sterling’s rebound from the falling trend line support (marked by red circle) on Friday, followed by a bullish daily closing above 1.4413 (Friday’s high) has opened doors for a rise to 1.4476 (immediate resistance on the hourly chart).

A break higher would expose 1.4516 (23.6% of 1.5930-1.4079).

Fresh bids are seen coming-in so long as the pair stays above the rising trend line support on the hourly chart currently seen at 1.4340.

An hourly close below the rising trend line support would warrant caution as the pair may slip further to next support seen at 1.4249.

EUR/USD Analysis: Eyes confluence of Fibo and falling trendline resistance at 1.0940

The EUR/USD pair rose to an intraday high of 1.0919 on the back of a moderate risk aversion in equities and weak US data. The PMI numbers across Eurozone once again received little/no attention from the markets. This has been the case ever since the EUR became a funding currency (after ECB introduced (-ve deposit rates). Moreover, the funding currency is more responsive to action in the risk assets and only tracks critical data sets like – inflation numbers in EZ and US data.

The German unemployment change and the Eurozone unemployment rate due today could be ignored as well. A few pips move here and there cannot be ruled out, but a major trend change is unlikely following the German/EZ data release. Meanwhile, the economic calendar in the US is light as well. Hence, the common currency remains at the mercy of the equity market sentiment and broad based demand for the US dollars.

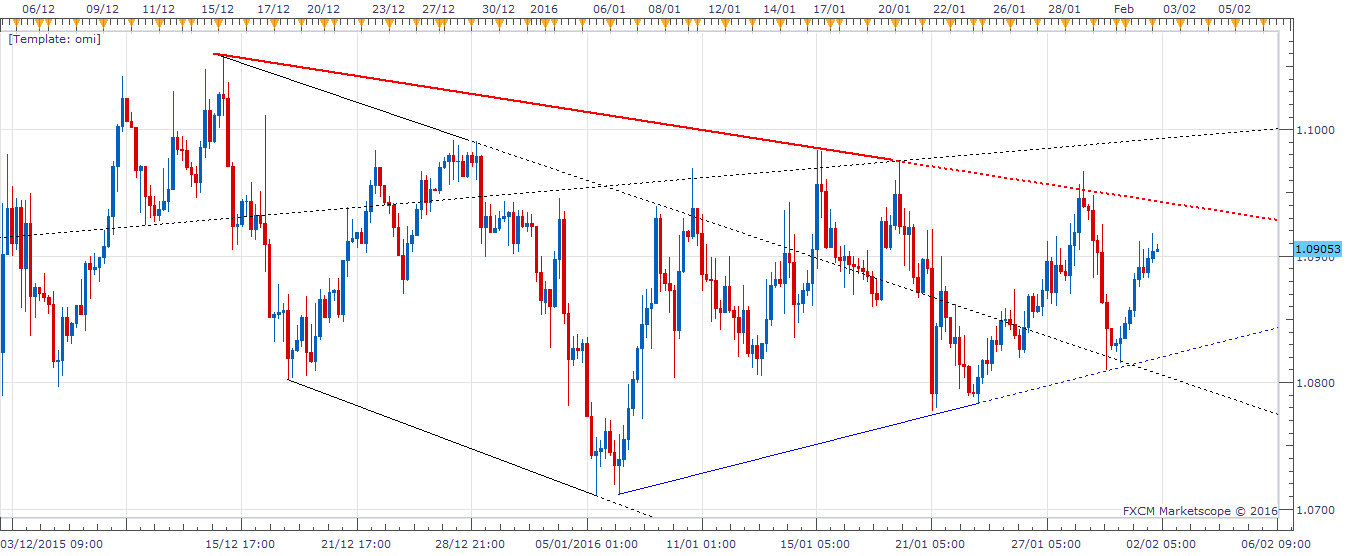

Technicals – Eyes 1.0940

Euro’s rising bottom formation on the 4-hour chart, coupled with a bullish break from the falling channel indicates the currency is likely to make a go at the confluence of the falling trend line resistance and 61.8% of Mar-Aug rally seen at 1.0940.

Only an hourly close above 1.0940 would open doors for a further rally to 1.10 levels

On the other hand, a failure take out 1.0940 could see the pair revisit the rising trend line (blue) support currently seen at 1.0820.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.