A stable GBP/USD pair has become a rare sight since December, but the pair finally found some stability in the last 24 hours – stuck in a 100-pip range of 1.4120-1.4220. The drop in the UK unemployment rate and a slightly better-than-expected UK wage growth data coupled with a weak US CPI and housing starts figure opened doors for a much needed technical correction in the pair. The spot attempted a recovery but was rejected at the hourly 50-MA. As of now the pair is trading around 1.4175 levels.

Eyes ECB rate decision

No major UK or US data is due for release. Hence, the doors are open for a technical correction. The technical correction may gather speed if the ECB President hints at an expansion of the QE program/or another rate cut, driving the EUR/GBP cross lower. A sharp drop in the EUR/GBP could help the GBP/USD move higher.

GBP/USD Technical Levels

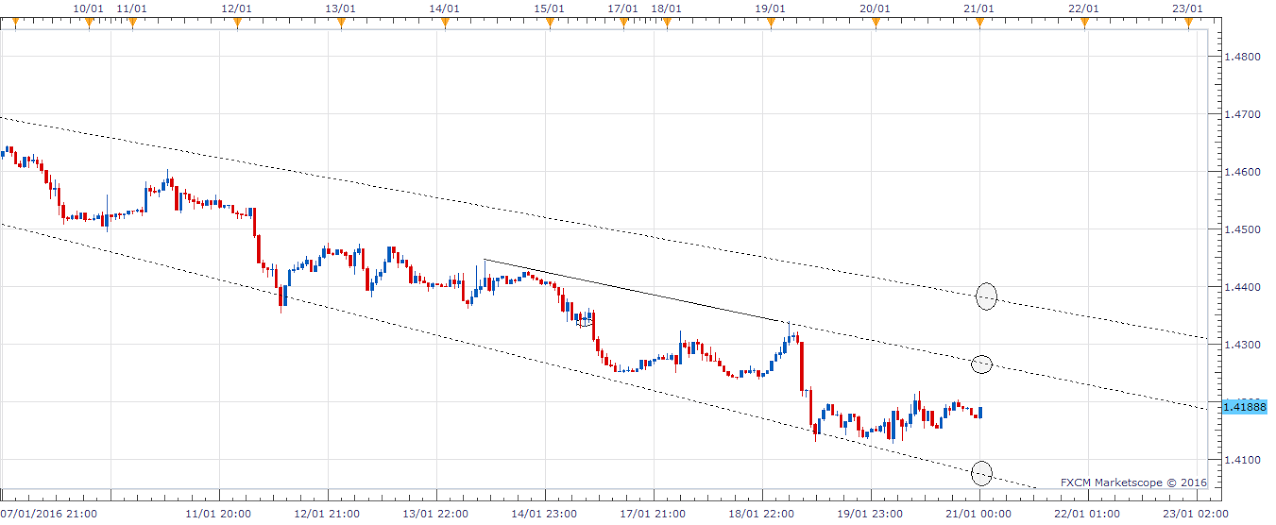

The pair found bids again yesterday as it approached the falling channel support on the hourly chart.

Sterling’s bounce from 1.4215 levels, coupled with the bullish Price-RSI divergence on the hourly chart indicates the currency could take out hourly 50-MA resistance of 1.4191 and head towards the falling channel resistance on the hourly chart at 1.4266.

Caution is advised once the pair is around 1.4266, since the 5-DMA is at 1.4249. The pair has been repeatedly offered around 5-DMA in last one month or so. Hence, a daily close above 5-DMA could indicate a short-term trend reversal.

On the other hand, a failure to take out/sustain above the hourly 50-MA could see the pair revisit previous day’s low of 1.4125.

EUR/USD Analysis: ready for a bullish move, but there is ECB ahead

The EUR/USD pair formed a bearish inverted hammer formation on the daily chart yesterday. The pair ran into offers again as it neared 1.0974 (38.2% of 1.1714-1.0517). The bearish move was quite surprising since the US data was weak, while the equity markets across the globe traded in the red. The Today, the Asian equities suffered losses again and that appears to have supported the pair, which is now trading slightly higher around 1.0890 levels.

ECB may disappoint

No one expects the ECB to tweak its monetary policy today. However, there is a consensus in the market that Draghi is likely to remind markets that the bank stands ready to cut rates further or expand QE in order to achieve price stability. Many in the market also expect Draghi to hint at a possible action in March as slide in oil prices is likely to push inflation lower. Yesterday’s drop in the EUR/USD despite weak US data and risk averse markets indicates the markets priced-in Draghi’s dovish tone.

However, there is a possibility that the ECB may disappoint in a sense that Draghi may not go any further than the routine dovish commentary – bank stands ready to do more (QE or rate cuts).

By now, it is quite clear that central banks are unable to fight oil driven low inflation. Hence, the ECB may throw in a towel in its fight against oil driven low inflation (by not hinting at more easing in March), the way BOJ did in Q4 2015. In this case, the EUR/USD pair would quickly recover from a minor hiccup and head higher towards its 200-DMA at 1.1048.

Technicals – Ready for a bullish move

Euro’s sharp recovery from 1.0517 followed by a falling channel and bullish break from the same indicates the currency is ready to test the 200-DMA at 1.1048.

Euro’s bounce from the falling channel support today has increased the likelihood of a move higher to 1.0974 (38.2% of 1.1714-1.0517). A break higher would expose the 200-DMA.

On the other hand, a failure to sustain above the falling channel support could see the pair drop sharply to 50-DMA at 1.0813. The bullish outlook is at a risk of a daily closing below 50-DMA.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.