The GBP/USD pair fell to a low of 1.5053 before recovering somewhat to end the day at 1.5076. The second estimate of the US Q3 GDP revised the growth rate higher to 2.1% as expected and thus turned out to be a non-event for the markets. Other US data sets were conveniently ignored. Mark Carney’s comments tilted a little on the dovish side and made matters worse for the Sterling bulls.

Eyes UK Autumn forecast statement

George Osborne, at the Autumn statement and spending review today, is set to announce the biggest housebuilding programme since the 1970s to end the “crisis of home ownership in our countryâ€. He is also expected to announce cuts in spending and welfare and spread cut in tax credits over the course of the next four years instead of introducing them overnight.

The markets will also eye the forward-looking statements on the UK’s economic health and the Sterling is likely to resume its downward journey if Osborne maintains a cautious tone regarding the economy.

Later today, the US durable goods orders, personal spending and income, weekly jobless claims are due. Whether the data would be able to move markets or not is discussed here (Macro Scan)

Technicals - Bear trend intact

An oversold RSI on the hourly and 4-hour chart led to a minor overnight rise in Sterling to 1.5114 levels. However the daily RSI remains below 50.00, but still above oversold territory. Thus, pair is likely to see a renewed selling pressure around the hourly 50-MA at 1.5117, leading to a break below 1.5087 (61.8% of Apr-Jun rally). Failure to sustain above 1.5087 would open doors for a drop to 1.5027-1.50 levels. On the higher side, an hourly close above hourly 50-MA could see a quick fire more to 1.5163 (Sep 4 low). Overall, the spot appears likely to end lower for the fourth consecutive session.

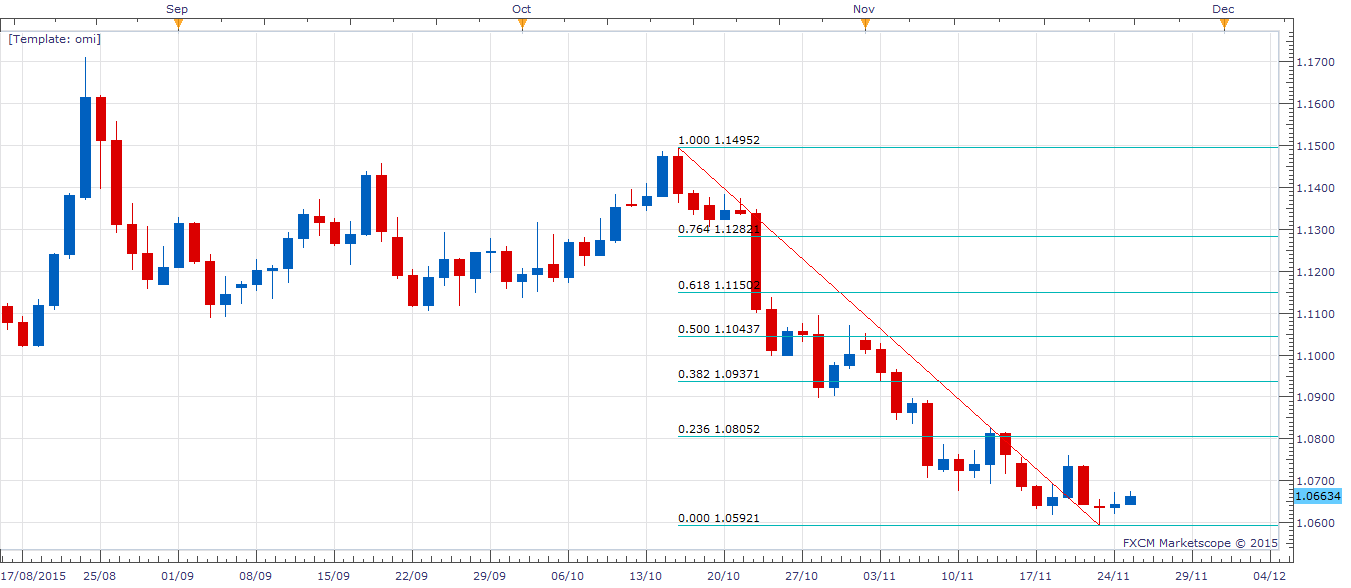

EUR/USD Analysis: Could revisit sub-1.06 levels

EUR/USD moved higher to 1.0673 in New York session due to broad-based short covering in euro on account of weakness in the stock markets before briefly falling back to 1.0628 following upbeat Q3 US GDP data.

With no major data due today, the EUR could track movement in the stock markets ahead of the US data due later today.

Technicals – short covering ends today?

Monday’s Dragonfly Doji was followed by a spinning bottom formation yesterday which says the traders continue to feel directionless despite a bullish candle (dragon fly) on charts on Monday. Consequently, the short covering in the EUR may end today opening doors for a fall back to 1.0592 (Monday’s low). A break lower would shift risk in favour of a re-test of yearly low of 1.0463. On the higher side, only a break above 1.07 will point to continuation of short covering, which may last till 1.0805 (23.6% of 1.1495-1.0592).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.