The GBP/USD spot witnessed an erratic move to an intraday high of 1.5678 on Friday after the Employment Cost index data in the US showed wage growth slowed to the lowest since 1982. The weak data pushed the 2-year treasury yield lower by almost ten basis points from its intraday high of 0.75%, indicating a drop in the US rate hike expectations. However, hawkish comments from Fed official ensured the spot closed at 1.5626. The investors now are likely to stay focused on the barrage of key data/events on Thursday – BOE minutes, Industrial Production, rate decision and BOE inflation report with the press conference to follow 45 minutes later. As for today, manufacturing PMI numbers in the UK and personal spending report in the US is likely to dominate the wires.

Could see a drop in UK PMI due to strong Pound

UK PMI (July): expected 51.5, previous 51.4

US Personal Spending (July): expected 0.2%, previous 0.9%

The final July PMI reading is once again likely to show the new inflow of work, especially export orders took a hit a due to strength in the Pound (primarily against the EUR). Moreover, The EUR/GBP average in July dropped to around 0.7070; its third monthly drop. Consequently, there is a high possibility that the actual PMI manufacturing figure prints below the expected 51.5 in July. A weak print is likely to see GBP/USD struggling to take out resistances at 1.5639-1.5690.

However, the losses post weak PMI print could be undone in the US session, in case US personal spending falls below the expected drop to 0.2% from 0.9%. The 2-year treasury yield would take further hit in such a case, thereby triggering broad based weakness in the USD. The GBP/USD pair could turn out to be the top performed today if the neutral/upbeat UK PMI is followed by a weak US personal spending report.

Technicals – Eyes 10-WMA at 1.5585

The resistance at 1.5639 (38.2% of June rally) stayed intact on Friday after the spot ended at 1.5625. An attempt at 1.5639 in the early Asian session failed today, opening doors for further weakness towards 1.5585 (10-WMA) levels. Moreover, the pair has been repeatedly offered above 1.5639 since mid July, ensuring it remained below the same on closing basis. Thus, intraday rallies on stronger UK PMI could run into fresh offers, thereby capping gains anywhere in the range of 1.5670-1.5690.

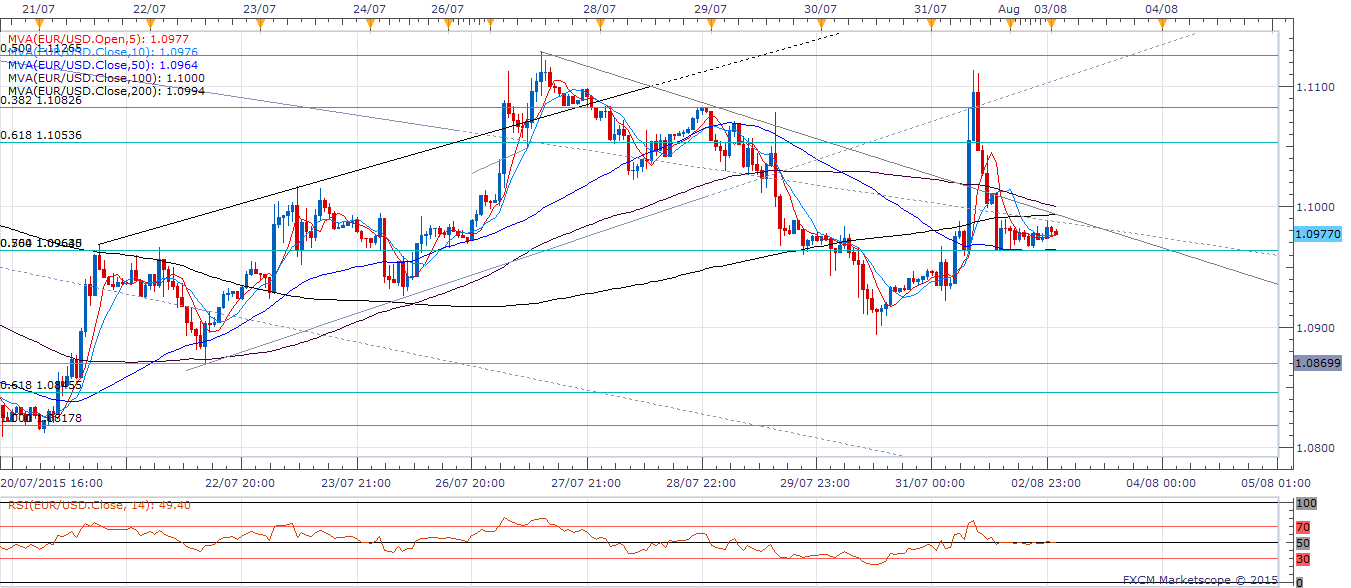

EUR/USD Analysis: Weak tone below 1.0964

The broad based weakness in the US dollar on Wednesday led to a sharp spike in the EUR/USD to a high of 1.1115, before hawkish comments from St. Louis Federal Reserve President James Bullard helped dollar to recover losses. In the early US session on Friday, the USD had come under fire due to the surprisingly downbeat US wages report, which led to a sharp drop in the 2-year treasury yield.

Focus on EZ PMIs and US Personal Spending

EZ PMI manufacturing (July): expected 52.2, previous 52.2

The final manufacturing EZ PMI reports are due across the Eurozone, followed by the personal spending and the core pce figure in the US. Upbeat PMI reports (on account of inflow of new work) could help the prices sustain above 1.0964 (50% of Mar-May rally). The PMI reports are likely to show weak exchange rate led to a high inflow of new orders from abroad and uptick in input price inflation. In case the PMI reports disappoint, the support at 1.0964 could be breached ahead of the US personal spending report, thereby opening doors for further losses, especially if the personal spending and core pce prints higher than expected.

EUR/USD Technicals – Bearish below 1.0964

The EUR’s failure to take out 1.1120 on Friday followed by a sharp retreat to the support at 1.0964 (50% of Mar-May rally) indicates the weak tone is likely to remain intact today. A minor upmove towards 1.1023 (100-DMA) could be seen in case of upbeat EZ PMIs, however, after the sharp retreat from 1.1120 on Friday, the upticks in the pair could be utilised by bears to initiate fresh offers. On the downside, a break below 1.0964 shall open doors for re-test of 1.0893 (July 30 low).

Commodity currencies could suffer

The commodity dollars could see a renewed sell-off, either against the GBP or against the US dollar. Crude sell-off is likely to continue after Iran oil minister Bijan Namdar Zanganeh said his country can boost oil production in one week after international sanctions are lifted. The resulting weakness in Crude along with weak Chinese PMI makes commodity currencies vulnerable. In case of weak US data, commodity currencies appear vulnerable against the GBP, especially if the UK PMI is upbeat. On the other hand, strong US personal spending report could push USD higher against Comm Currencies pack.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.