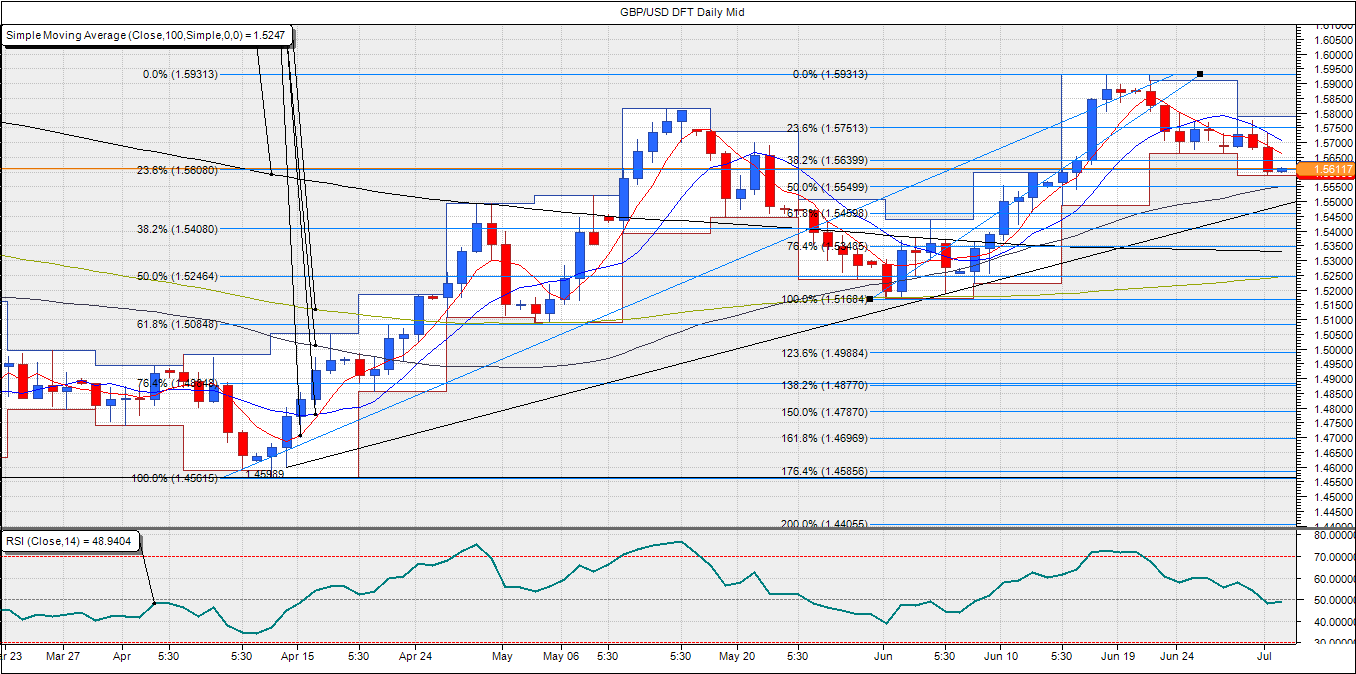

The GBP/USD pair witnessed a downside breakout from the week long range of 1.5667-1.5750 after the weaker-than-expected UK PMI manufacturing figure hit the wires. The pair hit an intraday low of 1.5588 in the North American session, before ending the session at 1.5603.

Strong GBP could eventually force the BOE to turn dovish

What was more important in the PMI report was the drop in the new export order due to the impact of a sterling exchange rate – primarily EUR/GBP. I have been posting this in morning report since last couple of months that the EUR/GBP exchange rate is having a negative impact on the export orders received by the UK firms. Given the BOE is concerned about the current account deficit, a sustained strength in the GBP against the EUR could force the BOE to adopt a dovish policy tilt.

As for today, the pair could trade in line with the overall market sentiment as the focus shifts from Greece to US on-farm payrolls. No major UK data is due for release. NPF is expected to show the US economy added 230K jobs in June.

On the technical charts, the pair suffered a bearish daily close below 1.5606 (23.6% Fib R of 1.4564-1.5928). At the moment, the pair is trading at 1.5611 with daily RSI bearish at 48 levels. The pair could test the immediate resistance 1.5638 (38.2% Fib of June rally). However, a downside breakout from the week long trading range is likely to bring in fresh offers, which could push the pair back below 1.5606. In such a case, the losses could be extended to 1.5549 (50% Fib R of June rally). On the higher side, only a break above 1.5667 would turn the short term view from bearish to consolidation.

EUR/USD Analysis: Drops below rising trend line support

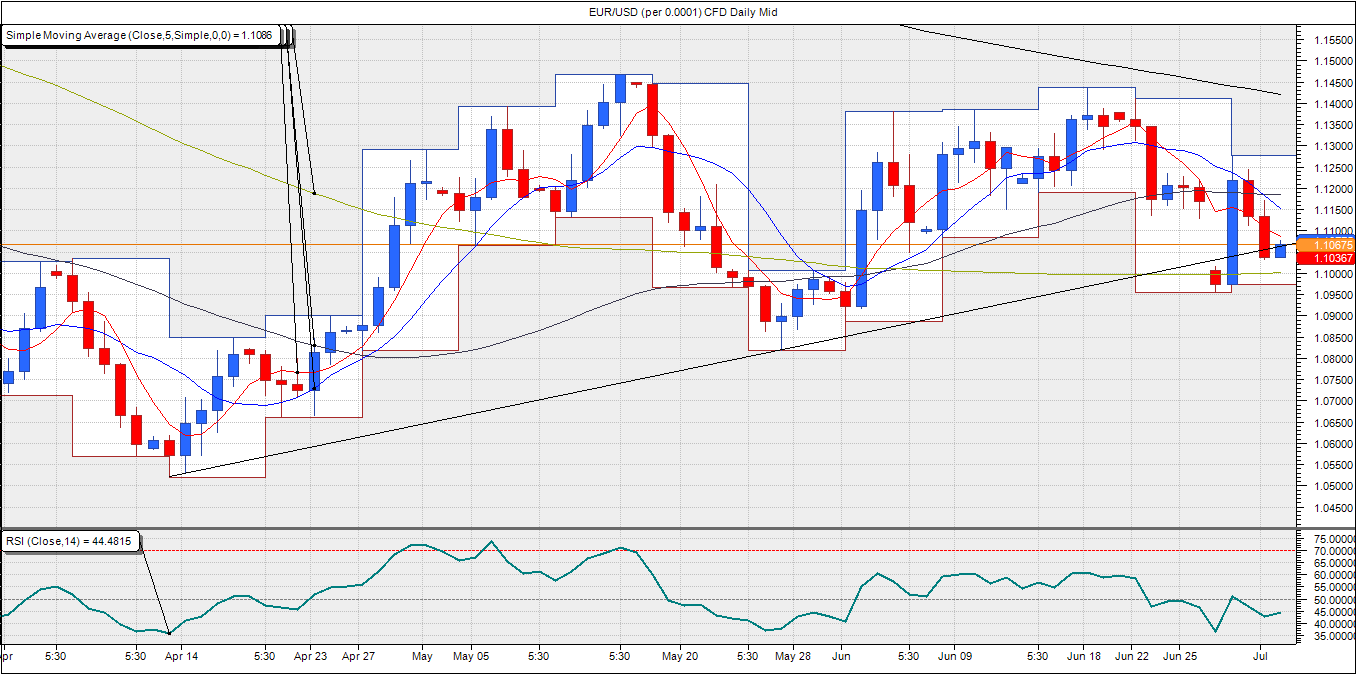

The EUR/USD pair fell to as low as 1.1043 near New York close due to the release of upbeat US ADP employment data. During the European session, the pair clocked a high of 1.1171 on hopes of a new bail out programme for Greece. However, optimism quickly faded after German Chancellor Merkel once again rejected talks before the July 5 referendum. Similar comments came from Germany’s Schauble and the EUR chief Dijsselbloem. From the Euro’s point of view, the focus now shifts to the July 5 referendum.

Meanwhile, investors would also watch out for the US non-farm payrolls in June (exp 230K, prev 280K). A number between 200K-230K would not have much impact on the overall market positioning. However,a better-than-expected figure could trigger a fresh USD rally. The EU PPI and the ECB minutes could be overshadowed by fresh noise about the Greece situation.

On the daily charts, the pair breached the rising trend line support on Wednesday as it close at 1.1037. A fresh attempt has been made today to sustain above the trend line resistance 1.1.068-1.1070. However, with the bearish daily close and bearish RSI on the daily and intraday time frame, the pair is likely to run into offers anywhere between 1.1070-1.11. The spot could drop to 1.10 levels. On the higher side, only a break above 1.1130 could lead to short term bullish momentum in the pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.