Last week was relatively positive for the Kiwi Dollaras a range of US economic data proved weaker than expected. The US NFP was highly negative, coming in at 142k (202k exp) whilst Average Hourly Earnings also fell to 0.0% m/m. The NZD Subsequently rose higher and managed to finish the week around the 0.6450 level. However, the week ahead will prove critical for the venerable currency as it prepares to be largely dominated by the US unemployment rate and Non-Manufacturing PMI results.

The next few days will see the Kiwi Dollar focused upon the US labour market as the Unemployment Claims figures fall due. The market will be closely watching the results from this indicator, for some sort of signal as to the US Federal Reserve’s intent in the coming FOMC meeting.

Any further demonstrated weakness within US labour markets could doom any rate hikes for 2015. The pressure is already mounting for the central bank to hold off on any monetary policy changes given the weaker than expected NFP data. So any weakness in the US Unemployment Claims figures could benefit the NZD and cause a sharp appreciation against its namesake. In fact, the NZD is currently climbing ahead of the labour market result, as the market looks to take a risk off approach.

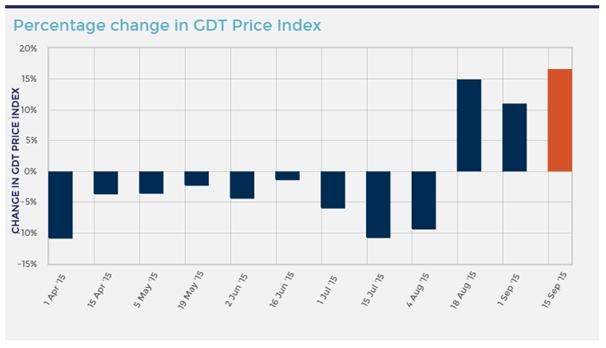

However, there is also some important NZ macroeconomic data due this week that has the potential to be missed considering the volatility that is likely to be present around the US unemployment Claims data. A Global Dairy Trade (GDT) auction result is due shortly and, given the importance of dairy to the New Zealand economy, should be watched closely.

New Zealand’s largest dairy producer, Fonterra, has recently restricted supply in an attempt to alter the equilibrium price, which obviously limits the possibility of a negative result. Subsequently, it is likely that the GDT auction will provide another price increase, albeit a largely artificial one.

From a technical perspective, the pair continues to consolidate as it remains above the 64 cent handle. Also, the moving averages have started to turn with the 12 crossing the 30EMA whilst RSI continues to creep higher. Subsequently, the NZD is looking bullish, albeit in the short term, given the MA crossover and trending RSI oscillator. Support is found at 0.6285, 0.6237, and 0.5918. Resistance is found at 0.6521, 0.6679, and 0.6707.

Ultimately, the coming week is likely to be critical in determining the NZD’s short term trend given some of the encouraging signs. However, the medium term is still presenting some highly bearish signals, so buyers should be careful not to get their fingers burned.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.