The EUR/USD pair witnessed a technical breakout on Monday on the daily charts, signalling the recovery from the March 2015 low of 1.0469 may have resumed.

The main reason for the upside break is the sharp fall in the Fed rate hike bets. Markets do not see a rate hike happening in 2015, but even the probability of a rate hike in March 2016 is very low. Right of the bat, it is worth noting that the rates could be hiked by 5/10/15 basis points, but such rate hikes would even lack the symbolic appeal and are more likely to signal extreme nervousness on the part of the Fed to begin policy tightening.

Meanwhile, the European Central Bank is likely to keep its QE program unchanged at least till the end of the current year. The popular opinion suggests that EUR is now almost 1000 pips higher from its March low and thus, may force the ECB to do more QE or push rates further into the negative territory. However, it must be remembered that the EUR is still more than 2000 pips below its May 2014 high of 1.3991. Despite this, inflation in the Eurozone is hovering around zero levels in annualised the terms. It is thus, quite clear that devaluing the currency is unlikely to help matters. Furthermore, a possible recovery in crude would only add to the EUR’s strength. (Sell-off in crude had triggered USD strength in Q4 2014 as it meant more easing from advanced nation central banks).

Carry unwind is also likely to continue heading into the year end on account of China-led risk aversion. Europe’s vulnerability to the Chinese economy is quite clear from the action in the European equity markets today. German export machinery is at risk since the China slowdown is likely to become more intense ahead. The drop in the Chinese imports (low domestic demand) is a more serious problem for Europe and the world economy and provides little scope for Fed to hike rates this year or in Q1 2016. Moreover, China slowdown (in imports) drags fed away from the rate hike (a negative sign) as it cannot afford to have a strong USD at a time when the global economy is facing aggregate demand deficiency and its own domestic consumption is anaemic.

And last but not the least, a spike in the EUR/GBP cross should also add to the upside momentum in the GBP/USD pair. BOE too is expected to turn dovish and may actually cut rates ahead (https://www.fxstreet.com/analysis/macro-scan/2015/09/29 ). BOE’s McCafferty, the only member vouching for a rate hike, was on the wires today stating that the bank may consider interest rate (cut) rather than QE and may even consider QE if required.

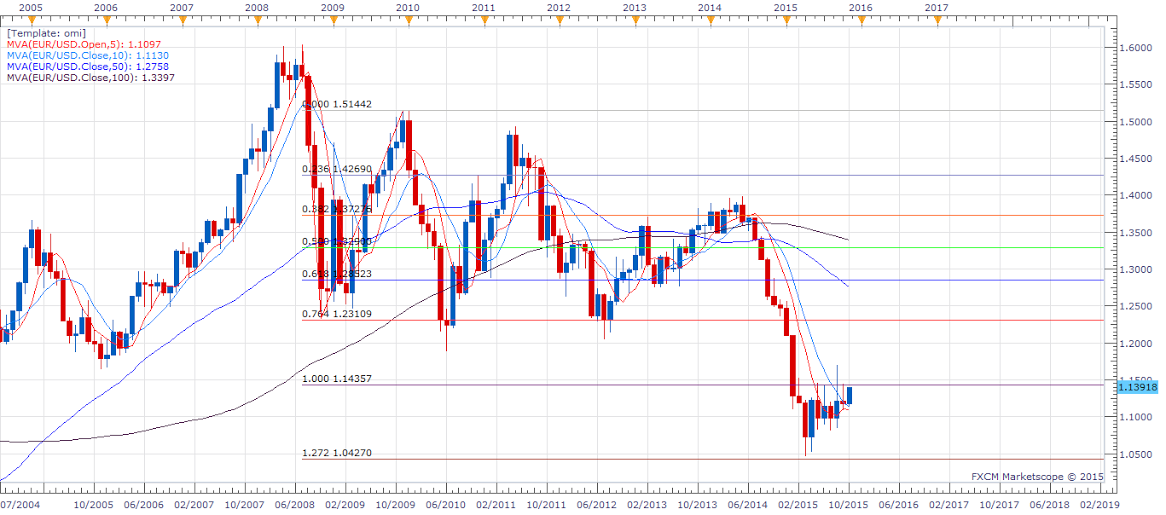

EUR/USD Technical Chart

The pair appears on its way to test 1.1808 (38.2% of May 2014-March 2015 plunge)

If we put a Fib expansion from 2008 high-2008 low-2009 high, the 100% expansion level stands at 1.14357; a level which has acted as a strong resistance since May 2015. The pair did rise above the same on a couple of occasions,but failed to see even a weekly close above it.

However, with dropping Fed rate hike bets and other reasons discussed above, the odds of a weekly/monthly close above 1.14357 are high now and this is likely to be followed by a rise to 1.1808 levels.

On the daily and the weekly chart, we have already witnessed an upside break from the symmetrical triangle formation.

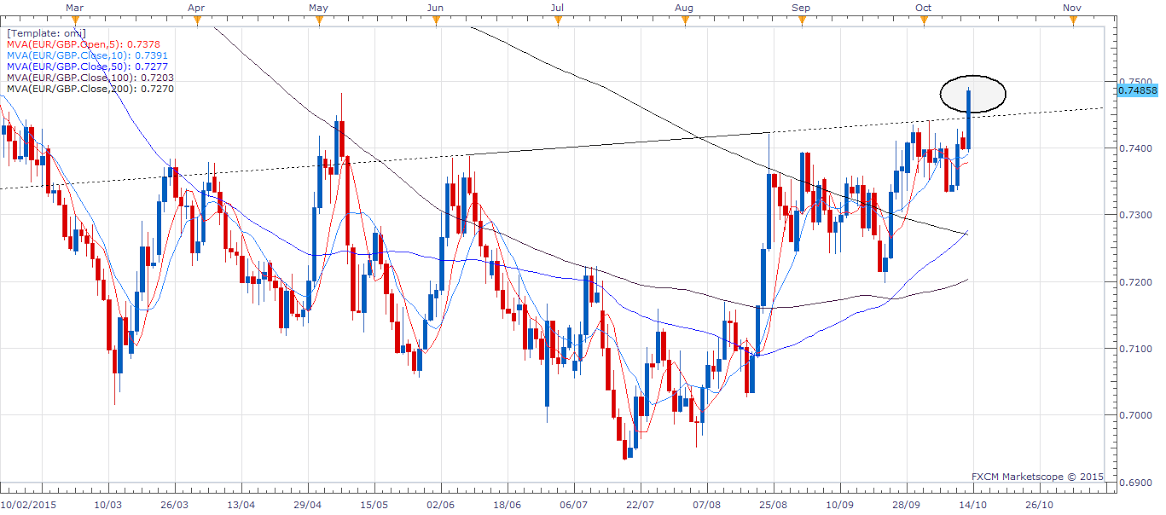

EUR/GBP – Inverted Head and Shoulder breakout almost confirmed

The EUR/GBP inverse head and shoulder breakout was already anticipated here (https://www.fxstreet.com/analysis/macro-scan/2015/10/06 ).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.