Crude Oil had a particularly bad start to the year going from its open on January 4th at $38.34 per barrel to its most recent low of $27.70 in the first three weeks. It has since turned the bear trend around, at least for now as it at $38.52. The market, however, has still not changed completely, and most analysts are waiting for further evidence before calling it a new bull trend.

The price of Oil has been helped over the past weeks as Stock markets in the US and Europe have shown signs of recovery. The S&P 500 has gained 8.2% over the since February 11th, which also coincided with a strong rally in Oil price as it moved from a low of $28.36 to its most recent high at $39.70. Oil production from the US has also been on the decline since October 2014 when there were 1,931 Gas & Oil fields combined. The rig count has been decreasing as it follows the downward movement of Oil price. As of March 4th, another 13 Gas & Oil rigs have been closed, sending the total count to 489. Oil rigs saw a reduction of 8 to bring total oil rigs down to 392, the lowest level since 2009.

Such a drastic reduction in production capability has also been offset in some ways by reduced demand especially from some developing countries, like China and Brazil. Another factor keeping Oil supply plentiful is Iranian Crude is available and being exported across the globe. Iran’s Crude Oil production is forecast to increase to 3.1 million barrels per day, from 2.8 million pre-sanction production. It is expected to increase further in 2017 to 3.6 million barrels per day.

OPEC has recently decided not to cut production quotas, and it may be a while before that action is taken. Supply would seem set to remain high, and it would probably take a significant expansion in global economic activity to change the medium-term trend for this commodity.

If you think volatility for Crude Oil will rise over the next week, then all you may buy a Straddle strategy which consists of simultaneously buying a Call and a Put option with the same strike, expiry and amounts.

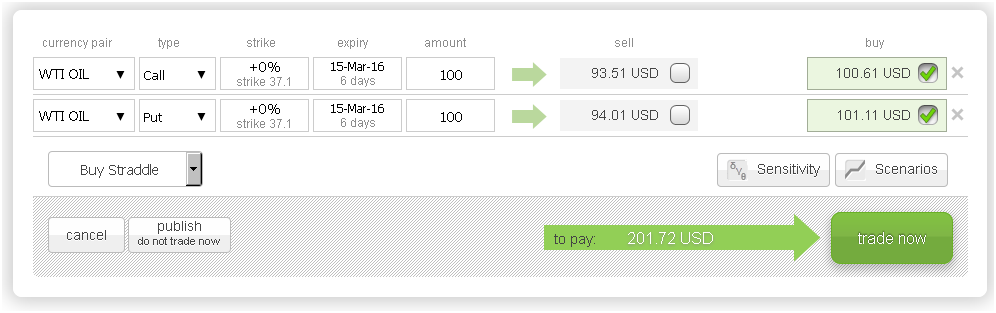

The screenshot below shows a Buy Straddle with $37.10 Strike, 6-day expiry and for 100 barrels would cost $201.72, which also be the maximum risk.

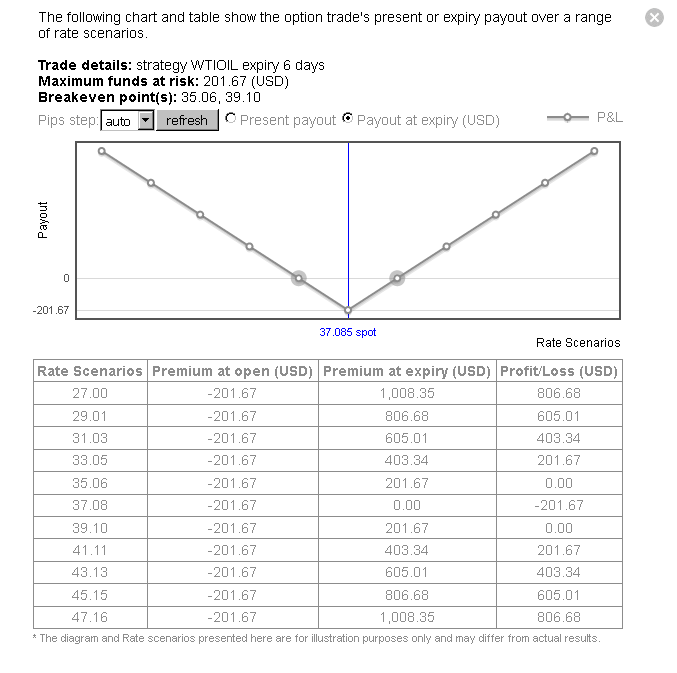

This screenshot shows the profit & loss profile of the above Buy Straddle strategy, just click the Scenarios button.

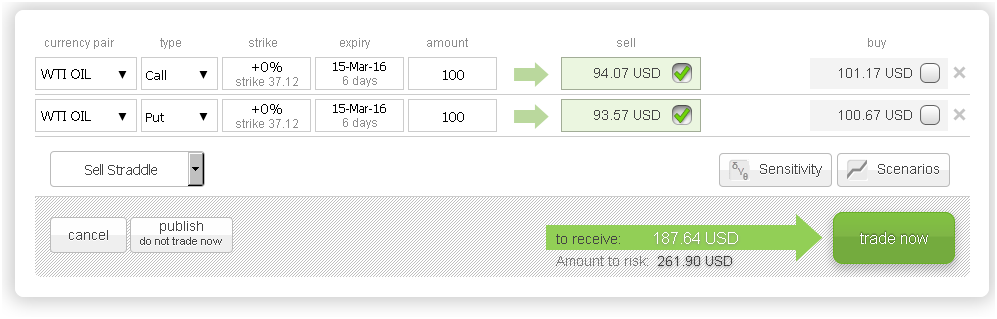

On the other hand, if you think volatility will remain flat or decrease then all you may sell a Straddle strategy, which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amounts. The screenshot below shows a Sell Straddle with $37.12 Strike, 6-day expiry and for 100 barrels would create revenue of $187.64, with a total risk of $261.90.

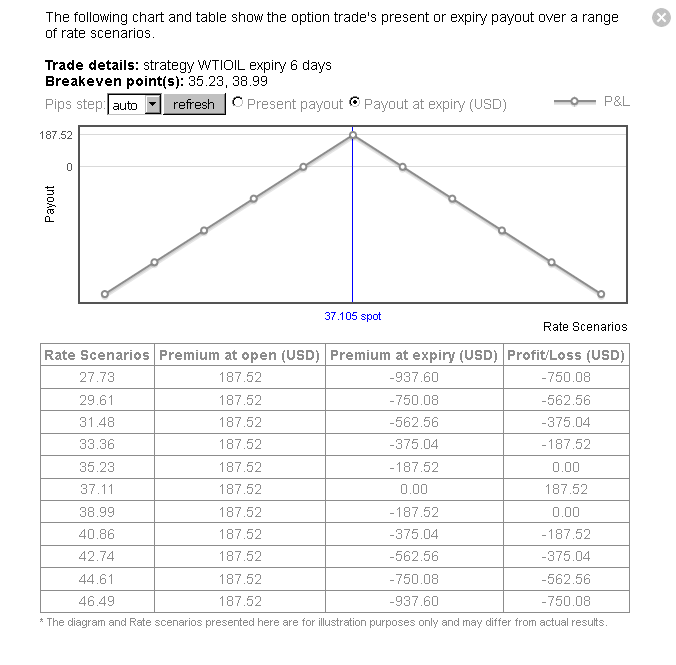

This screenshot shows the profit & loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.