DAX futures

The dollar traded mostly unchanged against its G10 peers during the European morning Friday. It was lower against NZD and SEK, in that order, while it was fractionally higher against JPY.

The euro was stable against the dollar during the European morning, after the Eurozone’s unemployment rate remained unchanged in July and the August CPI estimate came in line with expectation. Nonetheless, the fall in the rate of inflation to +0.3% yoy in August, its lowest level since last November 2009, added pressure to the European Central Bank to introduce new stimulus measures along with the anticipated TLTROs at its meeting next week. The recent weak data from the Eurozone, especially by its strongest economy, has left no choice for the ECB but to act as fast as it can to reverse the negative sentiment and boost growth in the region, in my view.

The DAX index opened the trading day with a gap up, ignoring a 1.4% mom fall in German retail sales in August. However, the index filled the gap within the next few hours on news about rising tensions in Ukraine and fears of further tit-for-tat sanctions that could further depress the country’s industrial output.

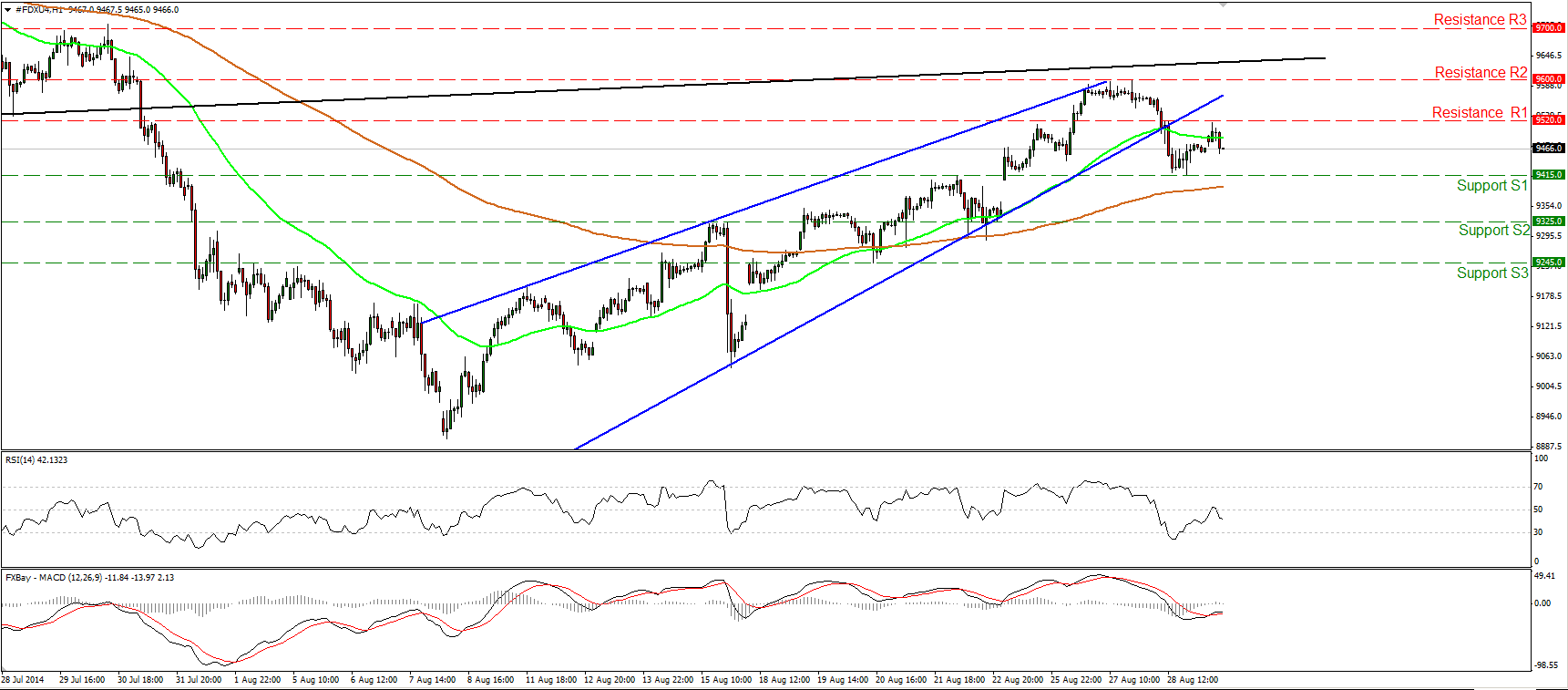

DAX futures fell below the lower bound of a possible rising wedge formation yesterday but later in the day rebounded from the support line of 9415 (S1). Today, during the European morning, the index found resistance near the 9520 (R1) area before sliding somewhat. As long as the price is trading below the rising wedge pattern and as long as the possibility for a lower high exists, I would consider the near-term bias to be mildly to the downside. A clear move below 9415 (S1) could set the stage for extensions towards our next support line of 9325 (S2).

On the daily chart, I see an evening star candle pattern, supporting the cautiously negative picture of the DAX. On the 31st of July, the index fell below the long term trend line (black line), drawn from back at the lows of June 2012 and connecting the lows on the weekly chart. However, I don’t expect a new long-term downtrend, as the index would need to fall below the 8900 line to establish a lower low.

Support: 9415 (S1), 9325 (S2), 9245 (S3).

Resistance: 9520 (R1), 9600 (R2), 9700 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.