We have heard many times before "Buy the dips, sell the rips". Recently we had some USD gains and there were some rumours that OPEC may cut production, so Oil price went up. If OPEC cuts production traders should go long all equities with both CAD and RUB currency crosses. Remember Oil is connected to CAD and RUB. Because USA and Canadian markets are on holiday we are not seeing some big price movements at this moment.

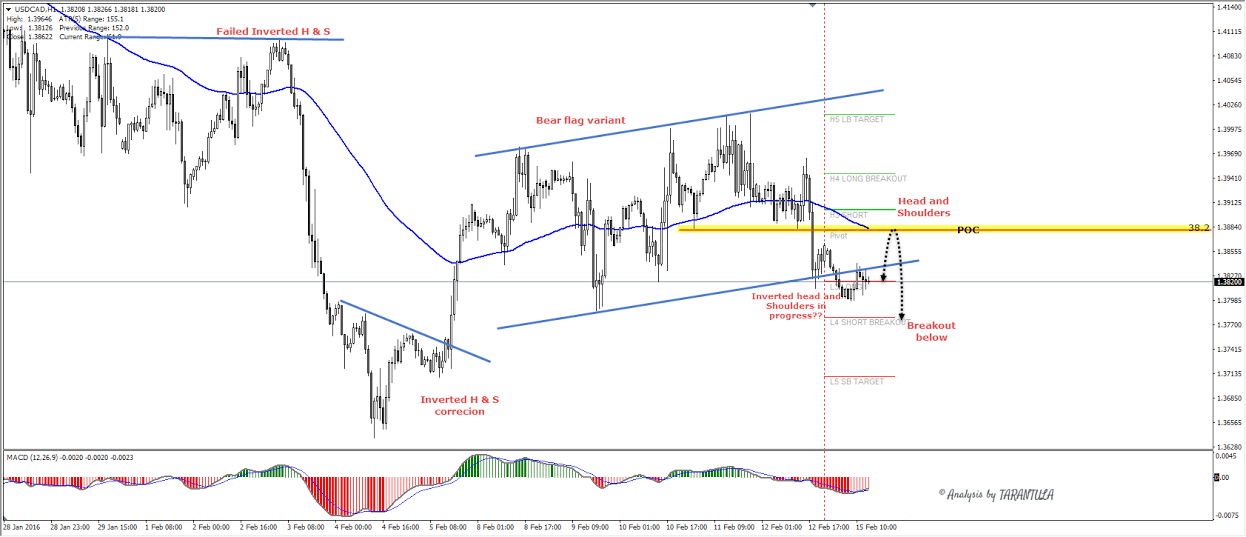

Technically USDCAD is showing multiple patterns suggesting that selling on rallies is the option. At the top price has failed to break the neckline of inverted Head and Shoulders. It dropped heavily making a correction with the successful break of inverted head and shoulders at the bottom. The backwind of Inverted Head and Shoulders made a Bear flag variant pattern and 1.3885-1.3900 looks like a good place to short. POC (38.2, H3, EMA89, H3, DPP) should hold the price and in the case of positional POC sell the target is 1.3780. Any breakout below 1.3780 targets 1.3710. We should pay attention to current price around 1.3820 as it shows a potential inverted head and shoulders in progress which if realized could spike the price UP towards our POC for a subsequent sell.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.