![]()

The second half of North American trade provided very little in the way of excitement as most of the major moves that had occurred earlier in the day maintained throughout the rest of the day. Equities were higher by over 1 percent in the Dow, WTI remained above $57 per barrel, and the USD remained on the front foot against a majority of her peers. However, the global atmosphere could get shaken up for the rest of the week as we trudge ever closer to another Greek telenovela at the end of the week.

For those who are unfamiliar with the next Greek crisis, there will be another Eurogroup meeting on Friday where discussions between Greece and its debtors is most assuredly going to be a major topic of conversation. Greece was just in the news this morning based on an order from Prime Minister Alexis Tsipras to local governments that they move their funds to the central bank. Those funds will then evidently be used to pay salaries, pensions, and the next payment for the International Monetary Fund. The demand from the central government to the local governments seems to exemplify the need for Greece to receive another bailout, to which they didn’t fully receive at the last Eurogroup meeting.

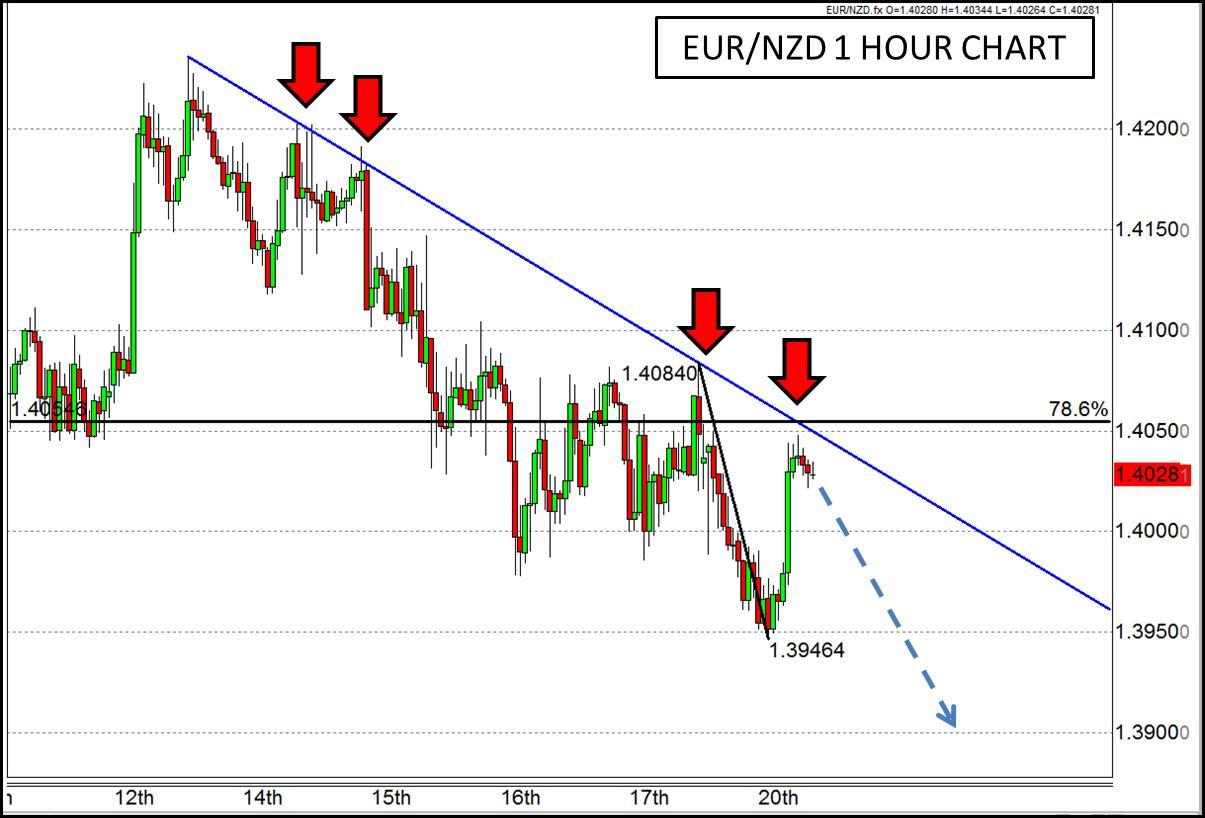

All this strange action from Greece likely points to uncertainty in the Eurozone and a really good reason for euro bears to assert their dominance against the moribund currency once again. One currency pair that is setting up technically for a potential drop as well is the EUR/NZD. Sure, I just gave you a couple of reasons to be skeptical of the Kiwi merely a few hours ago, but that was against the USD; against the EUR, it may be just the opposite. The EUR/NZD has been following a plunging trend line over the last week or so, and over the last few hours it has advanced right up to that line once again. Fortuitously, it has also reached a 78.6% Fibonacci retracement from Friday’s high to today’s low which may thwart any further advance. Therefore, despite the skepticism we may hold for the NZD, said skepticism may be more powerful and evident against the EUR, leading to a continuation of the current trend.

Figure 1:

Source: www.forex.com

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.