![]()

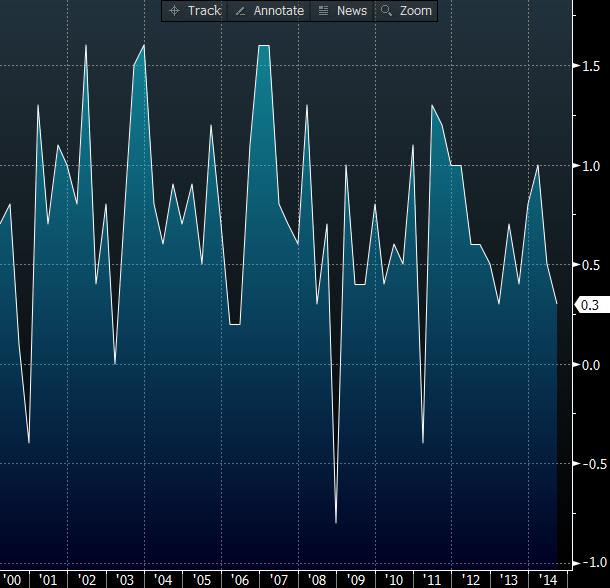

Later today we are expecting Australia’s growth figures for last quarter. The market is looking for a 0.6% q/q growth rate, which is better than the prior quarter’s very disappointing 0.3% jump – it was an important factor in our decision to lower our rates forecast for Australia. We think the risk for todays’ figures (released at 0030GMT) is tilted to the downside once again. Private non-farm inventories fell a worrying 0.8% q/q in Q4, which is a drastic change from Q3’s 1.2% increase. Without this backing, GDP figures for Q4 may underwhelm the market expectations and see AUDUSD test the base of its new trading range.

Australian q/q GDP growth

Source: FOREX.com, Bloomberg

Shortly after we are expecting to hear from Fed Chair Yellen and then glimpse HSBC’s services PMI data for February. Yellen is expected to talk about bank regulation so we aren’t expecting it to have a huge impact on USD, although it’s definitely worth keeping an eye on what the Fed chief has to say. At 0145GMT we are turn our focus to China and HSBC’s Services PMI (prior 51.8) – this index does carry the same weight as its Manufacturing brother, but further weakness in the services sector would only add the market’s concerns about China’s economy.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.