![]()

The week has started out with a lot of USD strength as a complicated set of influences are converging simultaneously in global markets. Not only do we have the month end flows to contend with, but this is also jobs week in the US, and there is a holiday on Friday (Good Friday) that is being observed by virtually the entire developed world outside of the Bureau of Labor Statistics who has decided to release Non-Farm Payrolls anyway. This strange set of circumstances could lead to irrational flows of currencies that could baffle many investors AND do so in increasingly illiquid environments. That being the case, it may be justifiable to consider some moves that go against your overall feel of markets, and the thought that USD strength could stop prematurely today may be just that type of situation.

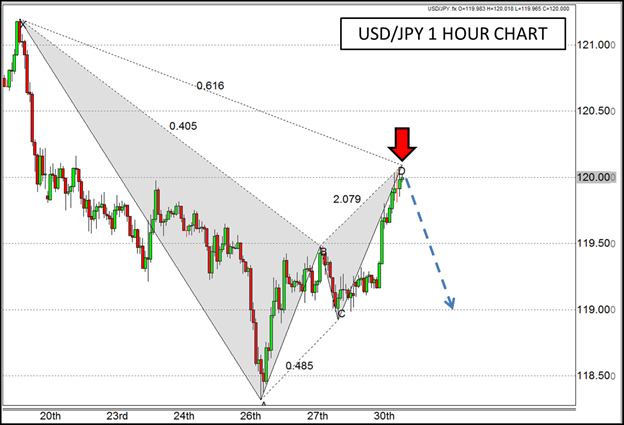

Overall, I’ve been in the USD/JPY Pamplona streets for a long time. The Bank of Japan’s Quantitative and Qualitative Easing program is utterly massive in relation to their economy, so I typically look for any excuse to find patterns that suggest it will go higher. However, as I was looking for said bullish patterns this morning, another pattern caught my eye that could provide impetus for it to stop.

Not only is the USD/JPY near a psychological level of resistance near the 120 level, but there is also a convergence of Fibonacci retracements and extensions there that form a Bearish Gartley pattern. The early USD strength that has proliferated thus far this week has already started to wane in currencies like the GBP/USD, and perhaps that is a sign that it may be time for a little profit taking for the USD bulls. While I’m not convinced that it will be long lasting, perhaps the USD/JPY could take a rest at this level and regroup for another run higher later in the week.

The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase of sale of any currency. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.