![]()

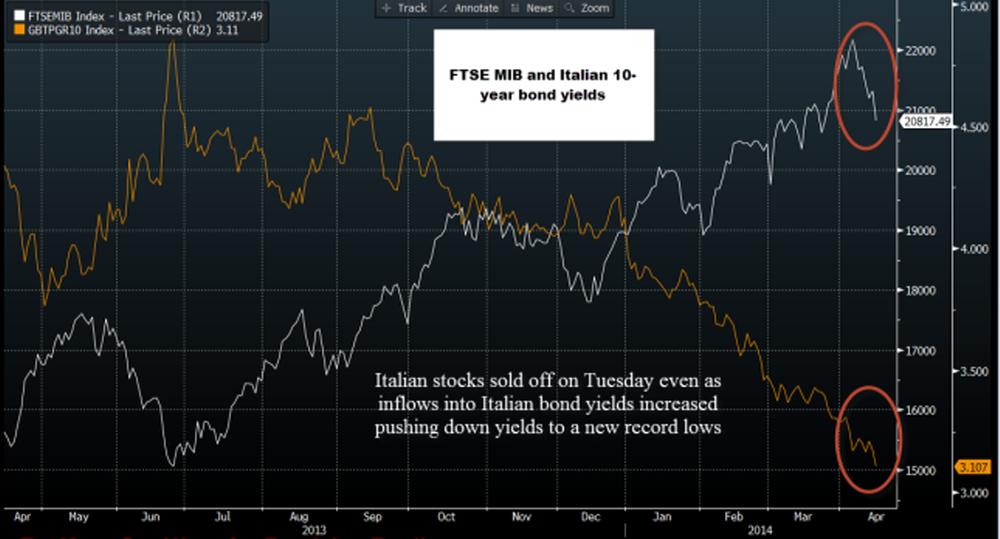

Tuesday saw some interesting price action; European stocks fell sharply on the back of a few factors and were led lower by Italy’s FTSE MIB, which fell more than 2%. However, at the same time as Italian stocks were being sold sharply, investors were buying Italian bonds and 10-year GBT yields actually fell.

As you can see in the chart below, the FTSE MIB (white line) usually moves in the opposite direction to bond yields (orange line), however today the two have moved together. This could be down to a few factors:

- Italian stocks were hit by a double whammy of pressures, firstly, overall risk aversion triggered by events in Ukraine and secondly, confirmation that the government is planning to overhaul the management structures at some state-owned companies, including changing their CEOs.

- The decline in bond yields (rise in bond prices) could also be down to Ukraine fears as we saw inflows into peripheral bonds today even though European stocks sold off. The Ukraine crisis could be triggering “safe haven” flows into European bond markets.

Who would have thought that Italian and Spanish bonds could be considered a safe haven, especially on a day that the dollar faltered? The markets work in mysterious ways and today’s moves may have been exacerbated by weak volumes in a holiday-shortened week for Europe. We will be watching this closely to see if it continues and if Russian/ Ukraine fears grab the market’s consciousness once more then we may have to get used to some strange moves in the markets.

Figure 1:

Source: FOREX.com and Bloomberg

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.