XAU/USD (gold price in terms of USD) ended last week down -2.60% and gave up nearly $ 60 from yearly tops reached earlier this month above $ 1280, after a string of hawkish comments from Fed official pointed towards a Fed rate hike as early as next month. Hence, growing Fed rate hike expectations in the upcoming months (April & June) boosted the rally in the greenback against a basket of currencies at the expense of the non-interest bearing gold. Gold prices witnessed the sharpest weekly fall in four months in the last week, extending its downward spiral, after having displayed a rising wedge bearish break on March 15.

As for today’s trade so far, the yellow metal stalled the recovery from one-month troughs just ahead of $ 1218 levels and now drifts lower to 1215 mark as the USD bulls remain in command as focus now remains on the US data flow due later in the NY session, particularly after the US Q4 GDP revision positively surprised markets. Later today, from the US docket we have the Fed’s preferred gauge PCE index, pending home sales, goods trade balance and personal spending data. Besides, gold’s recovery lacks momentum as volumes remain very light as the European traders rejoice the Easter holiday. Besides, rising Fed rate hike expectations also keep the yellow metal pressured, with the CME Group FedWatch tool now showing Fed rate hike chances at its April 27 meeting at 14%, markedly up from exactly a zero change seen a week ago. In the day ahead, a minor correction to the upside can be ruled in the prices ahead of the US economic updates, which could come in stronger than estimates and weigh heavily on the precious metal.

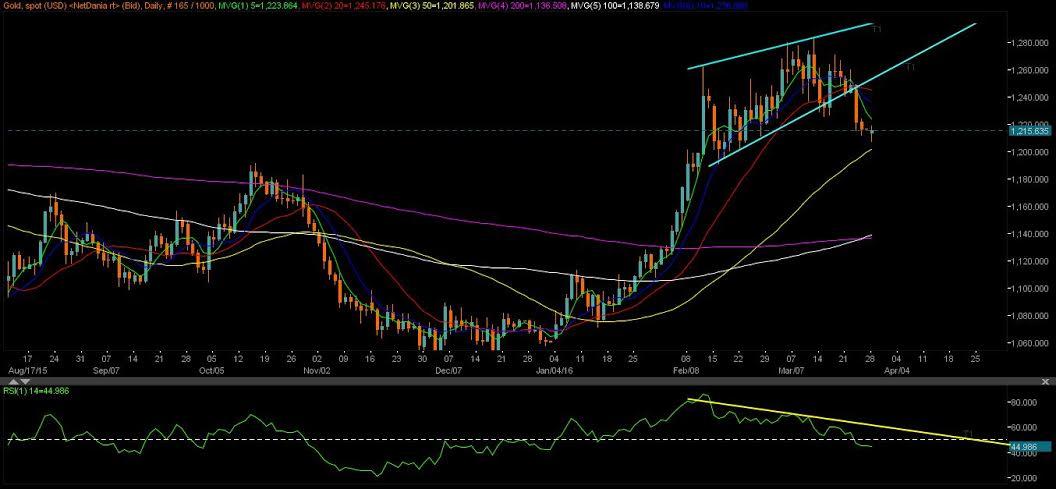

Technicals –Eyes 50-DMA just ahead of $ 1200 on upbeat US data

The daily chart for gold clearly indicates further downside potential in store heading into the NFP week. The rising wedge pattern target at $ 1190 still remains in place, below a break of the crucial 1200 – psychological levels, where the upward sloping 50-DMA is located. In case the data fails to add to the April/ June Fed hike expectations and hence, leaves the bulls unimpressed, we could see the prices swing back to daily highs, beyond which upside opens up for a test of the heavily bearish 5-DMA placed at 1224.05. Overall, the risk remains more towards the downside going forward.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.