The GBP/USD is up after the release of the UK GDP figures for the second quarter of 2015, when the economic growth accelerated as expected, posting a 0.7% increase compared to the 0.4% advance of the first quarter.

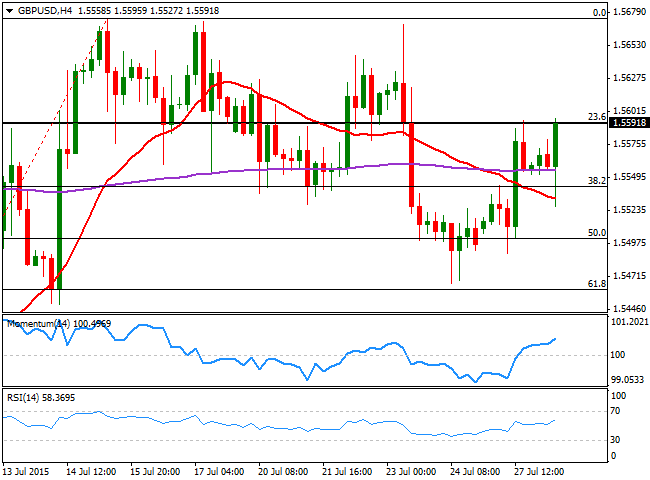

Pressuring Monday's high, the pair has been in recovery mode ever since correcting down to the 61.8% retracement of its latest bullish run mid last week. Currently stuck around the 23.6% retracement of the same rally, the 4 hours chart shows that the price has recovered above its 20 SMA that maintains a tepid bearish slope, and the 200 EMA, horizontal around 1.5560. Both moving averages are still far from supporting additional upward momentum.

In the same chart, the technical indicators head north above their mid-lines, supporting additional advances, although the pair needs to establish above the 1.5600 level to able to extend its rally towards the 1.5650/70 price zone during the upcoming hours. Failure to break above the actual Fibonacci level on the other hand, may see the pair retracing back to the 1.5550 price zone, the 38.2% retracement of the same rally.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold rises above $2,340 as US yields retreat

Gold gained traction and advanced above $2,340 in the European morning on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.7% ahead of key inflation data from the US, helping XAU/USD stretch higher.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.