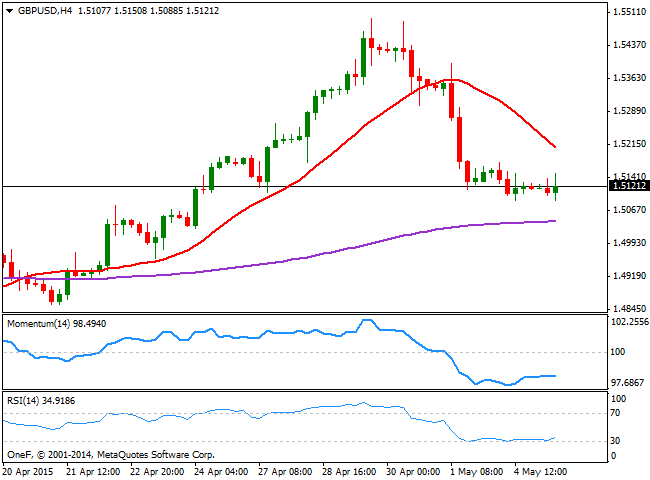

The GBP/USD pair trades uneventfully above the 1.5100 level, having saw a short lived spike early in the European session up to 1.5150. There are no macroeconomic news in the UK scheduled until Wednesday, when Britain will release its Service PMI figures. Anyway, market's eyes are on upcoming general elections next Thursday, and there's little to expect from the pair until then.

The technical picture favors the downside, as the 4 hours chart shows that the 20 SMA declined further above the current level, now around the 1.5220 level, whilst the technical indicators stand directionless near oversold levels. The pair posted a daily low of 1.5088, and a break below it could see the pair falling down to the 1.5050 region on dollar's strength. Should 1.5050 give up, the next bearish target stands at 1.5020. To the upside, the pair needs to advance beyond 1.5160 to be able to extend up to the 1.5200/20 region, where selling interest is expected to contain it.

View live chart of the GBP/USD

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.