The big news of the domestic session is China shutting its stock market after plummeting into ‘limit down’ territory. Essentially this means the market’s fallen too much (more than 5%) and the market has shut for 15 minutes. After re-opening the lower most limit of 7% was breached and markets subsequently closed for the day. From what I can decipher markets will open as normal again tomorrow, but not before the PBoC and the CFFE get stuck into stemming the rout somehow and perhaps find the source of the extraordinary selling.

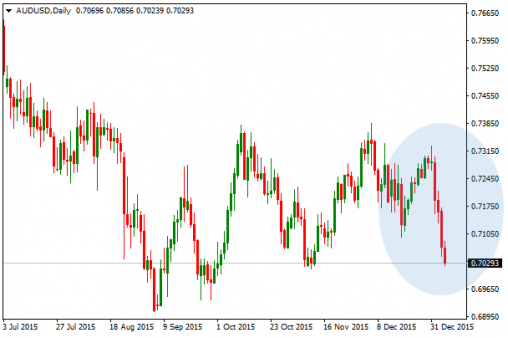

This is of course not good news for the local unit. The Australian dollar has entered its fourth consecutive day of losses, sinking below 71-figure in the US trading sessions and now eyeing 70 US cents. Broadly speaking, Chinese concerns and losses across commodity markets have prompted a general lean towards the Greenback and Yen – which is a good indication that the appetite of market participants have little tolerance for risk assets. The Yen’s the ultimate winner with the USDJPY pair falling below the 118-figure.

The Aussie and Kiwi are getting smashed across the board, but not more than against the Yen which is of course the preferred currency in times of adversity.

Aussie slides – AUDUSD Chart by MT4There’s been much talk in the press recently about the falling Yuan, known as the Renminbi or RMB (CNY). While the PBoC have the capacity to set the daily trading range for the (onshore) Yuan, lower limits continue to be breached, forcing the hand of China’s Central Bank to continue to lower the daily trading range. Meanwhile, the offshore RMB (CNH), which trades in major hubs such as Hong Kong, London, Singapore among other locations, is trading at a (growing) discount to the onshore price. This discrepancy could be seen as a reflection of lower confidence in the region, notwithstanding the PBoC’s efforts to control the depth and ferocity of the decline.

To provide a little background, in recent years China has been taking active steps to internationalise their currency by establishing offshore trading hubs. The internalisation of the RMB (by introducing external, offshore trading hub) provides China a greater capacity to deal in its own currency with the rest of the globe, rather than settle transactions in US dollars or other currencies.

The below chart represents the performance of the CNY (onshore) against the CNH (offshore) over the last 12-months. As we can see, since Oct/Nov there’s been a material rise in value.

CNY/CNH – Chart by BloombergPerhaps a better way of looking at it is by overlaying price action. As we can see below, the CNH is trading at a (growing) discount.

CNY & CNH – Chart by Bloomberg

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

GBP/USD bulls retain control near 1.3300 mark, highest since March 2022

The GBP/USD pair trades with a positive bias for the third straight day on Friday and hovers around the 1.3300 mark during the Asian session, just below its highest level since March 2022 touched the previous day.

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.