Introduction

Dennis P. Lockhart of the Atlanta Federal Reserve spoke yesterday to boost USD, mentioning that there was scope for the FOMC to raise rates in June if need be. Although Lockhart reiterated a neutral stance on rates, this may have given some buoyancy to USD with San Francisco Federal Reserve president echoing similar views on the timing of any benchmark rate hike in the states. Kiwi Dollar has shown the largest losses against USD overnight after a higher than expected unemployment rate reading to kick off global currency market trading in the APAC region. The market looks ahead today to flash PMIs across Europe and the ADP employment change report out of New York. Traders will also be likely to place a particularly keen eye on the EIA’s weekly release of crude oil stock data as WTI crude oil futures trade below a notable US$44 level.

Asian Session

Citibank analysts note that USD/JPY has rallied despite the risk-off sentiment prevalent across the market overnight. This indicates a fundamental adjustment in positioning that may have taken place, in favour of USD. Within the USD/Asia space, currency pairs moved higher with USD/THB and USD/KRW the strongest movers. USD/MYR, sensitive to the oil price, also moved higher to 3.9935 and has support at 3.9900.

NZD moved to a low of .6877 against USD and trades at 1.0872 versus its Antipodean cousin right now. Although the unemployment rate across the nation remains on a long term downward trend, this quarter it rose to 5.7% from 5.4%, higher than the 5.5% anticipated. Employment data can in general be seen to be solid however, with the employment change rising to 1.2%^ from 1.0% last and the participation level also increasing.

The day ahead in Europe and NY

EUR/USD trades at approx. the 1.1500 level, almost four big figures higher than its 2016 average of 1.1124. PMI data will be release throughout the morning as well as across the continent as a whole. Importantly, March retail sales figures will also be released at 10:00 BST today too.

Amidst a very recent rise in USD strength, the aforementioned ADP employment change report is anticipated to show a 195k print at 13:15 BST today. This comes ahead of a plethora of unemployment data that will be released from the US on Friday this week. Trade balance data is also published out of the US and Canada today, whilst the trading day will finish with PMI figures and crude oil inventory data too from the states too.

Spot

| Last | % since US Close | High | Low | |

| EURUSD | 1.1507 | 0.09% | 1.1511 | 1.1477 |

| USDJPY | 106.79 | -0.18% | 107.46 | 106.53 |

| GBPUSD | 1.4570 | 0.22% | 1.4571 | 1.4520 |

| AUDUSD | 0.7516 | -0.44% | 0.7517 | 0.7467 |

| NZDUSD | 0.6911 | -0.05% | 0.6907 | 0.6877 |

| USDCHF | 0.9551 | -0.07% | 0.9573 | 0.9537 |

| EURGBP | 0.7896 | 0.17% | 0.7912 | 0.7893 |

| EURCHF | 1.0985 | -0.10% | 1.0991 | 1.0970 |

| USDCAD | 1.2709 | 0.09% | 1.2749 | 1.2698 |

| USDCNH | 6.5062 | -0.04% | 6.5096 | 6.5006 |

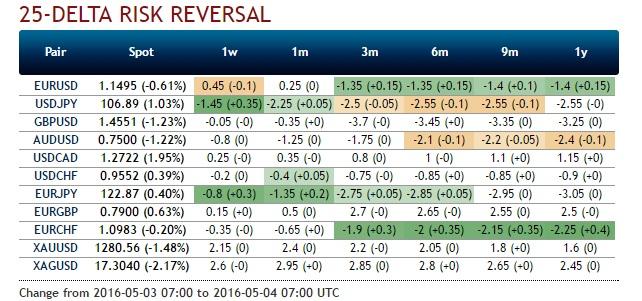

FXO

Friday dated EUR/USD strikes trade at an approx. volatility of 15% ahead of the forthcoming US employment data. This comes as no surprise, the option for this date and currency pair has traded higher in the past on an NFP date. AUD/USD volatility remains high after the RBA decision earlier in the week, with the one week straddle volatility approx. 3.5% higher in volatility than its yearly average of 12.75%.

EUR/USD options bias has been changing this week within the currency option space at Saxo Bank A/S. A further rise in popularity of long call and/or short put positions is evident, with 64% of traders in favour of the upside today.

The products offered by Saxo Markets UK Limited ("SCML") include but are not limited to Foreign Exchange, Stock, Index and Commodity CFDs, Options and other derivative products. These products may not be suitable for all investors, as trading derivative products carries a high level of risk to your capital. It is possible to lose more than your initial investment so before deciding to trade you should ensure you understand the risks involved and seek independent advice if necessary.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.