The week starts in earnest Yesterday’s becalmed market reflected another holiday session in Europe. The day’s range in EUR/USD was only 0.11%, compared to an average over the last year of 0.64%. Today we should see more volatility as traders come back to the market.

The dollar is generally opening higher this morning, although still in a narrow range against most currencies. It’s up against CHF, SEK and EUR and down vs AUD and NZD. There was no clear catalyst for the move in AUD and NZD, except perhaps a rise in Australian stocks and bond prices.

The RUB continued to fall on the increasing tension in Ukraine. The spillover from that crisis however seems quite well contained as most other Eastern European currencies remained little affected. Gold was only marginally higher.

We seem to be in a period of equilibrium with regards to many FX rates: EUR/USD and USD/JPY, the two most actively traded pairs, are trading in extremely narrow ranges. Former Bank of Japan policy board member Miyako Suda said yesterday that “the BOJ will probably maintain its bullish price forecast for as long as possible and keep policy unchanged until it becomes absolutely impossible to continue arguing that its price target can be met. But once he feels something must be done, I think Governor (Haruhiko) Kuroda will do something quite extraordinary because small steps won't work.” We might well say the same about ECB President Draghi, although it’s harder to imagine what large steps he might be able to make, given the legal constraints on ECB buying of government bonds. In any event, the FX market continues to look to central banks for direction.

During the European day, the Swedish unemployment rate is expected to fall slightly to 8.0% from 8.1% on a seasonally adjusted basis. There seems to be some demand for SEK during European time, as it was higher during the European day yesterday, so this could help to drive it higher as well. At the end of the European day, the EU will release the final version of its April consumer confidence figure, which the market is expecting to be unchanged from the preliminary version.

Canadian wholesale trade is expected to slow in February to +0.6% mom from +0.8% in the previous month. CAD has been rather weak recently – it fell on Friday despite higher inflation – and signs of softness in the economy could continue that trend.

In the US, the FHFA house price index is expected to rise 0.5% mom in February, the same as in January, while existing home sales for March are expected to be slightly lower at a 4.55mn annualized pace, down from 4.60mn in February. The existing home sales figure may not cause much of a splash however as there has been a lot of talk recently about the lack of inventory as banks slow their pace of foreclosure. A slowdown in sales could just reflect a lack of supply rather than a lack of demand. The Richmond Fed manufacturing index for April is expected to rise to 2 from -7, which could give USD a little boost.

The only speaker on the schedule is Former Fed Chairman Bernanke, speaking at the Economic Club of Canada on “Eight Years of Crisis Management at the Federal Reserve and the Way Forward.”

THE MARKET

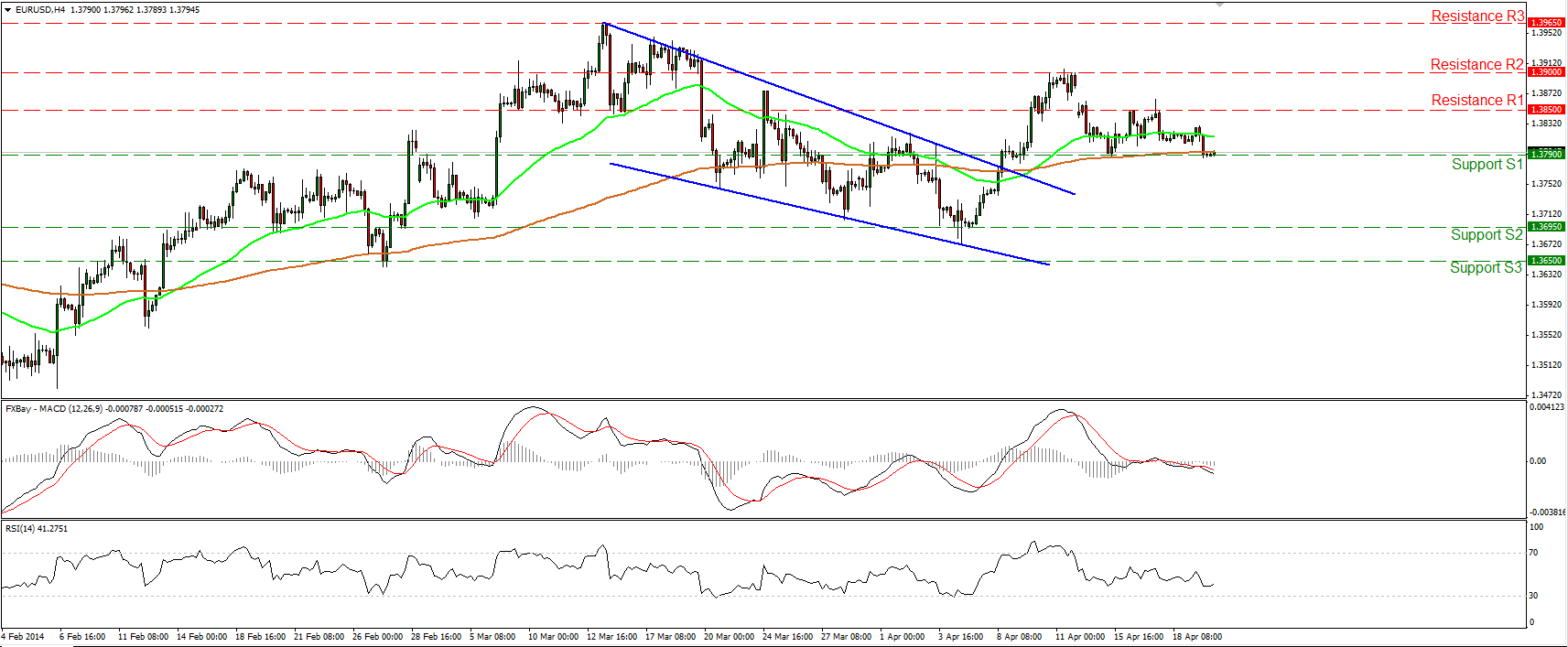

EUR/USD

EUR/USD moved slightly lower to meet the support of 1.3790 (S1), near the 200-period moving average. The pair remains between that barrier and the resistance of 1.3850 (R1), thus I maintain my neutral view. Both the moving averages are pointing sideways confirming the recent non-trending phase of the currency pair. A clear dip below the support of 1.3790 (S1) may have larger bearish implications and target the lows of 1.3695 (S2). On the upside, a clear move above 1.3850 (R1) could probably challenge the resistance bar of 1.3900 (R2).

Support: 1.3790 (S1), 1.3695 (S2), 1.3650 (S3).

Resistance: 1.3850 (R1), 1.3900 (R2), 1.3965 (R3)

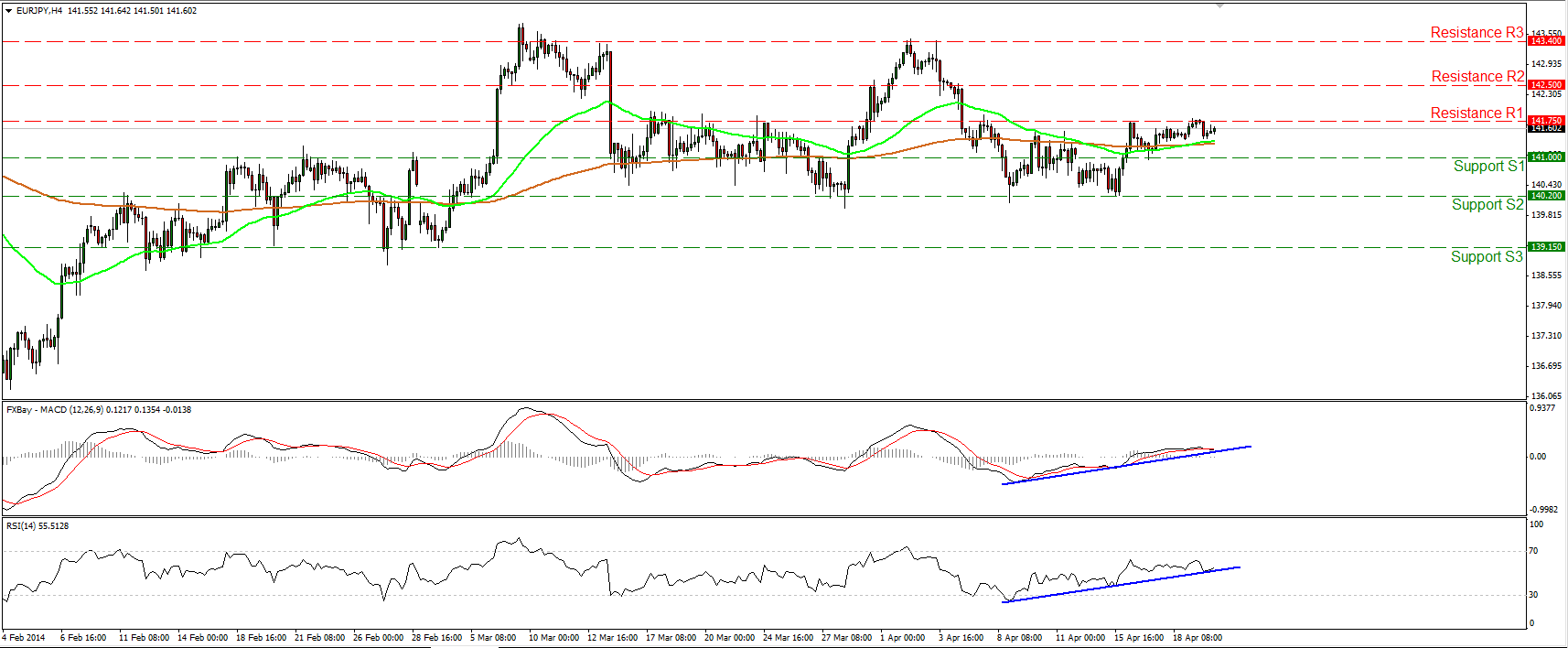

EUR/JPY

EUR/JPY moved slightly higher to hit once again the resistance barrier of 141.75 (R1). A clear break above that hurdle may challenge the next resistance at 142.50 (R2). The rate remains supported by both the moving averages, while both our momentum studies follow upward paths, thus I would consider the bias mildly to the upside. In the bigger picture, the pair is not in a clear trending mode and this is confirmed by the neutral readings of both the daily MACD and the daily RSI.

Support: 141.00 (S1), 140.20 (S2), 139.15 (S3)

Resistance: 141.75 (R1), 142.50 (R2), 143.40 (R3).

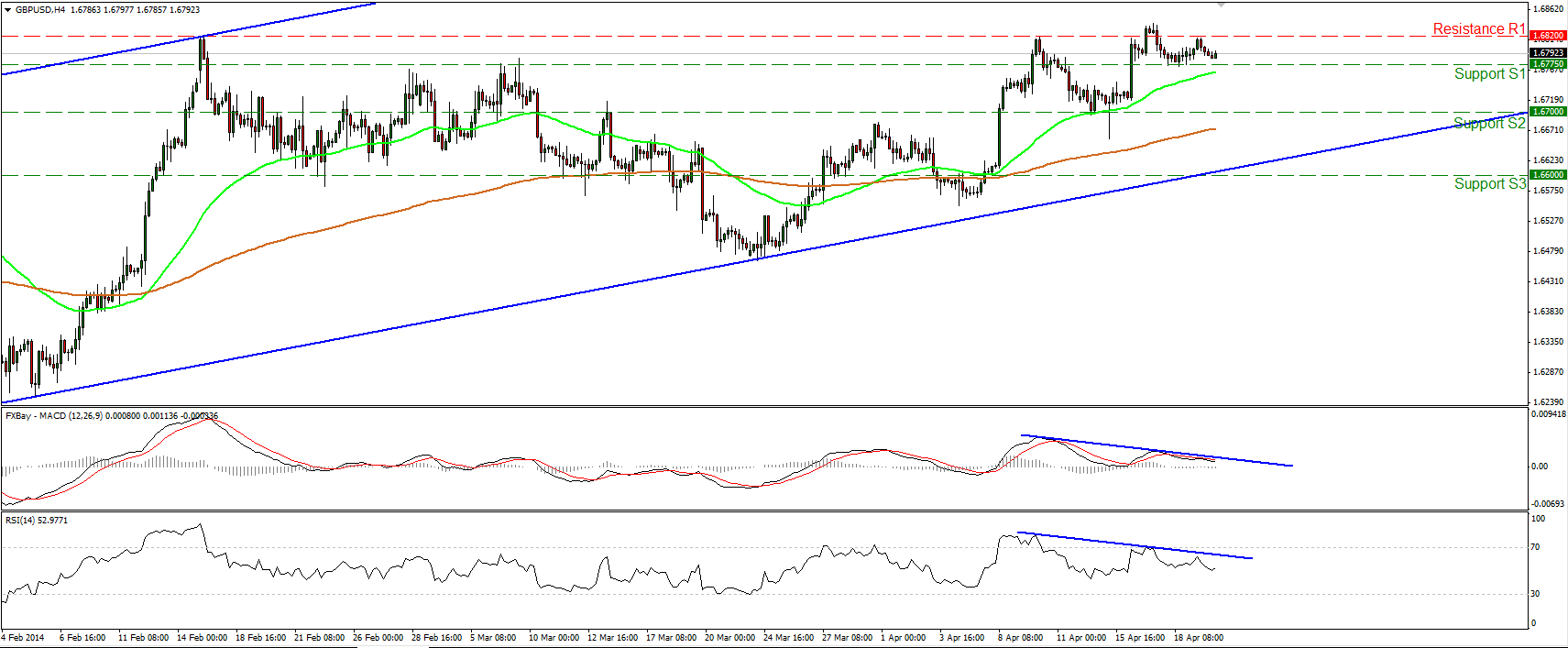

GBP/USD

GBP/USD hit once again the 1.6820 (R1) and moved lower. Considering that the negative divergence between our momentum studies and the price action is still in effect, I would expect further retracement. On the daily chart we can identify a shooting star candle formation, increasing the probabilities for the continuation of the corrective wave. Nonetheless, in the bigger picture, the currency pair remains within the upward sloping channel, keeping the long-term outlook to the upside.

Support: 1.6775 (S1), 1.6700 (S2), 1.6600 (S3).

Resistance: 1.6820 (R1), 1.6885 (R2), 1.7000 (R3).

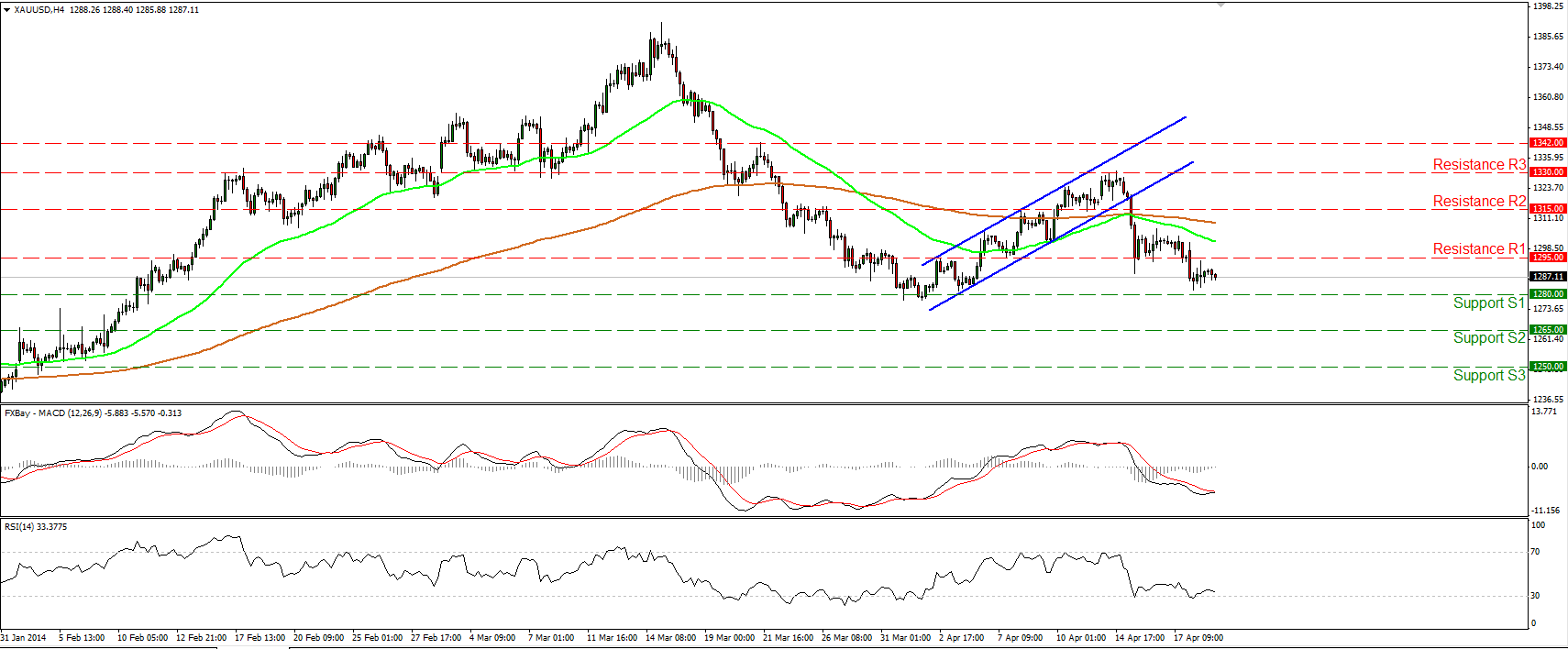

GOLD

Gold moved in a consolidative mode, remaining between the support of 1280 (S1) and the resistance of 1295 (R1). A clear break below the 1280 (S1) hurdle may trigger bearish extensions towards the next support at 1265 (S2). The MACD remains below its zero line, keeping the momentum to the downside, but is ready to cross above its signal line. Thus, some further consolidation or a corrective wave cannot be ruled out. Nonetheless, as long as the precious metal is printing lower highs and lower lows below both the moving averages, the short-term outlook remains negative.

Support: 1280 (S1), 1265 (S2), 1250 (S3).

Resistance: 1295 (R1), 1315 (R2), 1330 (R3)

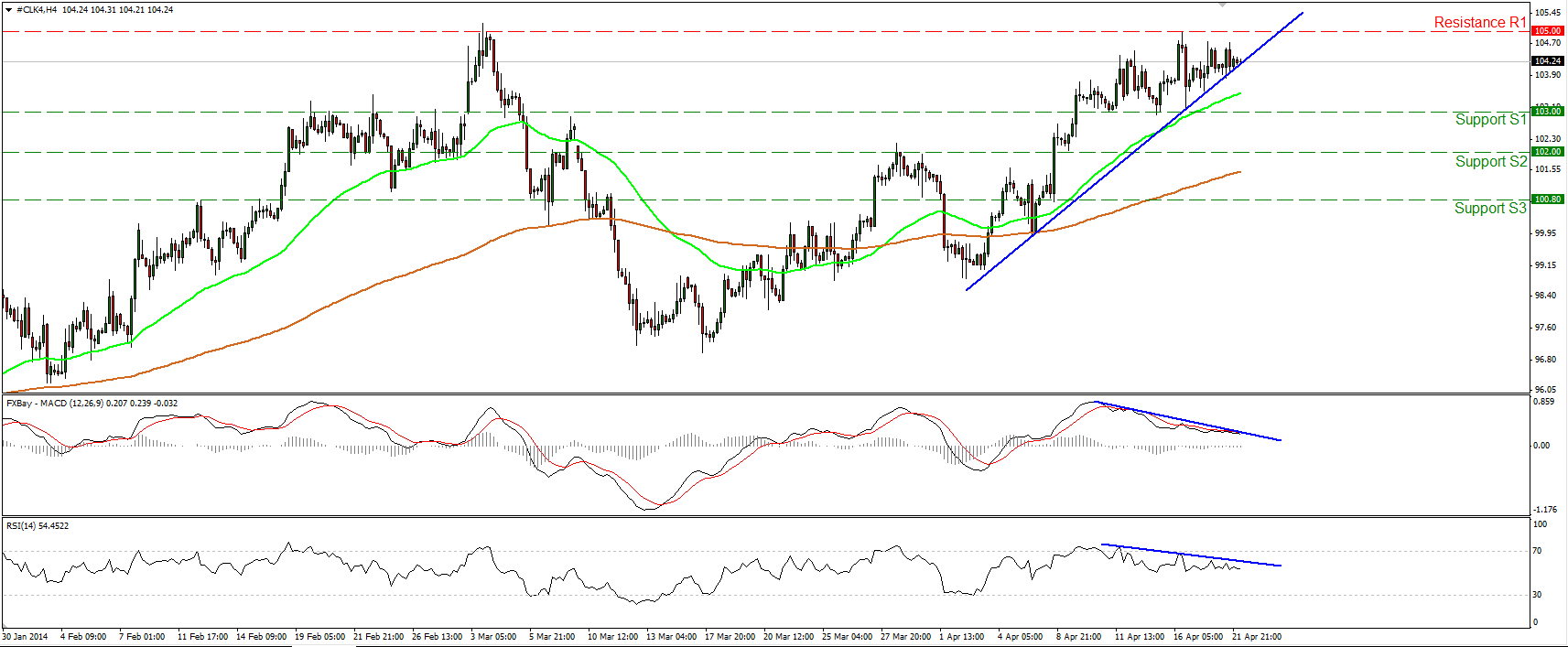

OIL

WTI moved sideways to reach the blue uptrend line. This keeps the short term uptrend intact, but considering the negative divergence between our momentum studies and the price action, a violation of the trendline may see a test of the support of 103.00 (S1). A break below that barrier would confirm a forthcoming lower low and will probably turn the short-term outlook to the downside. On the upside, only a clear break above 105.00 (R1) would have larger bullish implications and would perhaps pave the way towards the 108.00 (R2) area.

Support: 103.00 (S1), 102.00 (S2), 100.00 (S3)

Resistance: 105.00 (R1), 108.00 (R2), 110.00 (R3).

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.