EUR/USD: Four Fed Hikes In 2016, The First One In April

Federal Reserve Governor Jerome Powell said starting to raise US interest rates now is the “right way” to ensure the economy keeps growing. If conditions change, the US central bank could reduce rates back to zero, he said, adding that starting rate increases now allows future rate increases to be both small and gradual, which will help the recovery continue.

San Francisco Federal Reserve Bank President John Williams said the Fed will aim to keep the US economy running hot next year to boost the job market and inflation. Fresh forecasts from the Fed suggest most policymakers are looking for four rate hikes next year, and Williams said his own view is in line with that expectation. After the rate hike, attention turned immediately to the likely timing of the next move. In the opinion of many investors March is the most probable, in part because that would coincide with Fed Chair Janet Yellen's next scheduled press conference. That may not be the case, Williams suggested. "There was value to having the first move at a press conference meeting," Williams said, "but in the future I don't think that's as much of an issue." This was an idea that Yellen, in her news conference immediately following Wednesday's decision, also sought to emphasize, saying that rate hikes, though gradual, would not necessarily be all a quarter of a percentage point or evenly spaced in the calendar year. GrowthAces.com expects the next Fed hike in April.

Richmond Fed President Jeffrey Lacker, who will not have a vote in Fed policy decisions in 2016, said the Federal Reserve forecasts pointing to four interest rate hikes in 2016 show what the US central bank means when it says it anticipates raising rates at a "gradual pace.” Lacker said he had been in favor of raising rates this past June and was confident inflation would rise "noticeably" toward the Fed's 2% medium-term target in 2016 if oil prices and the value of the USD stabilized. He added: "I hope we're not behind the curve.”

European Central Bank Governing Council member Ewald Nowoty said the Eurozone has far less growth than the United States and it is too early to think of following its lead in raising interest rates. Chief Economist of the European Central Bank Peter Praet said the bank would keep monetary policy easy for as long as necessary in light of risks such as slower growth in emerging economies.

The USD is steady today, as holiday calm replaced the previous week's heavy market action driven by monetary policy moves in the United States and Japan.

We expect some profit taking on EUR-selling positions in the coming days. Our forecast for the next Fed move is slightly less hawkish than the market one – we anticipate a hike in April vs. March expected by the market. What is more, further appreciation of the USD would delay Fed hikes and that would result in weaker USD. That is why we assess that the potential for further EUR/USD fall is limited.

USD/CAD: High Inflation Limits The Chance For BoC Easing

Bank of Canada Governor Stephen Poloz said the trend in Canadian economic growth is likely "quieter" than the rebound in the third quarter suggested, which will mean the final quarter of the year should look softer.

Canada was in a mild recession in the first half of the year and although growth resumed in the third quarter, early data has pointed to a weak start to the last quarter of 2015. This is made even more concerning by the recent renewed drop in the price of oil, a major export for Canada.

The Bank of Canada cut interest rates twice this year to try to offset the shock from cheaper oil. The lower rates, drop in oil and the start of rate hikes in the United States have all served to knock the Canadian dollar down nearly 20% against the greenback this year. Poloz said: "It is never my intention to influence the currency through what I say” and he pointed to the strong correlation between the loonie and oil prices.

The CAD flirted with more than 11-year lows on Friday before managing a modest bounce. The drop in US crude oil to USD 35 a barrel leaves it well below the USD 45 price assumed by the central bank in October, and even further below the USD 60 price assumed in July, running the risk that energy investment gets cut back even further. However, the central bank will need to see that the lower level of oil prices is leading to a decline in activity overall, according to Paul Ferley, assistant chief economist at Royal Bank of Canada. The central bank is due to make its next interest rate announcement and update its economic projections on January 20.

Canadian annual inflation rate rose to 1.4%, a touch shy of market forecast for a rise to 1.5%. Core inflation, which strips out volatile items and is closely watched by the Bank of Canada, dipped to 2.0%, which was also short of expectations. Overall, prices were up in seven of the eight major components of the consumer price index. The transportation component, which includes gasoline, was the only one to decline. Still, its decrease of 1.1% was the smallest annual decline registered since last November.

Regarding other major economies, Canadian inflation is relatively high and the CAD depreciation may result in faster growth of consumer prices. That is why we do not think the Bank of Canada will cut interest rates again after it cut them twice this year to offset the impact of cheaper oil prices on Canada's resource-oriented economy. High inflation and accelerating economic growth in the USA, major Canada’s partner, should support the loonie in the medium term. What is more, in our opinion many negative factors for the CAD are already priced in (fall in oil prices, technical recession in Canada in the first half of the year, diverging monetary policies of Canada and the USA).

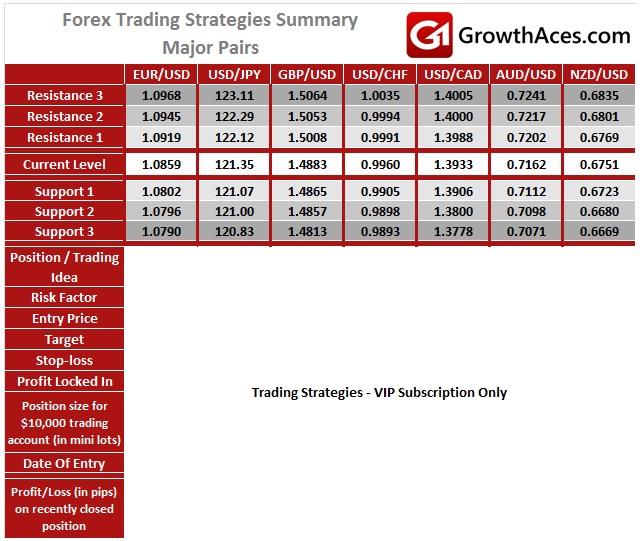

MAJOR PAIRS:

MAJOR CROSSES:

How to read these tables?

Support/Resistance - three closest important support/resistance levels

Position/Trading Idea: BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

Position Size - position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Profit/Loss on recently closed position - is the amount of pips we have earned/lost on recently closed position.

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.