GROWTHACES.COM Forex Trading Strategies

Pending Orders

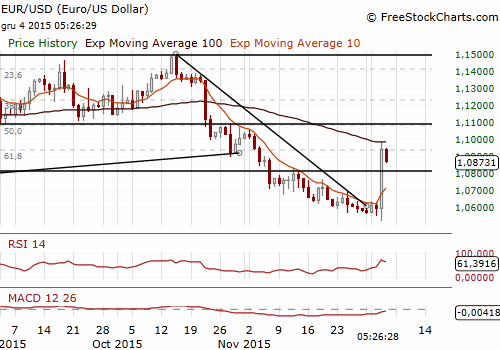

EUR/USD: buy at 1.0750, target 1.0990, stop-loss 1.0670, risk factor *

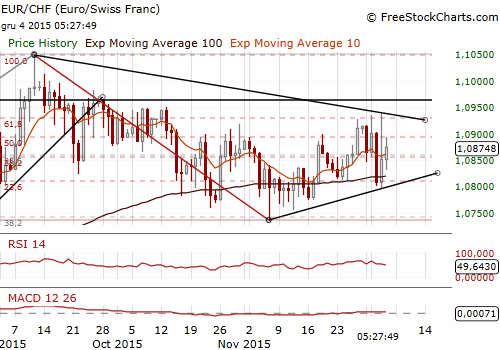

EUR/CHF: buy at 1.0790, target 1.1040, stop-loss 1.0710, risk factor *

More strategies - GrowthAces.com

EUR/USD: Today’s Non-Farm Payrolls Are Likely To Cement December Hike

(buy at 1.0750)

The EUR recorded its biggest one-day surge in nearly seven years, as the latest round of policy easing by the European Central Bank fell well short of market expectations. A 10 bp cut in the deposit rate was accompanied by a six-month extension of the purchase program worth about EUR 350 billion, the reinvestment of principal payments and the enlargement of eligible securities to include regional debt.

A 10 bp cut in the deposit rate was is in line with our and consensus expectations. The main “disappointment” is the size of QE2 and the lack of a step-up in the monthly pace of asset purchases. Given that the pace of monthly purchases remains at EUR 60bn, QE2 will be about EUR 350 billion, below our forecast of EUR 500 billion. It looks as if Draghi had to compromise more than expected with the most hawkish faction of the Governing Council.

The new ECB forecasts envisage slightly stronger growth and slightly weaker inflation over the next two years, with the maximum revision amounting to +/- 0.1 percentage points per year. With the 2017 CPI forecast revised down to 1.6% from 1.7%, the ECB is still likely to see the lower bound of price stability being reached towards the end of 2017 or in early 2018. It was not easy to push for very aggressive stimulus when the staff forecasts envisaged a broadly unchanged macro outlook and price stability still being reached within a couple of years.

At first sight, the market disappointment (strong EUR appreciation) reverses most of the improvement in financial conditions and creates downside risks to the ECB projections, especially if the market reaction were to continue in the next few days.

The market shrugged off yesterday’s comments from Fed chair Janet Yellen. Yellen in her testimony was generally upbeat, spelling out how the economy has largely met the criteria the Fed has set for its first rate hike. Unemployment is low, growth continues at a modest pace, and Yellen said she is confident inflation will return to the Fed's target over time. Yellen noted that one reason not to delay a rate hike too much longer is to avoid the need for faster increases that could be more disruptive to the economy than the gradual rate path policymakers prefer. She said the US economy needs to add fewer than 100k jobs a month to cover new entrants to the workforce, setting an implicit floor for the jobs growth policymakers want to see.

The November jobs report is scheduled for release at 13:30 GMT today. The market expects non-farm payrolls at 200k. Our economists expect slightly better figure – 210k. Wage growth likely slowed last month, but that would mostly be payback for October's outsized gains, which were driven by a calendar quirk.

Today’s US non-farm payrolls will cement rate hike in December. In our opinion this could be a good opportunity to buy the EUR/USD at lower level, as we expect that the bearish trend is already over after yesterday’s EUR rally. We have placed our bid at 1.0750.

Significant technical analysis levels:

Resistance: 1.0981 (high Dec 3), 1.1000 (psychological level), 1.1073 (high Oct 30)

Support: 1.0790 (hourly low Dec 3), 1.0725 (10-day ema), 1.0523 (low Dec 3)

EUR/CHF: ECB Cut Add To Pressure On The SNB

(buy at 1.0790)

With the latest ECB announcement to cut the deposit rate and to expand the QE program, pressure on the Swiss National Bank to deliver further easing measures continues, albeit to a lesser extent than previously. There is a risk that the SNB will react by cutting the target deposit rate deeper into negative territory by -0.25 bp to -1.00% at its meeting on December 10.

The main reason for further expansionary monetary policy measures involves the impact a continuously overvalued currency has on the Swiss economy. The economic fallout from the franc appreciation at the beginning of the year is already observable in very subdued growth numbers. After a contraction of 0.3% in the first quarter and slow growth of 0.2% in the second quarter, the Swiss economy recently stagnated. Additionally, CPI inflation is currently at -1.4% yoy, historically low levels.

But we do not expect another move on the rate front. In our opinion the SNB will only continue to point out that it sees the franc as still overvalued and that it is prepared to further intervene in the currency market if necessary.

The disappointment after the SNB decision next week should strengthen the CHF. We expect the CHF to remain weak in the medium term. That is why

Significant technical analysis levels:

Resistance: 1.0940 (high Dec 3), 1.0950 (high Oct 13), 1.0955 (high Sep 29)

Support: 1.0800 (low Dec 3), 1.0790 (low Nov 18), 1.0775 (low Nov 17)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.