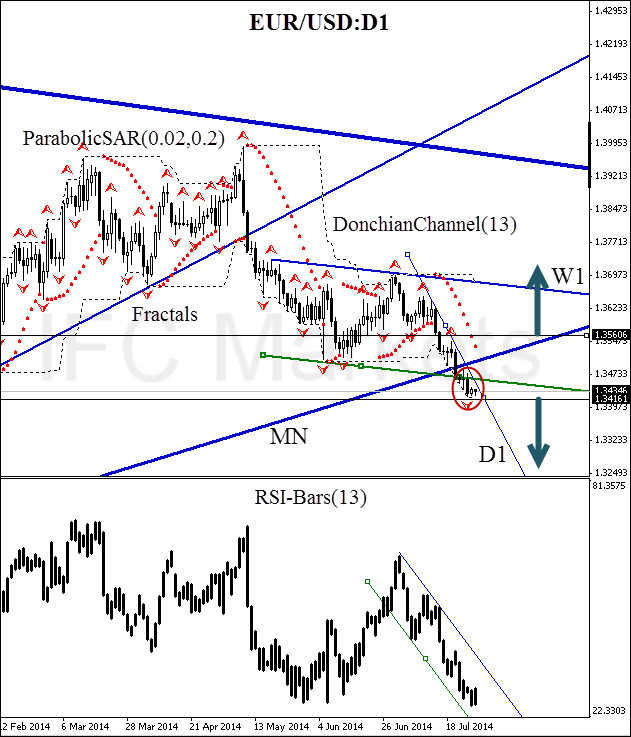

Good afternoon, dear traders. Here we consider the EUR/USD behavior on the daily chart. At the moment we can observe that the price broke the monthly trend line and is descending into the red zone. The weekly resistance was also broken, i.e. the movement is considerably accelerating. At the same time the DonchianChannel breach and the ParabolicSAR reversal occurred. Thus, there is a high probability of a new bearish momentum birth, especially that the RSI-Bars leading oscillator continues to slump in a narrow channel without significant corrections.

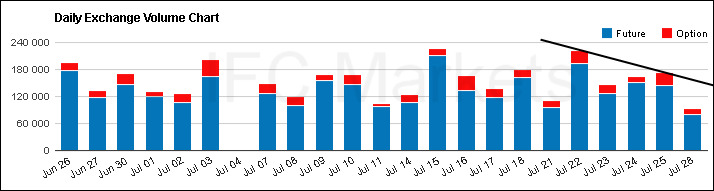

The only alarming factor is the low trading volumes. The daily volumes of the USD/CAD futures and options traded on the Chicago Mercantile Exchange are presented on the chart below. Both instruments are derivatives, and can be used to assess trends of the Forex spot market. We can see that the downtrend break is not observed yet. Thus, trading volumes do not confirm the bearish confidence, and it is possibly a disturbing signal of false breach. For conservative traders it is recommended to wait for a situation where the number of requests on futures and options exceeds 180,000. You can monitor trading volumes for this currency pair by clickinghere.

Right after that a pending sell order on euro can be opened starting from the key level at 1.34161. This support is confirmed by the 30-day DonchianChannel lower border and the fractal. It is reasonable to place the risk limitation at 1.35606, intensified by the parabolic and bearish trend line. Unlikely, but possible, that this breach might be false and the downward momentum will eventually be weakened, especially that there are low trading volumes observed. In this case, we expect a price rebound in the monthly trend channel area. Long position can be opened above the resistance at 1.35606. After position opening, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold price advances further beyond $2,600 mark, fresh record high

Gold price (XAU/USD) gains positive traction for the second successive day on Friday and advances to a fresh record high, beyond the $2,600 mark during the early European session.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.