Analysis of Murray levels on March 1, 2016

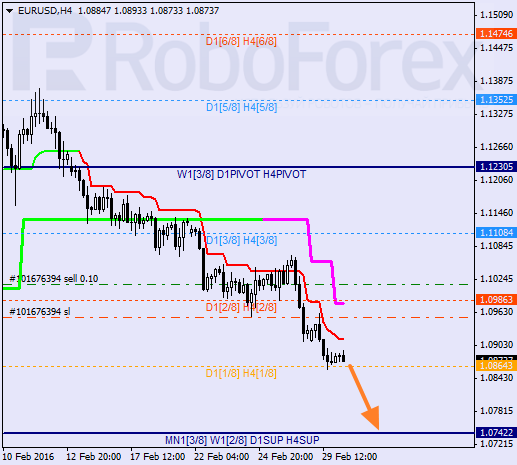

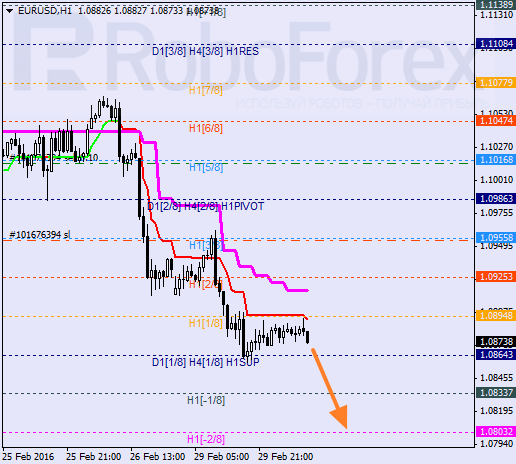

EUR USD "Euro to the US dollar"

The main trend for Euro-Dollar pair keeps slide. SuperTrend lines support the sliding, which early formed the “bearish cross”. The immediate goal for sellers is a mark 0/8, which is probably the beginning of correction.

Price formed a pullback from hourly SuperTrend line that indicates the probable renewal of pair decrease. It is possible that during the day, we get a breakdown of the level of 0/8, which will allow the pair to continue moving down towards the -2/8 level.

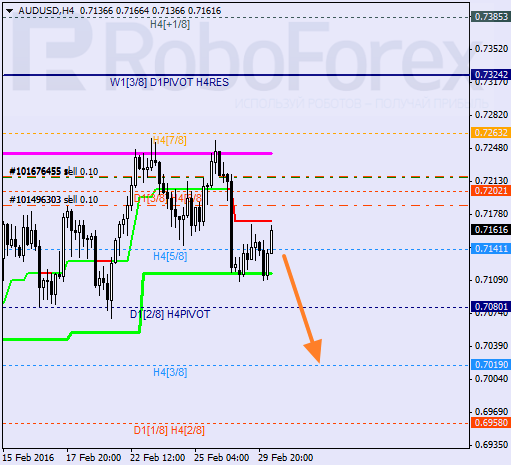

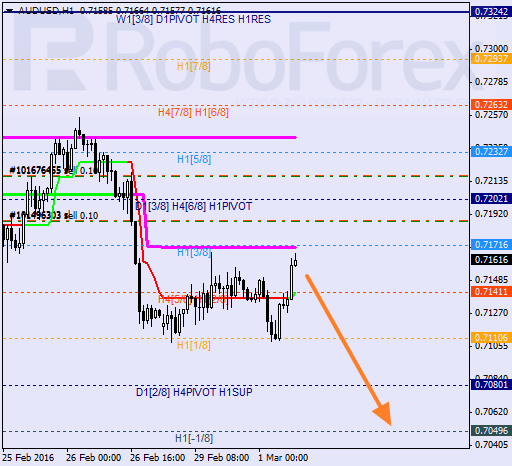

AUD USD "Australian Dollar to US Dollar"

The Aussie traded between SuperTrends lines on the four-hour chart. If later the price will be able to fix below the 5/8, then in the future it will be possible to decrease to 3/8. It is very likely that during the Tuesday's the price will update yesterday's minimum.

On the hourly chart, double pullback from the 1/8 mark is formed, which pointed to the raising of upward correction. However, if the price can be kept below SuperTrend lines, further quotations decrease and breakout of level 0/8 become possible.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

GBP/USD recovers to 1.3300 ahead of UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers near the 1.3300 mark in the European morning on Friday. Traders digest the BoE and Fed policy decisions, awaiting the UK Retail Sales data for further trading impetus.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.