Even though the China Q3 beat market expectations, the 7.3% annual expansion is still a six-year low and lower than the official target of 7.5%. The fixed-asset investment rate increased by 16.1% for the first month from the previous year – the lowest since 2001. On the flip side, it provides some with comfort knowing that the external demand has quickened and the services sector has expanded in Q3. Beijing repeatedly stresses economic reform over short term stimulus as the priority for the government. Hence, China’s demand for commodities may stay weak in the near future.

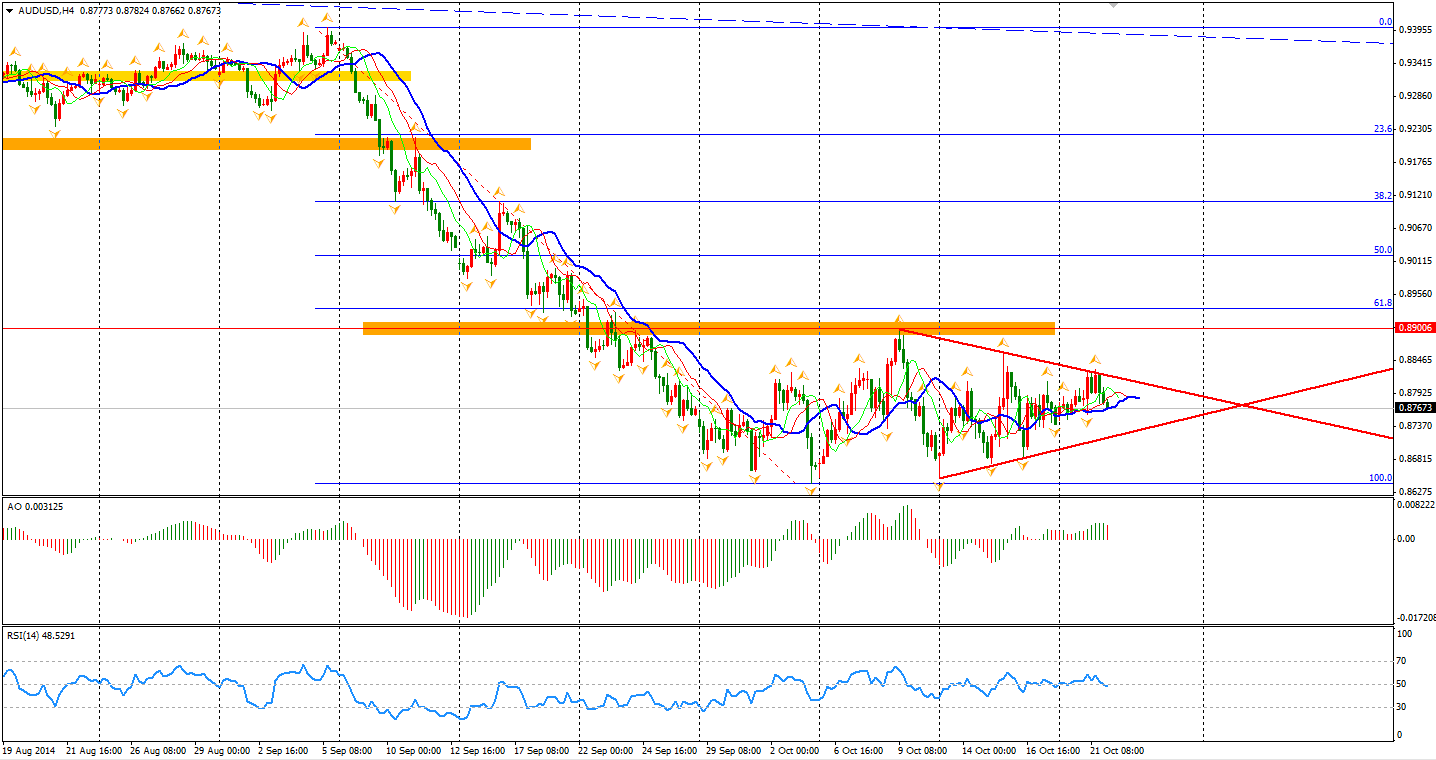

This is certainly not good news for Australia of which China is its largest trade partner. The Aussie Dollar is still in consolidation between 0.8650 and 0.89. In the 4-hour chart, a demand pattern is quite clear now, which we may see a breakout soon.

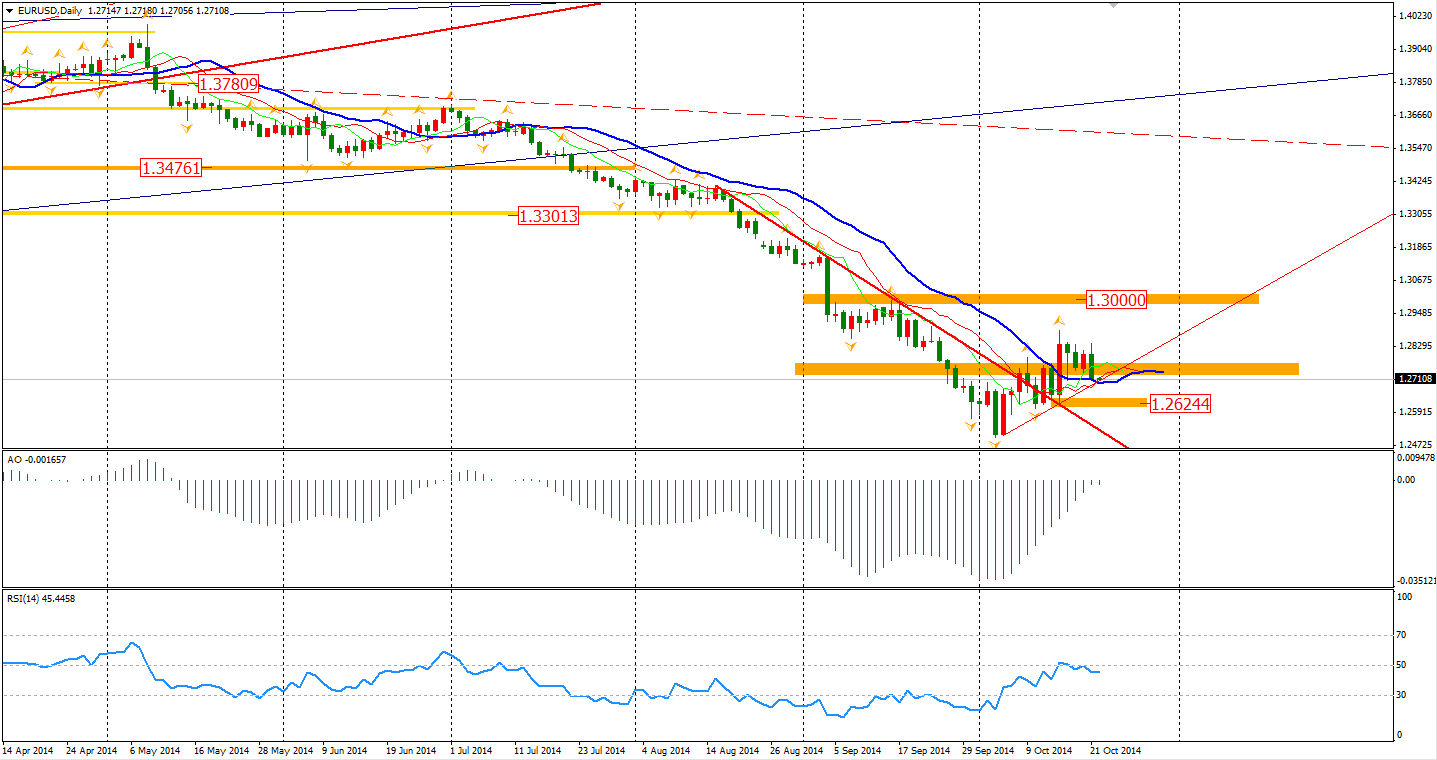

The Euro also fell against the Dollar yesterday, breaking the 1.2740 support and fell to 1.27 again. The breakout is not a good sign for the bulls and may imply that this round of rebound is over. The next support will be last Wednesday’s low of 1.2624, of which, if broken may confirm that the bearishness has come back.

The Asian stock markets fell across the board on Tuesday on the China GDP data. The Shanghai Composite lost 0.72% to 2339. ASX 200 gained 0.11% to 5325. The Nikkei Stock Average fell 2.03% as an adjustment of Monday’s surge. In European stock markets, the UK FTSE was up 1.68%, the German DAX gained 1.94% and the French CAC Index surged 2.25%. The US market bounced strongly, led by technology stocks. The Dow once gained 1.31% to 16614, while the Nasdaq Composite Index edge up 2.4% to 4419. The S&P 500 surged 1.46% to 1941.

For the data front, Australian CPI will be released at 11:30 AEST, followed by Chinese GDP and its disaggregated data. UK MPC minutes will be published at 19:30 AEST and US CPI and Canada Retail Sales are at midnight.

Recommended Content

Editors’ Picks

GBP/USD recovers to 1.3300 ahead of UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers near the 1.3300 mark in the European morning on Friday. Traders digest the BoE and Fed policy decisions, awaiting the UK Retail Sales data for further trading impetus.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.