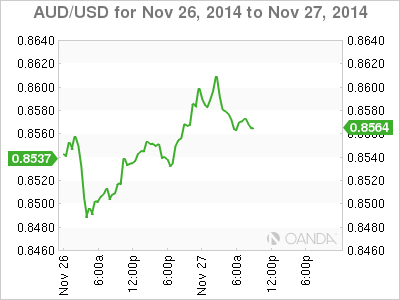

AUD/USD has posted losses on Thursday, continuing the trend which started the week. The struggling Aussie has lost about 160 points since the start of the week. Early in the North American session, the pair is trading just above the 0.85 line. In Australia Private Capital Expenditure posted a small gain of 0.2% in Q3. HIA New Home Sales, a minor event, climbed 3.0%. US markets are closed for the Thanksgiving holiday, so traders can expect light trading during the North American session.

In Australia, Private Capital Expenditure, a key event, easily beat expectations with a gain of 0.2% in Q3.The markets had predicted a fall of 1.7%. Still, this was a much softer reading than the Q2 reading of 1.1%. Earlier in the week, Australian construction data looked awful, as Construction Work Done slipped 2.2% in Q3, worse than the estimate of -1.7%. The weak reading could provide some insight as to what we can expect from Australian GDP next week, as the stagnating construction sector could weigh on economic activity.

The US released a host of key data on Wednesday, but the numbers were weak across-the-board. Unemployment Claims jumped to 313 thousand, its highest level since mid-September. Core Durable Goods Orders declined 0.9%, its third decline in four readings. The estimate stood at 0.5%. New Home Sales fell to a 3-month low, dropping to 458 thousand. This was short of the estimate of 471 thousand. Pending Home Sales was no better, declining by 1.1%, well off the estimate of 0.9%. There was better news from UoM Consumer Sentiment, which posted a fourth straight gain, rising to 88.8 points. However, this was short of the estimate of 90.2 points. Despite all the gloomy numbers, the US dollar managed to post gains against the Aussie, thanks to weak Australian construction data.

AUD/USD 0.8560 L: 0.8616 H: 0.8530

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.