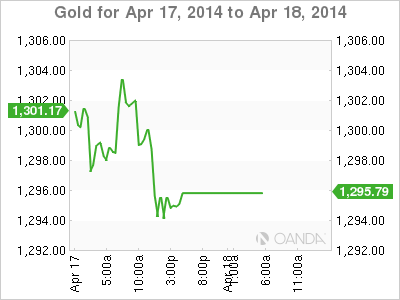

Gold prices dipped on Thursday, falling below the key $1300 level, as excellent readings from Unemployment Claims and the Philly Fed Manufacturing Index helped push down the precious metal. On Good Friday, gold is trading quietly, with a spot price of $1294.80. We can expect thin trading during the day, with no releases out of the US.

US releases ended the week on a high note, as employment and manufacturing numbers were strong. The all-important Unemployment Claims was up slightly to 304 thousand, but had no trouble beating the estimate of 316 thousand. With the Federal Reserve planning another trim to its QE program at the end of the month and speculation rising about a possible interest rate increase next year, every employment release is under the market microscope. Meanwhile, the Philly Fed Manufacturing Index soared to 16.6 points, its best showing since September. This was well above the estimate of 9.6 points.

Comments by Federal Reserve chair Janet Yellen on Wednesday continue to weigh on the US dollar. Yellen said there is little inflationary pressure on the economy, and it was unlikely that the Fed's inflation target of 2% would be met. She added that although the economy has showed signs of recovery, unemployment remains a sore spot. The Fed has abandoned its promise to maintain interest rates at least as long as the unemployment rate is above 6.5%, but the dovish stance we are seeing from Yellen means that a rate hike is unlikely in the near future.

The crisis in the Ukraine continues to simmer, as Russian President Vladimir Putin threatened to act his "right" to attack Ukraine. There have been several skirmishes between pro-Russian militiamen and Ukrainian forces, and casualties have been reported on both sides. Secretary of State John Kerry and his Russian counterpart met on Thursday, but a quick resolution is unlikely. Western Europe is dependent on Russian oil and gas, so we can expect the markets to react if the crisis intensifies.

XAU/USD 1294.80 H: 1294.80 L: 1292.80

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.