Analysis for August 20th, 2014

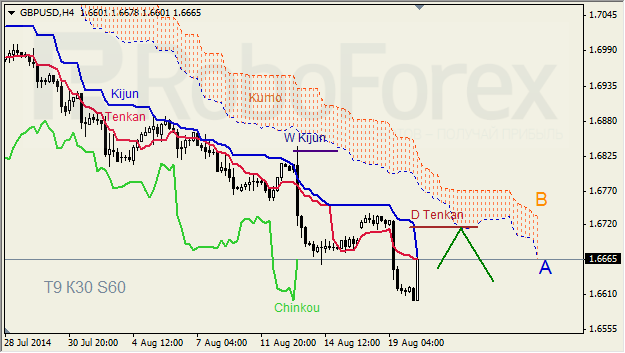

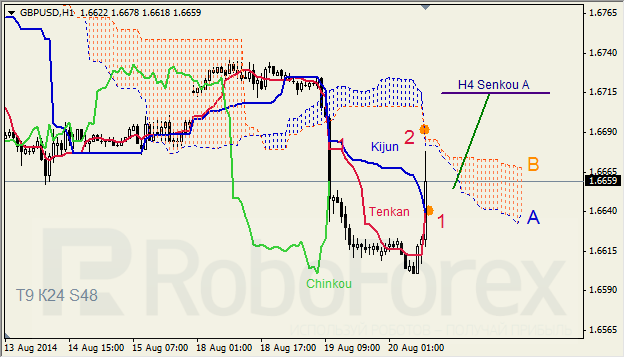

GBP USD, “Great Britain Pound vs US Dollar”

GBP USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are very close to each other below Kumo; all lines are directed downwards. Ichimoku Cloud is still going down, Chinkou Lagging Span is getting closer to the chart, and the price near resistance from Tenkan-Sen – Kijun-Sen. Short‑term forecast: we can expect attempts of the price to reach D Tenkan-Sen and Kumo’s lower border.

GBP USD, Time Frame H1. Tenkan-Sen and Kijun-Sen may intersect and form “Golden Cross” (1); Tenkan-Sen and Senkou Span A are directed upwards. Ichimoku Cloud is going down (2), and Chinkou Lagging Span is on the chart. Short‑term forecast: we can expect the price to break Kumo towards H4 Senkou Span A.

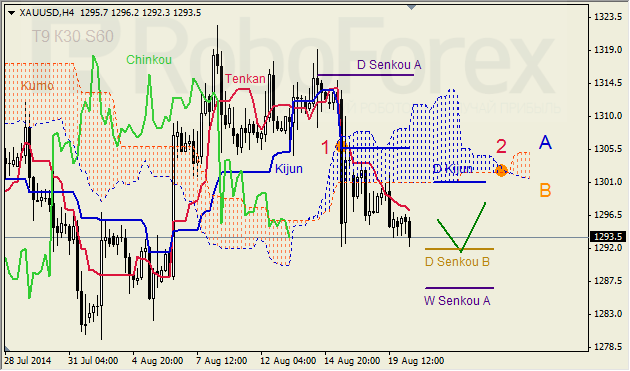

XAU USD, “Gold vs US Dollar”

XAU USD, Time Frame H4. Tenkan-Sen and Kijun-Sen are still influenced by “Dead Cross” (1); Tenkan-Sen is directed downwards. Ichimoku Cloud is going down (2), Chinkou Lagging Span is below the chart, and the price has almost reached D Kumo’s lower border and right now is moving below the lines. Short-term forecast: we can expect decline of the price towards support from D Senkou Span B.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.