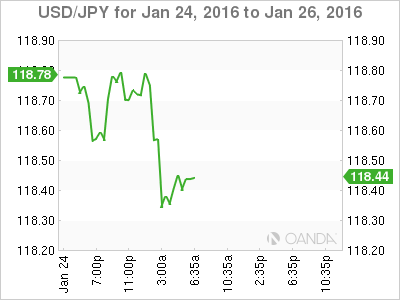

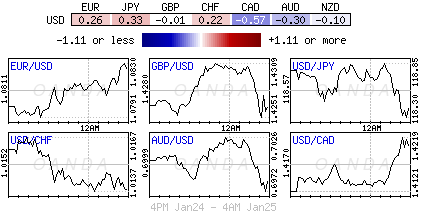

A Federal Open Market Committee (FOMC) rate announcement would usually be the highlight of any week. But this go around, it’s looking to play second fiddle to the Bank of Japan (BoJ). The Fed is expected to stand pat come Wednesday, while the BoJ decision on Friday may announce another round of monetary stimulus. With Japanese inflation non-existent, coupled with a rallying yen (¥118.00) on safe haven flows, Governor Kuroda may have little choice but to ease further.

FOMC

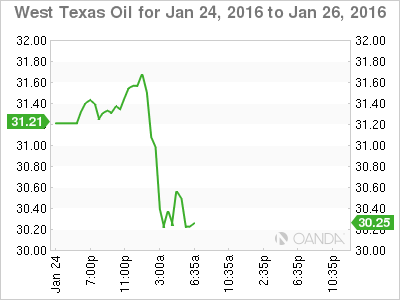

In December, with their credibility on the line, the Fed finally hiked a token +0.25bps. This was soon followed by extreme market turbulence. It’s not entirely the Fed’s fault, but they have contributed. The recent capital market volatility has taken on three distinct phases in a short space of time. First, investor concerns about China’s Yuan rate policy (PBoC set the o/n yuan mid-point at ¥6.5557 vs. ¥6.5572- the strongest yuan setting since Jan. 6 and the 11th straight firmer setting relative to close), second, the renewed collapse in crude oil prices (off -40% since mid-Dec.) and finally, the markets concern about the potential slowdown in the U.S. economy.

The first two concerns the market has been dealing with for some time, however, the possible slowdown in the U.S economy, the evidence remains relatively mixed, but it’s there. A floundering or regressing U.S should worry everyone. The U.S economy has to date been the only genuine beacon of hope. Most economists, speculators and investors have tended to agree with Ms. Yellen and company that the U.S slowdown is but a temporary dip, driven largely by specific drags on the manufacturing sector. However, there is now genuine market nervousness that the U.S slow-down could be deeper than first thought. The struggles from oil output, foreign demand and the rising strength of the U.S dollar are proving to be more negative.

Monthly U.S employment data would suggest that most things are under control. However, the Atlanta Fed’s GDPNow: A Model for GDP “Nowcasting,” which takes full account of the firm growth in domestic employment, would paint a different picture. To date, its been falling and now reports that U.S GDP Q4 2016 growth rate was only +0.7%. This implies that U.S underlying growth rate in the economy running at about +1.0-1.5%, down from +2.5% eight-months ago. Is this slowdown due to temporary factors? If so, then the Fed’s is justified in what they have been saying and doing to a certain extent. But if not, then the Fed could be backing itself into a tighter corner.

For many, the Fed’s December hike was a token, a hike to keep their credibility intact. This week’s announcement comes too soon to admit anything positive or negative. Do not expect them to provide any official comment on the “bear” equity markets – no one wants to admit that “free” money has overinflated stock prices. The world’s reliance on cheap money and ever more central bank interference is putting huge pressure on global central banks and certainly risks setbacks. Nevertheless, do not expect the Fed to draw attention to a possible U.S slowdown. Why would they, especially with the steady monthly employment numbers? Until there is a consistent slowdown in NFP headline the Fed’s language should always be focusing on “moderate.”

What Can They Say?

Do not be surprised to hear that they are “monitoring developments abroad.” The market consensus is expecting this. Back in September when the odds were in favor of a rate hike they used that exact statement. If they want to send an even stronger message they could take the ECB approach and mention, “that the downside risks to inflation or inflation expectations have increased recently.” In reality, no one seems concerned about this FOMC meet; it’s been viewed as a non-event in which Ms. Yellen is genuinely buying some time to prove that their “temporary blip” belief is correct. Even U.S money markets are unphased by this meet. Looking at their yield curves they do not expect another Fed hike until H2 and that could even be a stretch.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 inflation forecast, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.