Risk trading strategies found some temporary relief overnight, at least before the Euro session opened from the world's second largest economy - China. It has reversed some of yesterday's market negativity that followed the weekend comments made by China's Finance Minister not amending economic policies, despite some softer recent economic indicators. This morning's reprieve was kick started by China's HSBC flash manufacturing PMI. It's the first gauge of activity in September and it has avoided falling into contraction, overturning some of yesterday's bearish sentiment that was on display closing out the US markets.

Despite China's flash PMI being better (50.5 vs. 50), the devil remains in the details. Amongst the notable components, new orders and export orders both increased at a faster rate, but the employment component has decreased at an accelerated rate. It seems, despite the activity in the manufacturing sector showing signs of stabilization; the market remains weary of China's property downturn, believing it remains the country's biggest downside risk to growth. Despite giving risk a jumpstart, many believe that China needs to implement broad stimulus measures to support Chinese economic activity. Hopes that better than expected China PMI would spur material market relief look a tad too optimistic, now that diverging Euro PMI's has followed it.

France stuck in 'stagnation'

Activity in France's private sector has declined more rapidly this month (49.4 vs. 50.3). This morning's PMI survey suggests that the French economy remains close to, if not still stuck in the stagnation that has prevailed over the first-half of the year. This will only put Hollande under further pressure. The French composite PMI fell to 49.1 from 49.5 in August, and while the manufacturing PMI picked up to 48.8 from 46.9, the services PMI fell to 49.4 from 50.3. For Europe's second largest economy, there is little sign of recovery in the medium term; with new orders declining has led to further job losses. In contrast to the weak French release, the German PMI has come in stronger. This month's composite is at 54 compared to 53.7 in August with the breakdown revealing that a strengthening service sector helped to outweigh a weaker manufacturing sector. More importantly, the divergence is not just in the headline, but in prices too. The output prices in France have fallen further while Germany continues to show inflationary pressures. This scenario will turn an ECB headache into a migraine. It implies that monetary condition are too loose for the German economy, which will lead to German policy makers being averse to the ECB taking further easing actions.

ECB's ongoing 'deflation' problem

It's not surprising that the Eurozone composite flash PMI has come in weaker than expected with a reading of 52.3 vs. the 52.5 print August, a nine-month low. The details revealed that both the manufacturing and services sector were weaker, despite firms cutting prices for the 30th consecutive month. This only highlights the ECB's problems to stave off 'deflation.' The weakening demand from European's shows the difficulties of ECB's monetary policy to gain traction. It's no wonder Euro policy makers would prefer that fiscal policies and structural reforms would play a more positive role.

EUR building up momentum

It puts into perspective Draghi's appearance before the European parliament yesterday where he delivered a down beaten assessment on Europe. He indicated that growth of euro area real GDP came to a halt in Q2, and that he expects inflation to remain at low levels over the coming months. This did not come as a big surprise to the market - how else is he ever going to justify the ECB's further easing? Again, Draghi reiterated the ECB's willingness to use additional unconventional instruments, as well as stating that policy makers are ready to "alter the size and/or composition of said unconventional interventions if inflation remains too slow." This would involve a plethora of additional policy tools, including government bond purchases, as well as making it more attractive to conduct ABS, RMBS and covered bond purchases.

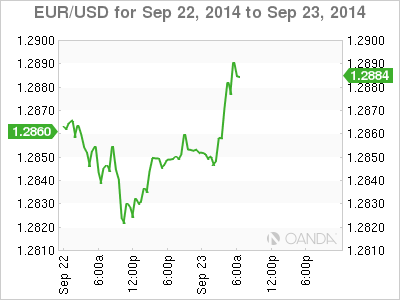

So far, the 18-member single currency is committed to a tightly contained range. The market continues to run into some resistance just north of €1.2880-85 with leveraged and real money sellers on the offer. While touted bids once again appear south of €1.2840-45, speculative accounts are said to be active on the buy-side. Market whispers have large options appearing throughout this week, rumored to total +€11B, if true, there is a strong possibility that the EUR's range will be very much contained. Nevertheless, the longer the EUR wades in higher territory then resistance at €1.2904 is under threat. Evidence of a "slowing downtrend" has helped the single unit rally from a 15-month low at €1.2815 yesterday. The techies believe that the €1.2930 area remains pivotal.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.