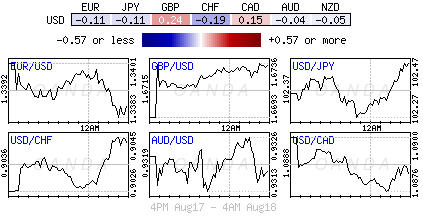

Risk "on" and "off" trading remains the order of the day, at least until the investor is convinced that the geopolitical landscape has changed for the better. If one eliminates geopolitical aggressive pricing actions from the equation, then investors are left dealing with tenuous global growth to price. In a week stacked with CBank meetings and speeches, perceived 'safe haven' assets remain in demand.

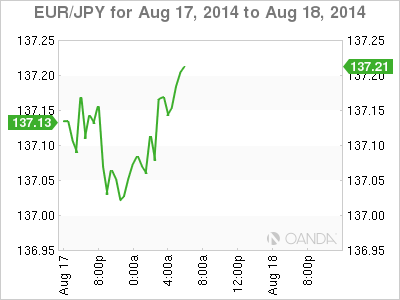

Currently, US 10-year Treasury yields (+2.36%) trade at a 14-month low, their German equivalent trade sub-1%. US debt is primarily a safe haven play, owning Bunds may suggest that the market is questioning the ECB's next move after some soft German data last week. With Euro yields trading at a new record low, would indicate that ECB's Draghi might have to proceed with QE to jump start Eurozone growth and fight the regional deflation demon. In retrospect, the market is probably getting too far ahead of itself - expect Draghi and company to insist that Euro policy makers will want to see how their June rate cut and increased credit plan plays out.

SNB to be on alert

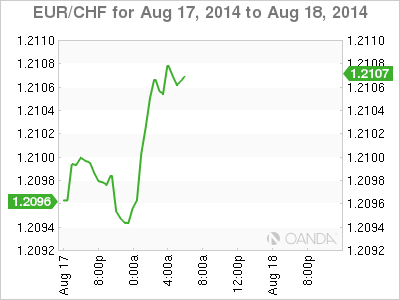

The EUR remains contained outright, mostly handcuffed by record 'short' positions and option barriers. Nevertheless, EUR/CHF has managed to drop to a 20-month low, trading atop of €1.2100, with CHF continuing to remain one of the most attractive currencies in times of stress. Under this scenario, investors will want to take into consideration the Swiss National Banks views before pushing the CHF much higher. The market will need to gauge Swiss policy makers determination and ability to defend the highly publicized €1.2000 EUR floor or minimum exchange rate. Despite the CHF trading at 12-month highs on 'safe haven' demand, further downward pressure on the EUR/CHF may be limited because of Swiss policy makers.

The EUR's failure to overcome the top-end of it's recent range at €1.3445, supported by ongoing EU/U.S/Russian tension will keep the EUR bear happy for now. Ideally, for the single unit to kick on to lower levels will require a momentum break through €1.3330 - this is expected to trigger a further two-handle slide. However, the significant size of EUR shorts being reported is likely to remain problematic for immediate further currency weakness. Theses shorts are a big factor in the EUR's resilience to geopolitical factors. Heavily defended option barriers are expected to continue to appear ahead of €1.3300. The longer the market is capable of sitting in a tightly contained range, the more vulnerable the weaker EUR short positions become - they will eventually be squeezed higher, and only because they can. The Russian/Ukraine crisis will weigh on the already fragile Eurozone economy if it escalates. Under this scenario last week, market concerns manifested much greater in the Euro-bond and equity market rather than a direct currency play.

MPC dissent this Wednesday?

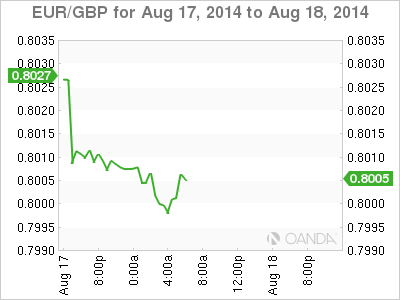

The BoE's Governor Carney is certainly keeping Capital Market's on its toes when it comes to signposting a potential shift in U.K interest rate policy. In overnight price action the pound gained ground against both the EUR (€0.8000) and USD (£1.6734) fueled by a Carney interview report over the weekend. Last week, during the BoE's quarterly inflation report, Carney proceeded with a market interpreted 'dovish' tone, saying that the BoE remains on course to raise rates in Q1 if wage growth in the UK picks up. A large percentage of the market had been pricing in a year-end rate hike. Sterling came under pressure across the board, while Gilt prices rallied.

The pound has managed to reverse its course this morning, after Carney said that interest rates could be raised even before real wages turn positive. In a Sunday Times article yesterday, he indicated that a rise in UK real-wages was not a pre-condition for a rate 'hike.' The Governor is confident that real wages will "sustainably grow and that the +17% rise in GBP since last March was not a deterrent to a rate hike." The Governor is even content for the BoE to take the lead and be the first of the 'biggies' to hike interest rates. UK Gilt prices have opened up lower on Carney's hawkish comments. Dealers and investors will want to seek out tomorrow's UK CPI data and Wednesday's MPC minutes for further directional asset class clues. The market will get to see if any 'hawks' have split from the consensus and voted for a rate hike. Under this scenario, the market will be looking to reestablish some of those positions hastily exited after last week's UK's growth and inflation proceedings.

The remainder of this week is be dominated by CBank rhetoric. The Reserve Bank of Australia will kick proceedings off this evening followed by the highly anticipated BoE midweek call. The Federal Reserve is not expected to deliver any surprises, however many will be looking for any hawkish comments from Fed Chair Janet Yellen at the Jackson Hole Economic Symposium. Sandwiched between the minutes and the Symposium will be China, France, and German flash manufacturing purchasing managers' indexes. The U.K. and Canada deliver their retail sales reports before Friday's labor market speech from both Yellen and ECB President Mario Draghi.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.