"It is hard to predict what the Central Bank may choose to do," says Valeria Bednarik, adding that apart from the euro strength "there are no big changes in the main factors in which authorities base their decision." Eurozone inflation remained low and growth subdued.

"In addition, recent data from France shows that the fragile recovery is widening and this could also hold back policymakers," Yohay Elam points out.

Various ECB Governing Council Members have spoken over the past few weeks, acknowledging the risk of deflation in the Eurozone and signaling that they were ready to take action against the trend. Most recently, Slovakia's central bank Governor Josef Makuch said that "nonstandard measures to prevent slipping into a deflationary environment" were discussed, although he didn't want to give any further details.

Even Buba head Jens Weidman suggested recently that a bond purchase program, similar to the US Fed's quantitative easing, could be adopted, despite the fact that Germany was until now the biggest opponent of such a solution.

Ilian Yotov, who believes that we won't see a rate cut at ECB's upcoming meeting, adds however that "the threat of deflation and stubbornly high unemployment rate will keep the ECB in an easing mode." Phil McHugh on the other hand sees a possibility that the first move could be made already in April and it could involve the introduction of a negative deposit rate or a stimulus program. Adam Narczewski also takes a negative deposit rate into consideration, but also a "slight cut of the main refinancing rate (by less than 25bp)" and gives the action scenario a 50/50 chance.

The ECB will announce its monetary policy decision on April 3 at 11:45 GMT. Below you will find the full forecasts of the contributing economists.

Ilian Yotov - FX Strategist and Founder at AllThingsForex:

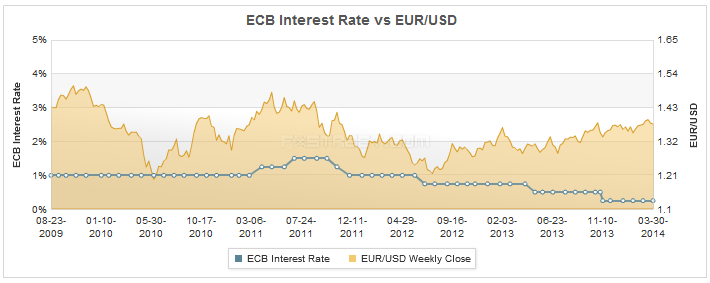

"Once again, the European Central Bank will be likely to disappoint the euro bears by not cutting rates in April. However, the threat of deflation and stubbornly high unemployment rate will keep the ECB in an easing mode, which could weigh on the euro, especially if the Fed does not backpaddle and maintains its hawkish stance while the U.S. economic data improves from the weakness seen in the winter months. The EUR/USD exchange rate will probably stay in the $1.33-$1.40 range until the Fed gets closer to ending the QE program in late October, 2014."

"Once again, the European Central Bank will be likely to disappoint the euro bears by not cutting rates in April. However, the threat of deflation and stubbornly high unemployment rate will keep the ECB in an easing mode, which could weigh on the euro, especially if the Fed does not backpaddle and maintains its hawkish stance while the U.S. economic data improves from the weakness seen in the winter months. The EUR/USD exchange rate will probably stay in the $1.33-$1.40 range until the Fed gets closer to ending the QE program in late October, 2014."Yohay Elam - Analyst at Forex Crunch:

"Assuming that both CPI and Core CPI do not fall below 0.5% in the flash reading for March, the ECB is likely to refrain from new stimulus. Draghi showed us that the bar is high for more stimulus in the previous meeting. In addition, recent data from France shows that the fragile recovery is widening and this could also hold back policymakers. A lack of action in policy does not meet a lack of market action: Draghi may certainly raise the so far subtle rhetoric regarding the exchange rate. The high value of the euro weighs on exports and pushes inflation lower due to cheaper imports. It seems like 1.40 is the "line in the sand" and it will not come as a surprise if Draghi plays down the euro. However, verbal intervention is usually short lived, and action will probably be needed later on in the year."

"Assuming that both CPI and Core CPI do not fall below 0.5% in the flash reading for March, the ECB is likely to refrain from new stimulus. Draghi showed us that the bar is high for more stimulus in the previous meeting. In addition, recent data from France shows that the fragile recovery is widening and this could also hold back policymakers. A lack of action in policy does not meet a lack of market action: Draghi may certainly raise the so far subtle rhetoric regarding the exchange rate. The high value of the euro weighs on exports and pushes inflation lower due to cheaper imports. It seems like 1.40 is the "line in the sand" and it will not come as a surprise if Draghi plays down the euro. However, verbal intervention is usually short lived, and action will probably be needed later on in the year."Adam Narczewski - Financial Analyst at X-Trade Brokers, XTB:

"Some big investment banks have been forecasting that in April the ECB will cut interest rates. Additionally, ECB'S Makuch stepped in to say that they are getting ready for such scenario and that the euro is too strong. On the other hand, since the last monetary policy meeting, macro data has not shown any deterioration. If the ECB acts, it could introduce a negative deposit rate (-0,1%?) or a slight cut of the main refinancing rate (by less than 25bo?). I predict the chances for such a scenario are 50/50. Lets remember though the ECB likes to surprise the markets (as Mario Draghi has proven many times)At the last ECB meeting, action was expected and nothing happened. So this time we have to be ready for everything, like before any ECB's statements."

"Some big investment banks have been forecasting that in April the ECB will cut interest rates. Additionally, ECB'S Makuch stepped in to say that they are getting ready for such scenario and that the euro is too strong. On the other hand, since the last monetary policy meeting, macro data has not shown any deterioration. If the ECB acts, it could introduce a negative deposit rate (-0,1%?) or a slight cut of the main refinancing rate (by less than 25bo?). I predict the chances for such a scenario are 50/50. Lets remember though the ECB likes to surprise the markets (as Mario Draghi has proven many times)At the last ECB meeting, action was expected and nothing happened. So this time we have to be ready for everything, like before any ECB's statements."Phil McHugh - Senior Analyst at Currencies Direct:

"The ECB seems to be gearing for some activity in the near future. Recent comments from Bundesbank president Jens Weidmann indicate that Quantitative Easing is not out of the question. In addition, negative interest rates discussions have also been revisited by ECB officials. Although Mario Draghi is still keeping his cards close to his chest, a strong euro and the risk of deflation is likely to spark some activity, possibly as early as the April meeting."

"The ECB seems to be gearing for some activity in the near future. Recent comments from Bundesbank president Jens Weidmann indicate that Quantitative Easing is not out of the question. In addition, negative interest rates discussions have also been revisited by ECB officials. Although Mario Draghi is still keeping his cards close to his chest, a strong euro and the risk of deflation is likely to spark some activity, possibly as early as the April meeting."Steve Ruffley - Chief Market Strategist at InterTrader.com:

"With the Euro at a 2 ½ high against the Dollar, there are increasing pressures on European consumers and for the ECB to address this. The unfortunate situation is that with the aim to still stimulate growth there is very little room for manoeuvre on rates. Saying this the only reason we have seen any growth is by consumers taking advantage of cheap money. Maybe the ECB should just bite the bullet and realise that we have done all we can with low rates and use other more aggressive stimulus policies to kick start the economy.

"With the Euro at a 2 ½ high against the Dollar, there are increasing pressures on European consumers and for the ECB to address this. The unfortunate situation is that with the aim to still stimulate growth there is very little room for manoeuvre on rates. Saying this the only reason we have seen any growth is by consumers taking advantage of cheap money. Maybe the ECB should just bite the bullet and realise that we have done all we can with low rates and use other more aggressive stimulus policies to kick start the economy. With companies in the UK, Europe and US holding some the largest cash reserves in history, maybe it is time for the world’s governments to impose windfall type taxes? My ideas would be that you have to give 2% of cash reserves or profits directly to employees as bonuses. Why not try and stimulate the economy that way, get people spending company money not borrowing more!"

Bill Hubard - Chief Economist at Markets.com:

"Should forward-looking indicators start to disappoint, this could weigh on EUR given a relatively upbeat growth outlook has been one of the key factors keeping the central bank on hold. Indeed, credit and inflation have both been a concern for the ECB, and we expect lending data (Thur) to be weak. With the euro area CPI revised down last week, the market may focus on the release of the ‘flash’ estimate of German CPI on Friday. We expect an unchanged print. Further weakness in inflation could cause the market to speculate on action from the ECB."

"Should forward-looking indicators start to disappoint, this could weigh on EUR given a relatively upbeat growth outlook has been one of the key factors keeping the central bank on hold. Indeed, credit and inflation have both been a concern for the ECB, and we expect lending data (Thur) to be weak. With the euro area CPI revised down last week, the market may focus on the release of the ‘flash’ estimate of German CPI on Friday. We expect an unchanged print. Further weakness in inflation could cause the market to speculate on action from the ECB."Ahmad Mamdouh - Analyst at ICN.com:

"ECB President Mario Draghi slashed the benchmark interest rate to record low of 0.25 percent in November last year when inflation hit the current level of 0.7 percent. Therefore, the ECB will probably introduce new stimulus in April after the recent drop in inflation has sparked concerns of a deflationary cycle.

"ECB President Mario Draghi slashed the benchmark interest rate to record low of 0.25 percent in November last year when inflation hit the current level of 0.7 percent. Therefore, the ECB will probably introduce new stimulus in April after the recent drop in inflation has sparked concerns of a deflationary cycle.Although growth is showing a gradual improvement, a long-period of low inflation may hamper the recovery trajectory and hence a new bank-lending programs and large-scale asset purchases may be on the table."

Valeria Bednarik - Chief Analyst at FXStreet:

"I believe this time, is hard to predict what the Central Bank may choose to do. Compared to last month, there are no big changes in the main factors in which authorities base their decision, except maybe Euro strength: inflation remains low, growth subdue, and overall Draghi words have tend to be hawkish during this last month. As per now, ECB officers had been started to down talk the currency, but the fact is that without action to back up the wording, the EUR will continue attracting buyers. If the Central Bank stays on hold, the most likely scenario is further EUR gains, looking for fresh year highs against the greenback."

"I believe this time, is hard to predict what the Central Bank may choose to do. Compared to last month, there are no big changes in the main factors in which authorities base their decision, except maybe Euro strength: inflation remains low, growth subdue, and overall Draghi words have tend to be hawkish during this last month. As per now, ECB officers had been started to down talk the currency, but the fact is that without action to back up the wording, the EUR will continue attracting buyers. If the Central Bank stays on hold, the most likely scenario is further EUR gains, looking for fresh year highs against the greenback."Alberto Muñoz, Ph.D. - Forex Analyst at FXStreet:

"It looks clear that the ECB is worried about the Euro rate exchange against many currencies; also the latest Eurozone inflation data suggest that prices might be slowing down so it's very likely that Draghi will insist in that the ECB is ready to take additional measures if needed, trying to jawbone the market to lower the Euro. In my opinion, regardless what he could say, the market will consider that the Euro is bearish even if there are no new measures so expect a break below 1.3750 which is a key EURUSD support level."

"It looks clear that the ECB is worried about the Euro rate exchange against many currencies; also the latest Eurozone inflation data suggest that prices might be slowing down so it's very likely that Draghi will insist in that the ECB is ready to take additional measures if needed, trying to jawbone the market to lower the Euro. In my opinion, regardless what he could say, the market will consider that the Euro is bearish even if there are no new measures so expect a break below 1.3750 which is a key EURUSD support level."

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.