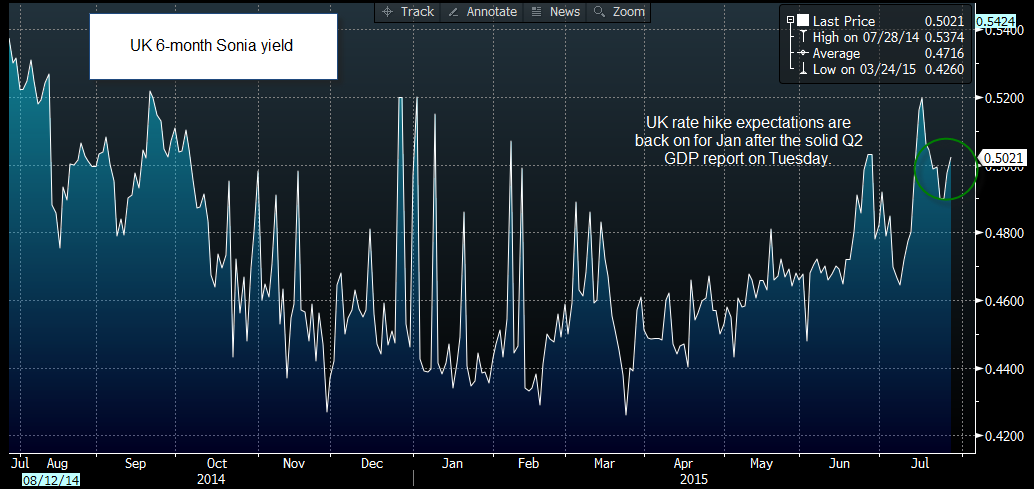

Figure 1 and figure 2 below show current market expectations for the Dec 2015 Fed Funds rate and the 6-month Sonia rate (a good proxy for UK rate expectations), respectively. Right now there is only a month in it, with the market expecting the first hike from the Fed in December, and the BOE only a month behind with its first hike expected in January 2016.

Figure 1:

Source: City Index, Data: Bloomberg

Figure 2:

Source: City Index, Data: Bloomberg

Don’t bank on the Fed moving first…

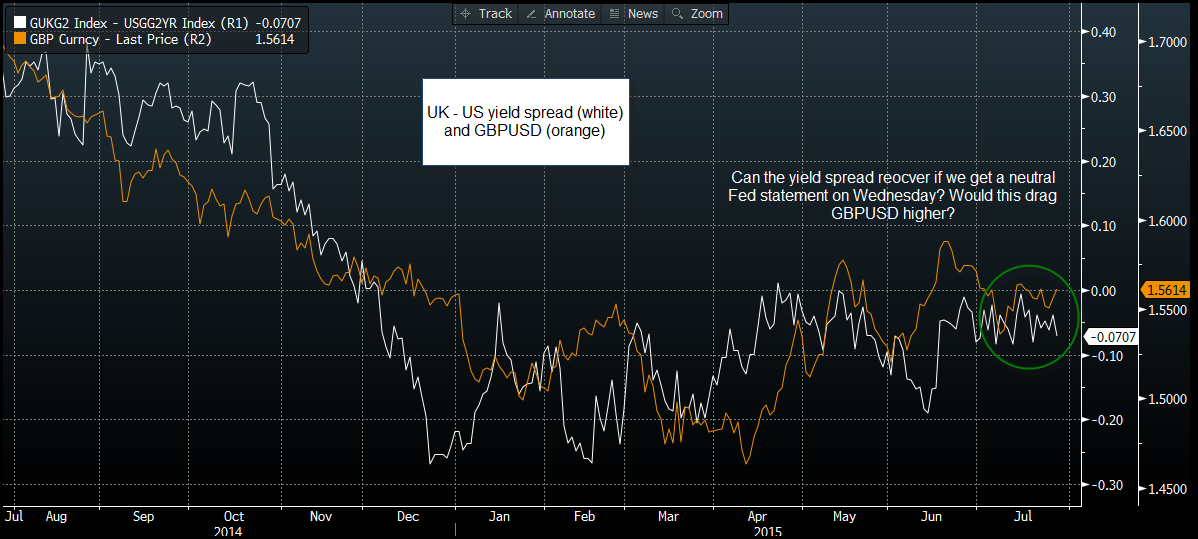

When expectations are this close, any shift in tone from the Fed at this week’s meeting could have major implications for interest rate expectations and, in turn, for the FX market. Figure 3 shows the 2-year US and UK government bond yield spread, which is also considered a good way to detect relative market expectations for the UK and the US. As you can see, US yields are higher than UK yields, however, the UK-US yield spread has recovered and is only -6 basis points, after falling to as low as -20 basis points in June. Thus, if the Fed sticks to a neutral to dovish tone in its post-meeting statement on Wednesday then we could see US yields fall causing this spread to recover, and maybe move back into positive territory. As you can see, the spread moves closely with the GBPUSD rate, so if the spread recovers then we could see GBPUSD gain some traction to the upside.

From a technical perspective, a dovish or neutral Fed statement that might confirm that a September hike is off the cards could trigger some GBPUSD strength. Key resistance lies at: 1.5684 – the high from 15th July, then 1.5881 – the 50% retracement of the July 2014 peak to the April 2015 low.

Figure 3:

Source: City Index, Data: Bloomberg

Takeaway:

- The Fed and the BOE are expected to hike interest rates one month apart in Dec and then Jan, respectively.

- There are a few in the market expecting a September rate hike from the Fed, so any sign that a Sept hike is unlikely in the statement from this week’s Fed meeting, could be perceived as dovish and thus dollar negative.

- When rate expectations are so close, the smallest shift in tone or economic data could trigger a big reaction in the GBPUSD rate.

- After the solid Q2 UK GDP report, it is worth watching the US GDP report, released Thursday. Any weakness could trigger a GBPUSD recovery later this week.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.